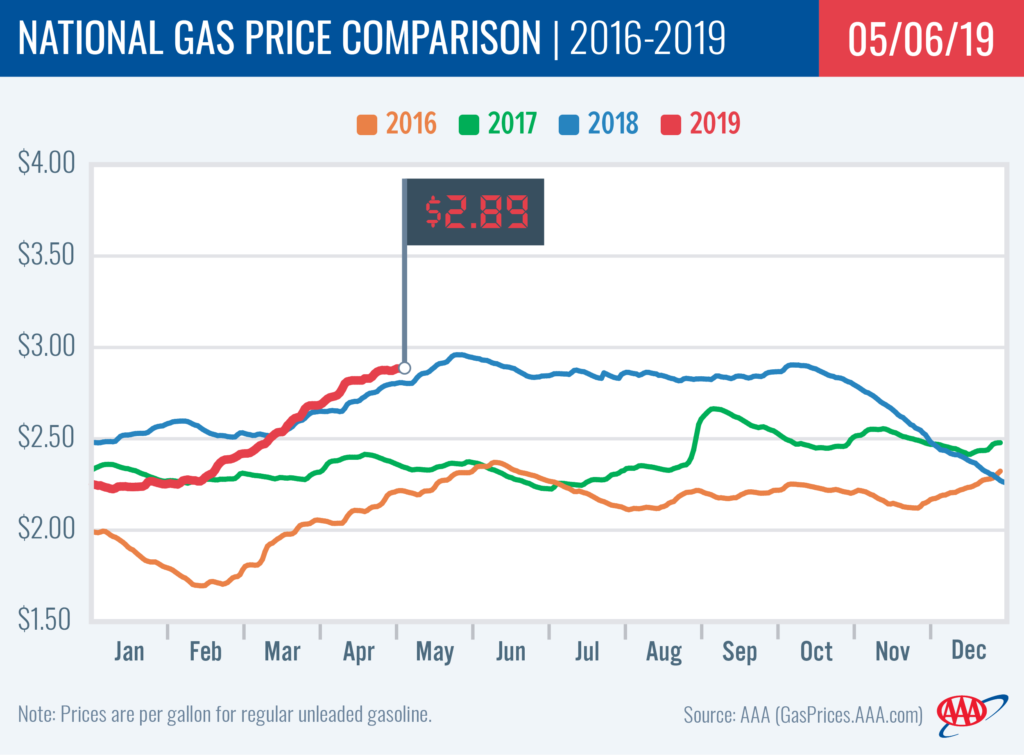

With the national gas price average at $2.89 – just a penny more expensive than last week – the majority of states are seeing moderate jumps and even declines at the pump. Twenty-seven states saw gas prices decrease or hold steady on the week with Delaware (-4 cents), Kentucky (-3 cents) and North Carolina (-3 cents) seeing the largest declines.

“While gasoline demand remains robust, gasoline inventories built for the first time since early February, which was a surprise, and contributed toward the national average only increasing by a penny” said Jeanette Casselano, AAA spokesperson. “Today’s average is just eight cents cheaper than the highest pump price of 2019, which was set going into Memorial Day.”

Today’s average is 16 cents more than last month and eight cents more expensive than this time last year.

