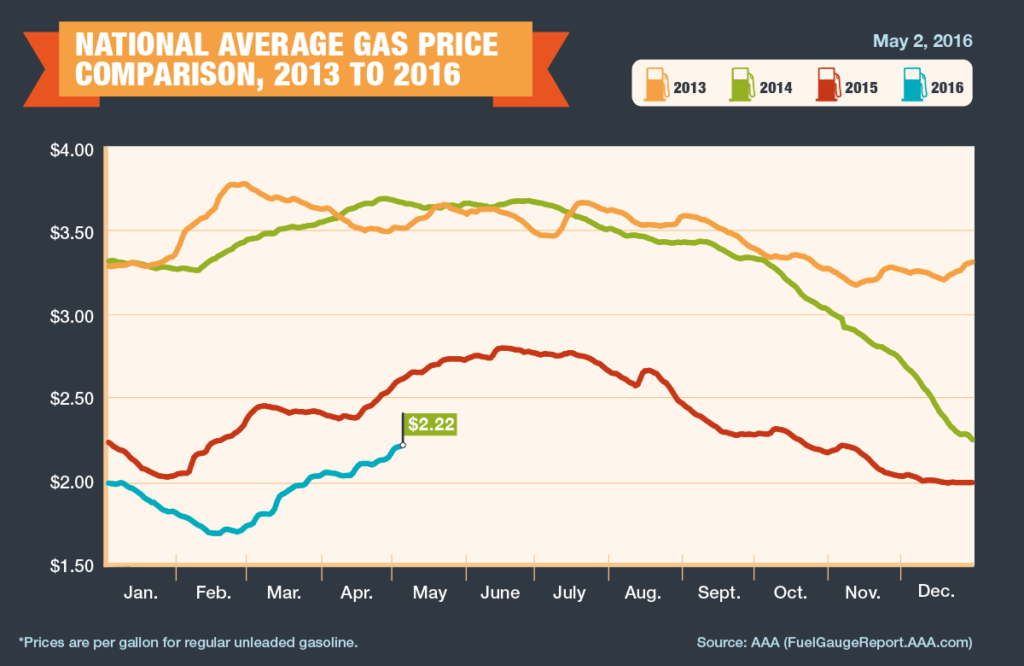

Gas prices are at their highest levels in more than six months, and the national average has remained above $2 per gallon for 40 consecutive days. Today’s average price of $2. 22 represents an increase of eight cents per gallon on the week, and prices are up 16 cents per gallon on the month. Ample gasoline supplies and relatively lower crude oil costs are helping to sustain year-over-year savings, with today’s price discounted by 39 cents per gallon versus a year ago.

Gasoline demand continues to break seasonal records as low prices motivate people to drive more. Additionally, crude oil costs are also increasing and recently reached new 2016 highs. Increased demand and more expensive oil costs have helped to push gas prices higher in many parts of the country over the past few weeks, and prices may move even higher leading into the busy summer driving season.

The average price at the pump for the month of April was $2.10 per gallon, which is the lowest average for this month since 2009. Only 20 percent of U.S. stations are still selling gas for less than $2 per gallon and pump prices are moving due to growth in fuel demand, which is up 5.6 percent versus a year ago, according to the latest data from the U.S. EIA. Gas prices have increased by 52 cents per gallon after hitting a 2016 low in mid-February.

Four states are posting averages below $2 per gallon, which is nine fewer states than last week’s report. Retail averages have historically fluctuated during this time of year, and although the overall price at the pump is beginning to trend higher, gas prices during this year’s summer driving should remain noticeably discounted in comparison to previous years.

The national average price of diesel has been cheaper than gasoline for the past five days, and diesel may remain less expensive than gasoline for the remainder of the summer. In recent years it has been rare for diesel to be cheaper than gasoline. The last time the national average price of diesel was less than gasoline for a significant period was in the summer of 2009, when the average was cheaper for 48 days in a row. It is possible that diesel will remain cheaper than gasoline for the next 3-4 months due to abundant supplies and seasonal factors impacting both gasoline and diesel.

Quick Stats

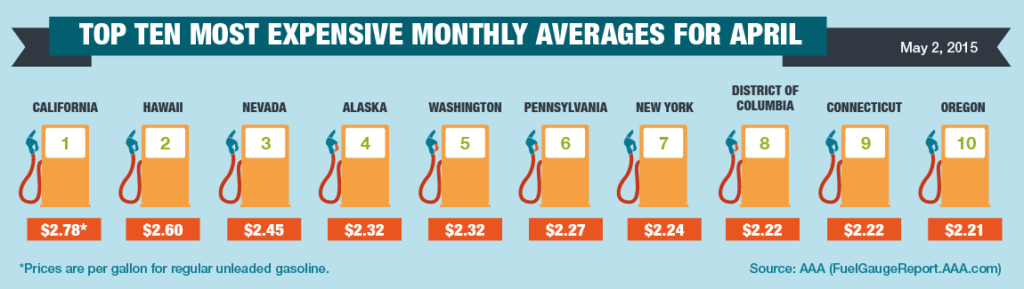

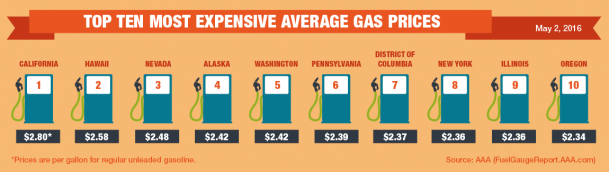

- The nation’s top five most expensive markets are: California ($2. 80), Hawaii ($2. 58), Nevada ($2.48), Alaska ($2.42) and Washington ($2.42).

