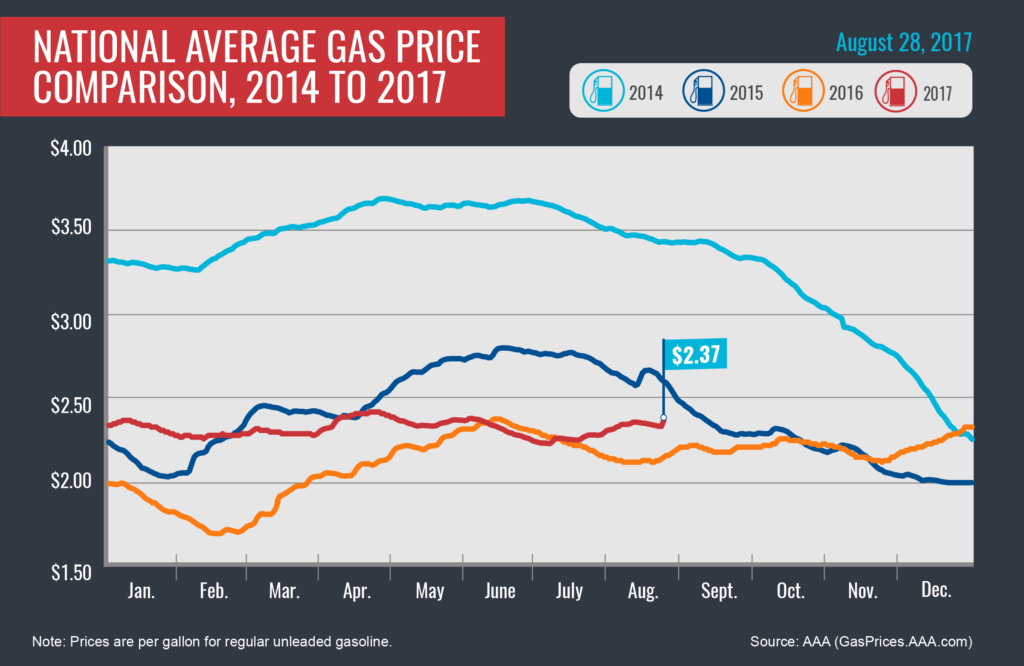

As Hurricane Harvey blasted Texas, gas prices shot up across the country. At $2.37, today’s national gas price average is four cents more expensive on the week and one of the largest one-week national gas prices surge seen this summer.

About one quarter of oil refining capacity in the Gulf Coast had been taken offline, according to forecasts by Oil Price Information Service (OPIS). That equates to about 2.5 million b/d. Harvey also caused eight refineries in Texas to shutdown, including: ExxonMobil Baytown (584,000 b/d), Deer Park (340,000 b/d), Pasadena Refining (115,700 b/d) and Phillips 66 Sweeny (260,000 b/d) in the Houston region, while several others are operating at reduced rates. In Corpus Christi, Flint Hills (304,000 b/d); Valero (300,000 b/d); CITGO (163,500 b/d) and Valero Three Rivers (91,000 b/d) remain offline since initial shutdowns began in advance of Harvey late last week. Over the weekend, Valero reported its refineries in Corpus Christi and Three Rivers sustained “substantial refinery impacts” and the company is evaluating infrastructure needs to determine when the refineries can resume operations. Corpus Christi is connected via pipeline to refineries in San Antonio and Nixon, TX, which can supply Corpus Christi if local refiners are offline for an extended period.

“No doubt, Harvey has impacted operations and access to refineries in the Gulf Coast. However a clear understanding of overall damage at the refineries is unknown,” said Jeanette Casselano, AAA spokesperson. “Despite the country’s overall oil and gasoline inventories being at or above 5-year highs, until there is clear picture of damage and an idea when refineries can return to full operational status, gas prices will continue to increase.”

On Sunday, Magellan Midstream Partners suspended all inbound and outbound refined products and crude oil transportation services on its pipeline systems in the Houston area. Conversely, the Colonial Pipeline said its Gulf Coast pipeline and terminals are continuing to operate normally. The Colonial Pipeline delivers gasoline from Houston to the Mid-Atlantic.

