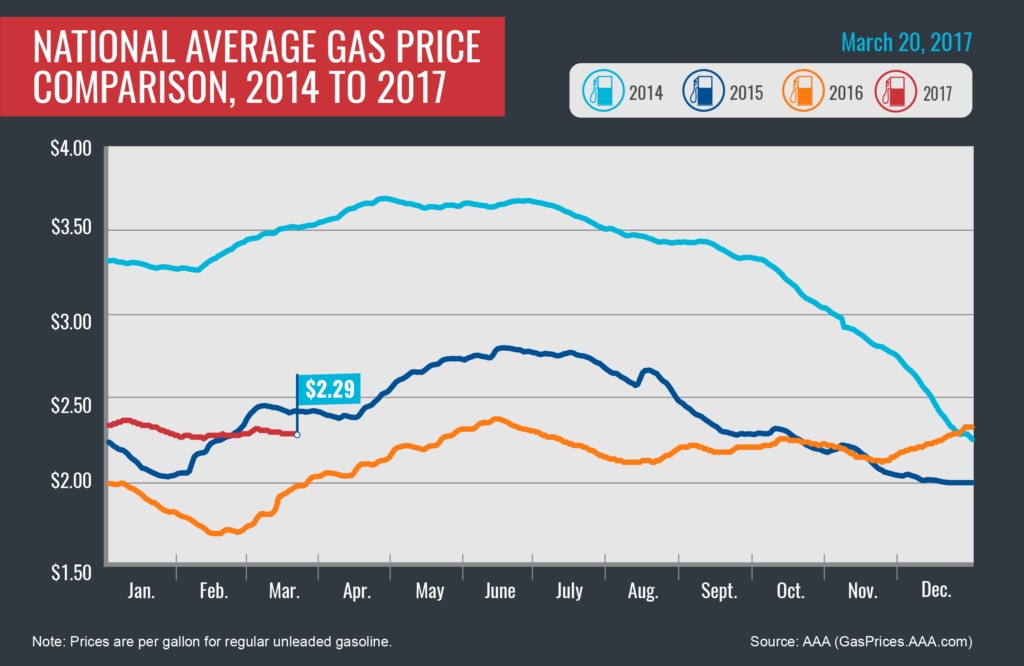

Pump prices remain relatively stable, with today’s national average price for regular unleaded gasoline holding at $2.29 per gallon. Today’s average price is down by fractions of a penny compared to one week ago, but has moved one cent higher compared to last month. Drivers are paying 31 cents more per gallon at the pump compared to this same date last year.

Quick Stats

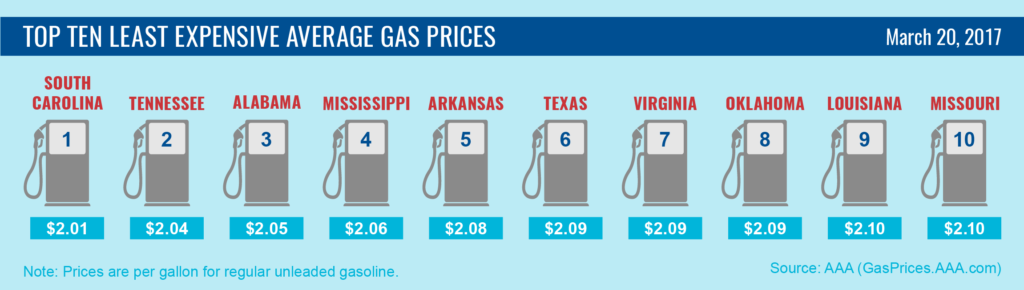

- The nation’s top ten least expensive markets are: South Carolina ($2.01), Tennessee ($2.04), Alabama ($2.05), Mississippi ($2.06), Arkansas ($2.08), Texas ($2.09), Virginia ($2.09), Oklahoma ($2.09), Louisiana ($2.10) and Missouri ($2.10).

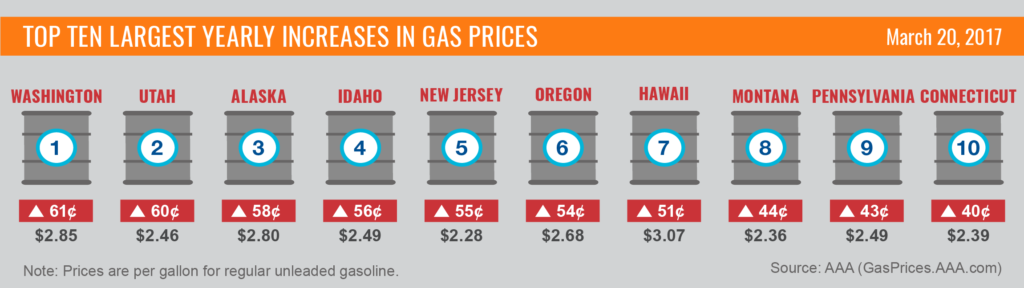

- The nation’s markets that have seen the largest yearly increases include: Washington (+61 cents), Utah (+60 cents), Alaska (+58 cents), Idaho (+56 cents), New Jersey (+55 cents), Oregon (+54 cents), Hawaii (+51 cents), Montana (+44 cents), Pennsylvania (+43 cents) and Connecticut (+40 cents).

