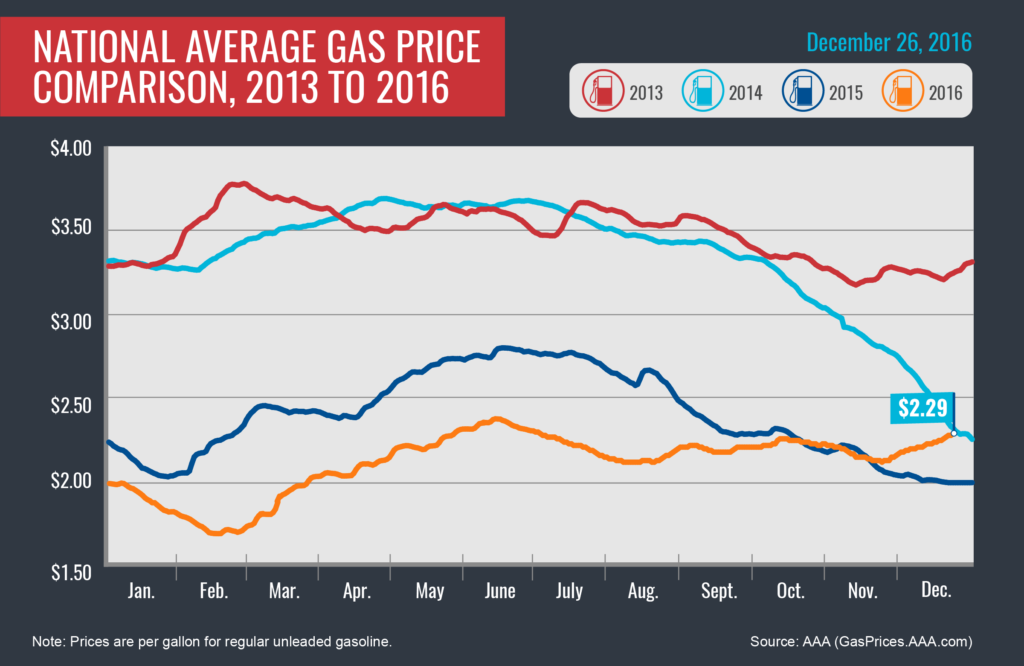

Retail averages have increased 28 of the past 30 days and prices have moved higher by fractions of a penny since Friday. The national average for regular unleaded gasoline currently sits at $2.29 per gallon, which is five cents more than one week ago, 16 cents more than one month ago and 29 cents more year-over-year.

Heading into 2017, gasoline demand is expected to drop drastically during the month of January following the busy holiday travel season. Over the past five years, the average drop during that period has been 358,000 b/d or about 15-million gallons, according to OPIS. The oil information service estimates a larger dip this year.

AAA estimates U.S. drivers have saved about $27 billion at the pump so far this year compared to the same period last year. Today’s national average price for a gallon of gasoline is $2.29, 29 cents more than the average price on New Year’s Day in 2016 ($2.00). Most U.S. drivers are expected to pay the second-cheapest New Year’s Day gas prices since 2009, when the national average was $1.62.

To start off the new year, all eyes will be on OPEC to see if they, along with partnering countries, will stick to their 6-month promise to cut 1.8-million b/d of crude. OPIS projects that member compliance will likely be around about 70 percent, with expectations that Saudi Arabia, Kuwait, the United Arab Emirates and other Arab Gulf countries will stick to the deal while Libya and Nigeria could potentially increase their production output if conflict in both countries continues.

Quick Stats

- The nation’s top five least expensive markets are: South Carolina ($2.04), Mississippi ($2.07), Texas ($2.07), Arkansas ($2.07) and Alabama ($2.08).

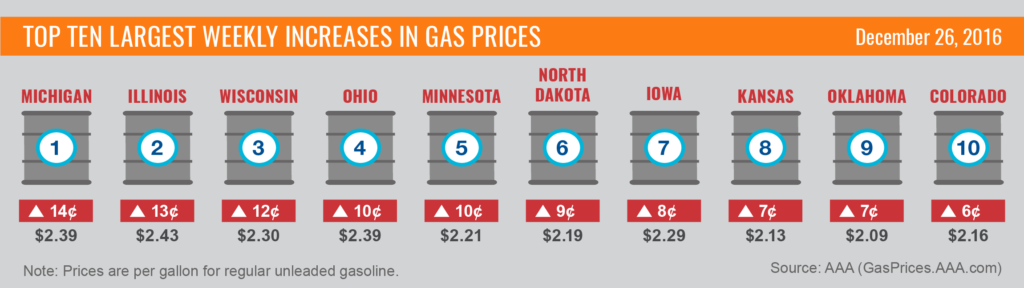

- The biggest weekly price increases are reflected in Michigan (+14 cents), Illinois (+13 cents), Wisconsin (+12 cents), Ohio (+10 cents) and Minnesota (+10 cents).