Harvey is expected to continue to impact the region through the middle of the week with an additional 15 – 25 inches of rain expected over the middle and upper Texas coast through Friday.

To help alleviate the tight and potential shortage of supply, the Environmental Protection Agency (EPA) announced over the weekend that it will waive environmental standards on gasoline for select counties in Texas.

“As in any national or local state of emergency, AAA expects gas prices to be held in check up and down the gasoline supply chain, including prices set by refiners, distributors and dealers unless there is a clearly justifiable reason for an increase,” added Casselano.

Quick Stats

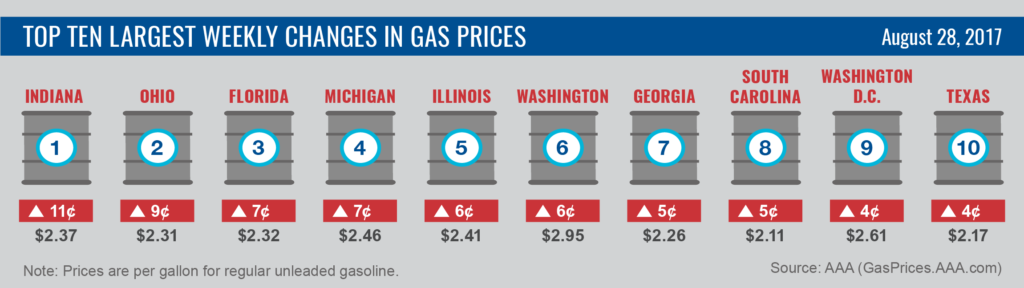

- The nation’s largest weekly changes are: Indiana (+11 cents), Ohio (+9 cents), Florida (+7 cents), Michigan (+7 cents), Illinois (+6 cents), Washington (+6 cents), Georgia (+5 cents), South Carolina (+5 cents), Washington, D.C. (+4 cents) and Texas (+4 cents).

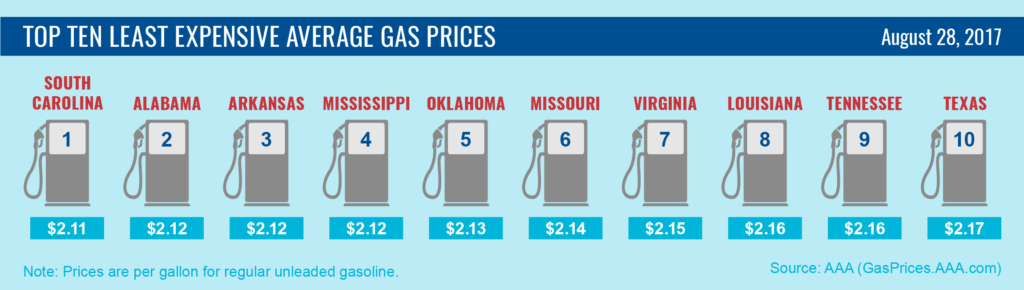

- The nation’s top ten least expensive markets are: South Carolina ($2.11), Alabama ($2.12), Arkansas ($2.12), Mississippi ($2.12), Oklahoma ($2.13), Missouri ($2.14), Virginia ($2.15), Louisiana ($2.16), Tennessee ($2.16) and Texas ($2.17).

South and Southeast

On the heels of Harvey, gas prices in the South and Southeast states are on average three cents more expensive on the week. Florida (+7 cents), Georgia (+5 cents), South Carolina (+5 cents) and Texas (+4 cents) land on this week’s top ten states with the largest change.

In Texas, retail gas station outages have been reported. While the statewide gas price average in Texas increases, prices vary among cities hit hard by the hurricane and tropical storm. In Corpus Christi, where demand was reduced due to the storm, gas prices are one cent cheaper on the week. However, in Houston, which also was hit by Harvey, many motorist filled gas tanks ahead of severe weather, gas prices are four cents more than last Monday.

As Texas continues to deal with Harvey, another storm is heading up the East Coast and will likely turn in to Tropical Storm Irma, which is projected to hit South Carolina late Monday. While it is not expected to be a threat to the region, the potentially heavy rains and strong winds could lead to a spike in prices at the retail and wholesale levels.