West Coast

Gas prices on the West Coast remain the highest in the country with six states in the region topping the list of most expensive U.S. markets: Hawaii ($3.07), California ($2.99), Washington ($2.85), Alaska ($2.80), Oregon ($2.68) and Nevada ($2.66). The latest US Energy Information Administration (EIA) report shows that gasoline inventories dropped to 29.027 million bbl for the week ending March 10, while regional refinery production increased 17 percent. OPIS reports that production increases are likely the result of the completion of a major 45-day turnaround at Phillips 66’s 107,500- b/d refinery in Ferndale, Washington.

Rockies

Gas prices remain stable over the past week with averages in most states moving by just fractions of a penny. The region is home to some of the largest yearly state increases: Utah (+60 cents), Idaho (+56 cents) and Montana (+44 cents). OPIS reports that recent increases near the Utah area largely resulted from a shutdown on the Wahsatch Pipeline, which negatively impacted refinery production in the region. Plains All American Pipeline completed repairs on the pipeline March 10.

Great Lakes and Central States

Volatility continues to characterize pump prices in the Great Lakes region. Some states reflected double-digit declines at the start of the month, only to see gains over the past seven days: Ohio (+6 cents), Indiana (+6 cents) and Michigan (+2 cents). Drivers in other states saw modest declines on the week: Iowa (-3 cents), Minnesota (-3 cents), Wisconsin (-3 cents) and Kansas (-2 cents).

OPIS reports that a unit fire has slowed production at LyondellBasell’s 302,300-b/d refinery in Houston, Texas. The refiner ships most of its gasoline to the Midwest through the Magellan Pipeline. Wolverine Pipe Line Company reports that the new Detroit Metro Access Pipeline (DMAP) is now in service and is transporting refined oil products from Chicago to Detroit.

Mid-Atlantic and Northeast

The East Coast saw a decline in gasoline supplies last week as refiners prepare to switch from winter-blend to summer-blend gasoline. Despite the decline in supply, prices in the regions remain stable on the week with Pennsylvania ($2.49), Washington, D.C. ($2.46), New York ($2.43) and Connecticut ($2.39) all landing on the list of top 15 most expensive markets in the country.

South and Southeast

Markets in the South and Southeast continue to post some of the lowest prices for retail gasoline in the nation, including South Carolina ($2.02), Tennessee ($2.04), Alabama ($2.05), Mississippi ($2.06), Arkansas ($2.08), Texas ($2.09), Oklahoma ($2.10) and Louisiana ($2.10). The latest EIA report shows that Gulf Coast crude oil inventories dropped 2.4 million bbl for the week ending March 10. The declines are the result of a nearly 500,000-b/d drop in regional imports last week. As mentioned in the Great Lakes/Central States summary, OPIS reports that a unit fire at LyondellBasell’s 302,300-b/d Houston, Texas, refinery resulted in production cuts. The refiner ships most of its product to the Midwest via the Magellan Pipeline.

Oil Market Dynamics

While prices have been flat in recent weeks, a long-term bearish sentiment continues to underscore the global oil market as speculation about the balance between OPEC cuts and U.S. production drives the market. Last Friday, OPEC’s Joint Technical Committee met to review compliance and participant’s level of adherence to the production cut agreement. Following the JTC meeting, Russia agreed to drop total production by 300,000 barrels per day by the end of April and pledged to maintain that level until the deal expires at the end of June. Saudi Arabia followed the compliance meeting with news that it may consider working with partner countries to continue the cuts beyond the June agreement deadline.

Even with OPEC’s compliance in the 90 percent range, U.S. production continues to cut into any rebalancing efforts by OPEC and non-OPEC countries. On Friday, oil service company, Baker Hughes, reported that the U.S. rig count increased again last week when producers added 14 drilling rigs, bringing the total rig count to 631 in the United States. Traders will continue to watch whether OPEC and non-OPEC members make moves to further cut production in an attempt to balance the global oil supply. At the close of Friday’s formal trading session on the NYMEX, WTI was up three cents to settle at $48.78 per barrel.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.