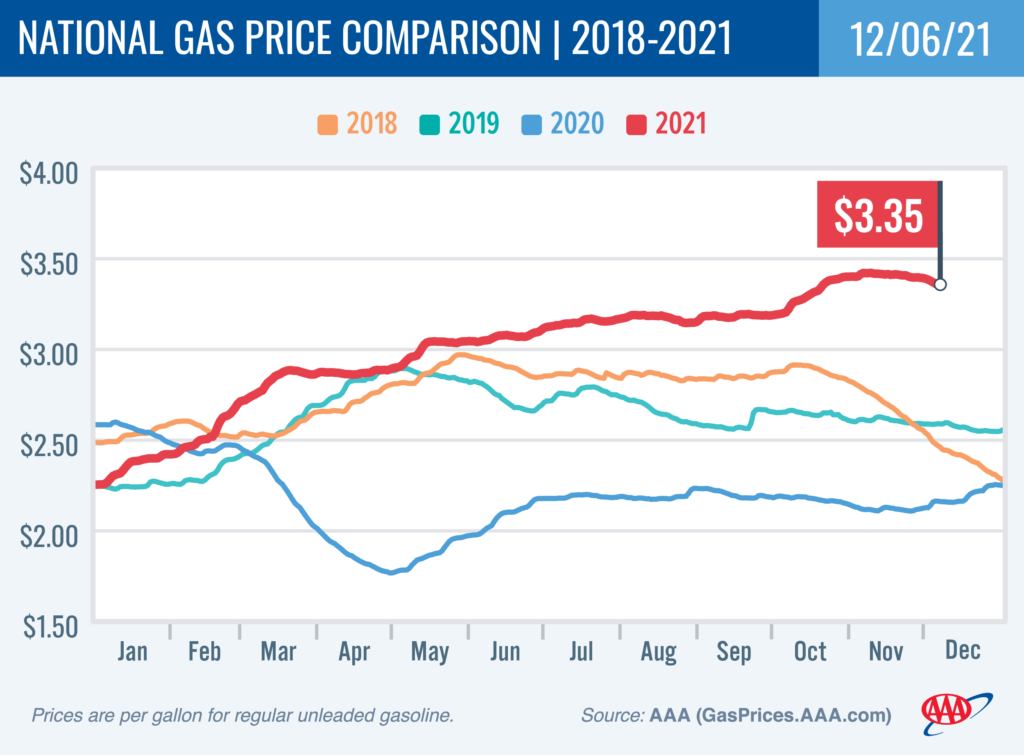

WASHINGTON, D.C. (December 6, 2021)—Pump prices continue to tumble as fears of a possible COVID-19 global economic slowdown pushed oil prices into the mid $60s per barrel—a price not seen since August. Also helping to ease upward pricing pressure was the decision by OPEC and its oil-producing allies not to cut production. The national average for a gallon of gas dipped 4 cents on the week to $3.35. For consumers, gasoline prices were last this low on October 20.

“Consumers may be catching a break at the pump right now, but it’s not for a very good reason,” said Andrew Gross, AAA spokesperson. “A potential COVID-19 induced economic slowdown hurts everyone and could prompt OPEC to slash production if oil prices drop too low.”

On December 2, OPEC and its allies, a group referred to as OPEC+, announced it would stick to its plan, for now, to raise production by 400,000 b/d in January. The move was likely in response to the Biden Administration’s call to increase supply to tame high fuel prices.

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks increased by more than 4 million bbl to 215,422 million bbl last week. Meanwhile, gasoline demand dipped from 9.3 million b/d to 8.8 million b/d. The slight decrease in demand contributed to falling prices, while lower crude prices also put downward market pressure on pump prices.

Today’s national average of $3.35 is seven cents less than a month ago and $1.19 more than a year ago.

Quick Stats

The nation’s top 10 largest monthly decreases: Indiana (−21 cents), Michigan (−18 cents), Ohio (−17 cents), Washington, D.C. (−15 cents), Missouri (−14 cents), Texas (−13 cents), Iowa (−13 cents), Kansas (−12 cents), Oklahoma (−12 cents), and South Carolina (−12 cents).

The nation’s top 10 most expensive markets: California ($4.68), Hawaii ($4.34), Nevada ($3.91), Washington ($3.87), Oregon ($3.78), Arizona ($3.77), Alaska ($3.71), Idaho ($3.65), Utah ($3.62) and Pennsylvania ($3.57).

Oil Market Dynamics

At the close of last week’s formal trading session, WTI decreased 24 cents to settle at $66.26. Crude oil prices decreased last week due to uncertainty of the COVID-19 omicron variant’s impact on demand and the announcement that OPEC+ will ramp up production by 400,000 b/d in January. Additionally, EIA reported minimal draws on U.S. commercial crude oil inventories, which decreased by 900,000 bbl from the previous week to 433.1 million barrels. This week, crude oil prices could continue to fluctuate. Market watchers will keep a close eye on crude oil inventories and the impact that the omicron variant has on demand.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.