West Coast

All states in the region are selling more expensive gas than last week. Washington (+6 cents) landed on this week’s top ten list of the largest increases. At $3.09/gallon, Hawaii is selling the country’s most expensive gas followed closely by California at $2.99.

West Coast gasoline inventories took a 500,000 bbl draw on the week, which is largely attributed to last week’s heavy tourism in the Pacific Northwest tied to the eclipse. The draw brings the inventory levels to 26.1 million bbl, which is the lowest level seen in the region this year.

Rockies

At the lowest level of the year, gasoline inventory in the Rockies sits at 6.2 million bbl as gas prices continue to increase in Montana (+4 cent), Utah (+2 cents), Idaho (+2 cents) and Wyoming (+1 cent). Colorado ($2.33) remained flat on the week. Idaho ($2.74) and Utah ($2.61) sell the most expensive gas in the Rockies and, for another week, hold steady on the top 10 list of states with the most expensive gas.

The Rockies could see ripple effects of Harvey in terms of gas price increases, depending on the severity of damage to Gulf Coast refineries and tight supply shortage.

Great Lakes and Central States

A flip-flop from last week’s trend of cheaper gas prices, the bulk of the region is selling gas that is more expensive this week, except for Missouri (-1 cent). Four Great Lakes and Central states saw the country’s largest increases in gas prices on the week: Indiana (+11 cents), Ohio (+9 cents), Michigan (+7 cents) and Illinois (+6 cents).

The price increases come as gasoline inventory also increases with a 1.3 million bbl build. Sitting at 52.7 million bbl of gasoline inventory and given its proximity to the Gulf Coast, the Great Lakes and Central states region could be tapped to help alleviate the tightness of supplies in Texas and surrounding areas caused by Harvey.

Mid-Atlantic and Northeast

Gas prices are relatively stable throughout the region, with the exception of increases in Washington, D.C. (+4 cents) and North Carolina (+3 cents) and decreases in Delaware (-2 cents) and West Virginia (-1 cent) on the week.

The bulk of the region’s flat prices derives from the latest Energy Information Administration (EIA) report showing that gasoline inventories in the Mid-Atlantic and Northeast declined by 1.8 million bbl for the week ending August 18. Total stocks on hand now sit at 63 million bbl, more than 6 million bbl lower than year-ago levels and 3.7 million bbl higher than the running five-year average for this week. With stocks below year-ago levels, prices indicate that demand has not increased dramatically during the last weeks of summer and supply is meeting current need. However, stocks could drop and prices may increase in the week ahead depending on Harvey’s impact on the ability of several Gulf Coast refineries’ to return to operational status.

Oil market dynamics

At the end of last week, the price per barrel of West Texas Intermediate remained below $50 – settling at $47.87. On Monday morning, prices began to fall as news of refinery closings due to Tropical Storm Harvey began to influence the market. Refinery closings signal that less oil will likely be consumed as catastrophic flooding persists in the region, and assessments of damage to energy infrastructure assets are stalled until conditions improve. All of this uncertainty has made the market jittery.

EIA data released last week showed that crude oil inventories dropped by an additional 3.3 million bbl. The continued decline in crude oil has been largely tied to strong refining operations as gross inputs refineries across the U.S. have topped 17 million b/d every week going back to mid-April. However, this trend could change due to refinery closures and reduced operations due to Harvey. As the emergency situation evolves, refiners in other regions, additional imports and alternative transportation routes may be needed to fill any gaps in meeting demand during the aftermath of the storm – all of which could tighten supply and add extra costs to getting gasoline to the pump.

Moreover, according to Baker Hughes, Inc., active oil rigs are down by four, standing at 759 as of last week. Fewer active rigs — coupled with crude oil output being currently reduced by more than 21 percent in the Gulf of Mexico due to the storm — could be a recipe for oil prices to jump throughout the week. However, any price jumps will be linked with matching demand estimates, which could signal a dramatic decline based on the storm.

It is still too soon for the market to know how badly damaged energy infrastructure is from the storm, but the coming days will offer more insight into how long recovery and restoration may take. Demand shifts based on the storm and countermeasures the market will take to meet a new supply and demand landscape will also be evaluated.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also be used to map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.