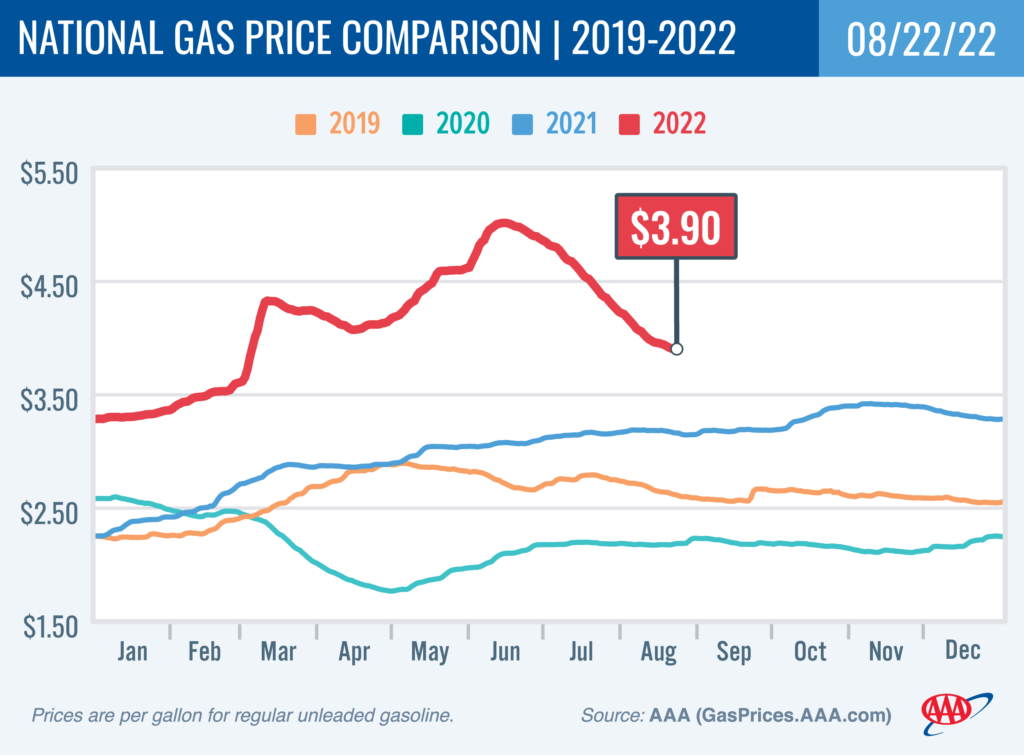

WASHINGTON, D.C. — Stable global oil prices and modest domestic demand for gasoline led pump prices to fall a nickel in the past week to $3.90.

“Drivers are now benefiting from gas prices that are $1.11 less than their peak in mid-June,” said Andrew Gross, AAA spokesperson. “But now we need to keep an eye on the weather as hurricane season arrives. These storms can affect prices by disrupting oil production in the Gulf of Mexico and impacting large coastal refineries.”

AAA finds that drivers are making significant changes to cope with high pump prices. In a recent survey, almost two-thirds of U.S. adults say they have changed their driving habits or lifestyle since March. Drivers’ top two changes to offset high gas prices are driving less and combining errands.

According to data from the Energy Information Administration (EIA), gas demand rose slightly from 9.12 million b/d to 9.35 million b/d last week, which is nearly identical to this time last year. Total domestic gasoline stocks decreased by nearly 5 million bbl to 215.7 million bbl. Although gasoline demand has risen and supplies have tightened, easing oil prices have helped lower pump prices. If oil prices edge lower, drivers will likely continue to see falling pump prices.

Today’s national average of $3.90 is 51 cents less than a month ago but 74 cents more than a year ago.

Quick Stats

- The nation’s top 10 largest weekly decreases: Florida (−12 cents), West Virginia (−11 cents), Maine (−11 cents), New Jersey (−11 cents), Rhode Island (−11 cents), Vermont (−11 cents), Massachusetts (−11 cents), Wyoming (−10 cents), Connecticut (−10 cents) and Mississippi (−10 cents).

- The nation’s top 10 least expensive markets: Arkansas ($3.41), Mississippi ($3.43), Georgia ($3.43), Texas ($3.44), Tennessee ($3.44), Louisiana ($3.46), South Carolina ($3.46), Missouri ($3.47), Alabama ($3.47) and Kansas ($3.48).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI increased by 27 cents to settle at $90.77. Although crude prices increased at the end of the week due to EIA reporting that total domestic crude supply decreased by 7 million bbl to 425 million bbl, crude prices declined earlier in the week after U.S. housing data showed that homebuilding dropped to its lowest level in 1.5 years in July. Higher mortgage rates, alongside the rising costs of materials, played a role in decreasing the demand for new housing. Lower housing demand also pushed oil demand expectations lower. If crude demand expectations remain low this week, crude prices could decline further.

Drivers can find current gas prices along their route using the AAA TripTik Travel planner.