West Coast

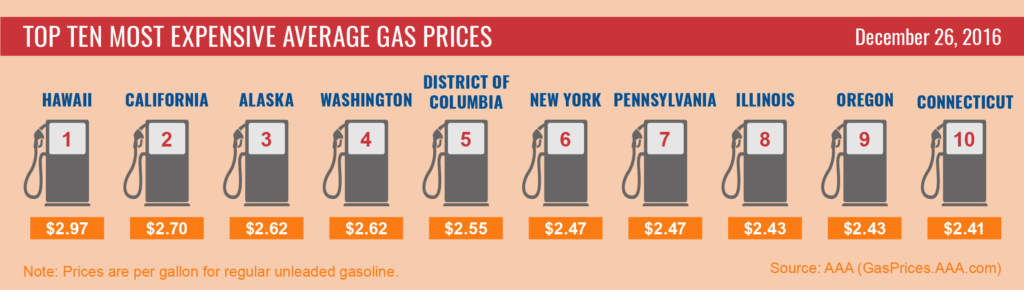

The West Coast leads the nation with four of the top five most expensive states located in the region: Hawaii ($2.97), California ($2.70), Alaska ($2.62) and Washington ($2.62). According to the latest EIA report, West Coast gasoline supplies declined 800,000 bbl to 29.2 million bbl for the week ending Dec. 16. These draws were the result of a few regional refinery issues, strong demand and recent exports out of the region to Mexico and Guatemala. OPIS reports that the delayed restart of Chevron’s 257,200-b/d Richmond, Calif., refinery following planned autumn maintenance was likely a contributor to the drop in supplies. Maintenance at the refinery was originally scheduled to end in November, but was delayed in to the early part of December. Oil prices along with a drop in supplies and increase in demand over the busy holiday travel period are likely to result in rising prices at the pump.

Rockies

Gas prices for drivers in the Rocky Mountain region have been a mixed bag of increases and decreases over the past week. There are four states in the region that are among the top-15 cheapest markets in the country this week: Arizona ($2.10), Utah ($2.12), Wyoming ($2.14) and Colorado ($2.16).

Great Lakes and Central States

The Great Lakes region often sees dramatic fluctuations in pump prices as regional refinery and distribution issues have regularly sent prices sharply higher. The past week has been no different with five states in the region topping the list of the largest weekly increases: Michigan (+14 cents), Illinois (+13 cents), Wisconsin (+12 cents), Ohio (+10 cents) and Minnesota (+10 cents). While increases in Central States have not been as pronounced, they are still substantial, with North Dakota (+9 cents), Iowa (+8 cents), Kansas (+7 cents), Nebraska (+6 cents) and South Dakota (+5 cents) all ranking in the top-15.

Last week BP shut down a 70,000-b/d reformer unit at its 430,000-b/d Whiting, Ind., refinery, according to reports from OPIS. The outage was only expected to last a few days but will have impact on supplies in the region. The refinery is the largest in the region and any production outages typically result in increases at the pump.

Mid-Atlantic and Northeast

The Mid-Atlantic and Northeast have also seen price increases over the past week, although they are less than those in the Great Lakes and Central region. Washington D.C. ($2.55), New York ($2.47), Pennsylvania ($2.47) and Connecticut ($2.41) all land on the list of top-10 most expensive markets. The latest report from the EIA shows that East Coast gasoline inventories dropped by 1.1 million bbl last week to 62 million bbl on hand. Although the region remains amply supplied, record breaking travel numbers during the holiday season will likely continue to pressure prices at the pump higher.

South and Southeast

Most drivers in the South and Southeast regions continue to enjoy some of the cheapest prices in the nation due to their proximity to major Gulf Coast refineries and some of the lowest state gasoline taxes in the country. Five states in the region rank in the top-ten lowest prices nationwide: South Carolina ($2.04), Mississippi ($2.07), Texas ($2.07), Arkansas ($2.07) and Alabama ($2.08).

Oil Market Dynamics

Last month, the Organization of Petroleum Exporting Counties (OPEC) along with non-cartel countries worked out an agreement to limit crude oil production by 1.8 million barrels per day beginning in January 2017. Efforts to curb oil production are aimed at rebalancing the oil supply and as a result, markets have reacted, causing retail prices to increase. Last week, Libya announced the re-opening of pipelines from two major oil fields which has led many to speculate that increased production in Libya may counter OPEC’s anticipated cuts. Traders will pay close attention to Libya’s efforts and monitor OPEC’s ability to implement production cuts starting in January. At the close of Friday’s formal trading session on the NYMEX, WTI was up seven cents to settle at $53.02 per barrel.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.