- The nation’s top five least expensive markets are: Oklahoma ($1.96), Texas ($1.98), Missouri ($1.99), Kansas ($1.99) and Mississippi ($2.00).

- The most common price at the pump is $1.999 per gallon.

Consumer Attitudes

The lower price environment for gas prices has not only led to drivers taking to the roads at record levels, but is also shifting attitudes about various price points. Attitudes towards gas prices have changed significantly over the past few years, according to a new survey by AAA:

- Half of U.S. drivers now believe gas is “too high” at $2.50 per gallon. This figure has dropped significantly in relationship to the price of gas. As recently as 2014, half of Americans believed gas was “too high” at $3.30 per gallon, while last year half of Americans believed it was “too high” at $3 per gallon. Only nine percent of U.S. stations are selling gas for more than $2.50 per gallon today.

- More than 35 percent of Americans believe that gas is “too high” based on today’s average price, even though gas prices are at the lowest levels since 2009. The vast majority of Americans also do not believe that gas is “cheap” today.

West Coast

Gas prices on the West Coast remain some of the highest in the nation, led by California ($2.80) and Hawaii ($2.58), which are the only two states with averages above $2.50 per gallon. Regional neighbors Nevada ($2.48), Alaska ($2.42) and Washington ($2.42) join in the rankings as the top five most expensive markets. Six out of ten of the nation’s top 10 most expensive retail markets are located in this region.

Refinery operations in California are described as relatively healthy compared to a year ago, and gasoline production on the West Coast is reportedly at a seven-month high. The market appears to be well supplied with product, and barring any unexpected disruptions in supply, gas prices in the region should hold relatively steady. Drivers in the region have benefitted from a surplus in gasoline supply versus one year ago, which has contributed to noticeable savings at the pump year-over-year. A total of five states nationwide are posting yearly discounts of more than 50 cents per gallon, all located within this region: California (-88 cents), Alaska (-68 cents), Nevada (-66 cents), Hawaii (-61 cents), Oregon (-59 cents).

ExxonMobil’s Torrance Calif. refinery is still in the process of restarting gasoline production, and is expected to be fully online in May. This refinery produces approximately 10 percent of all gasoline sold in California and when it went offline in February of 2015 due to an explosion, prices to spiked in the region.

Midwest

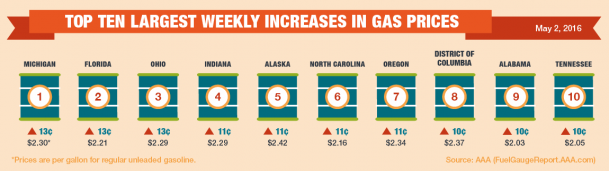

Prices in the Midwest continue to swing significantly due to movements in supply and demand. Retail averages are up double digits on the week in the Midwestern states of Michigan (+13 cents), Ohio (+13 cents), Indiana (+11 cents) and Illinois (+10 cents). Some of the largest jumps in gas prices month-over-month are also seen in the region, and averages are up by more than a quarter per gallon in Illinois (+29 cents), Indiana (+28 cents), Ohio (+28 cents) on the month.

Despite this trend of weekly and monthly increases, this region is also home to some of nation’s least expensive markets for retail gasoline: Oklahoma ($1.96), Missouri ($1.99) and Kansas ($1.99). Crude oil supply is reportedly building in the region and refineries are continuing to return to production following the spring maintenance season. The refinery utilization rate in the region is increasing, which should help stabilize the price at the pump, barring any unexpected disruptions in supply.

Gulf Coast

The Gulf Coast region includes some of nation’s least expensive markets for retail gasoline: Texas ($1.98), Louisiana ($2.00), Arkansas ($2.00) and New Mexico ($2.03). Ample supply is a contributing factor to the comparatively lower prices in the region, and the latest data from the U.S. EIA reflects an increase in gasoline inventories. Approximately 50 percent of the total U.S. refining capacity is located along the Gulf coast, which generally helps prices in the region to remain relatively low. However, a few refineries in the region are reporting challenges and supply could begin to tighten in the near term, which could support higher prices in the near term.

Oil Market Dynamics

Oil is the largest cost associated with producing gasoline, and every $1 change can increase gas prices by as much as 2.4 cents per gallon. The cost of crude has increased by approximately $10 per barrel since the beginning of April, attributed to interruptions in global supply and the expectation that demand will rise in the coming months.

Despite falling U.S. rig counts and weekly decreases in U.S. production, the domestic crude oil market remains well supplied. The latest data from the U.S. EIA shows an increase in both crude oil inventories and gasoline inventories, which should help offset growing demand and keep pump prices relatively low.

A weakening U.S. dollar and expectations that the Fed will increase interest rates is supporting speculations that the global oil market will begin to come into balance sooner than expected. Geopolitical factors are also likely to influence the market in the near team, and attention remains focused on both OPEC and non-OPEC production based on the current glut in global supply.

WTI reached its highest price for 2016 the last week in April as talks of a weakening U.S. dollar, increased demand and falling output surfaced. However, this boost in price was short lived and reports of increased production out of OPEC pushed prices lower to close out the week. At the close of Friday’s formal trading session on the NYMEX, WTI was down 11 cents and settled at $45.92 per barrel.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.