Quick stats

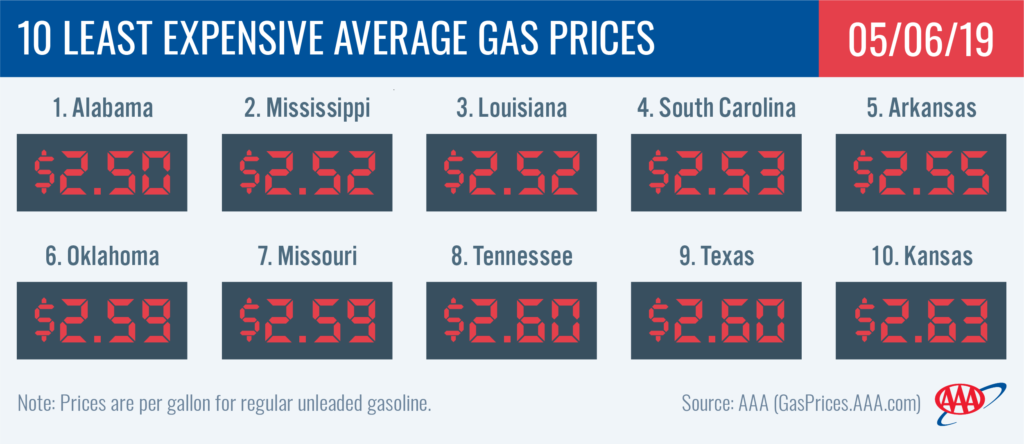

- The nation’s top 10 least expensive markets are: Alabama ($2.50), Mississippi ($2.52), Louisiana ($2.52), South Carolina ($2.53), Arkansas ($2.55), Oklahoma ($2.59), Missouri ($2.59), Tennessee ($2.60), Texas ($2.60) and Kansas ($2.63).

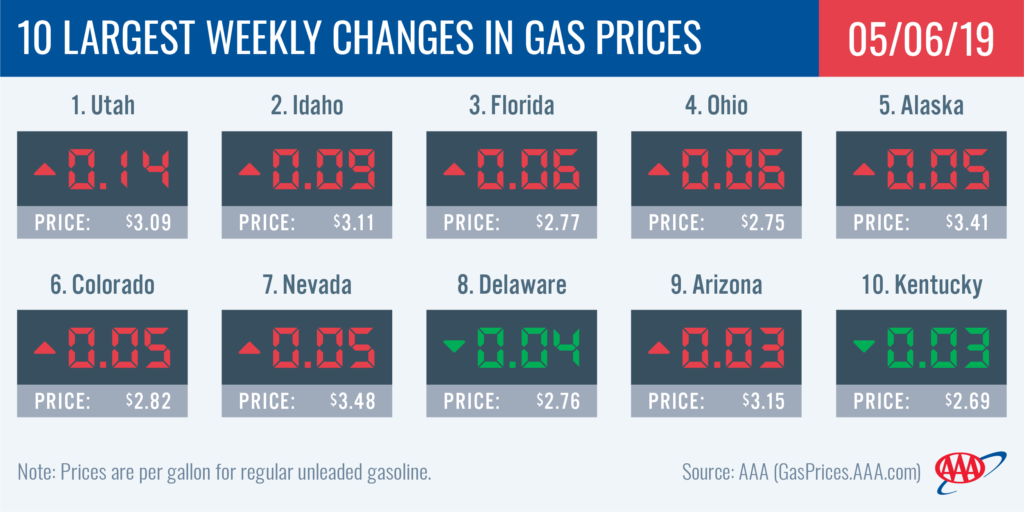

- The nation’s top 10 largest weekly changes are: Utah (+14 cents), Idaho (+9 cents), Florida (+6 cents), Ohio (+6 cents), Alaska (+5 cents), Colorado (+5 cents), Nevada (+5 cents), Delaware (-4 cents), Arizona (+3 cents) and Kentucky (-3 cents).

West Coast

Pump prices in the West Coast region are the highest in the nation, with all of the region’s states landing on the nation’s top 10 most expensive list California ($4.09) and Hawaii ($3.63) are the most expensive markets. Washington ($3.53), Nevada ($3.48), Oregon ($3.42), Alaska ($3.41) and Arizona ($3.15) follow. All prices in the region have increased slightly on the week, with Alaska (+5 cents) seeing the largest gain.

The Energy Information Administration’s (EIA) recent weekly report for the week ending on April 26 showed that West Coast gasoline stocks fell for the seventh consecutive week by approximately 400,000 bbl from the previous week and now sit at 27.5 million bbl. If ongoing planned and unplanned refinery maintenance continues throughout the region, the West Coast may see continued price volatility and shrinking gasoline stocks.

Rockies

Utah (+14 cents) and Idaho (+9 cents) again top the nation’s list for the largest increases at the pump on the week. This last week’s increases also move Idaho ($3.11) and Utah ($3.09) to the top 10 list of most expensive gas prices in the country, which is not uncommon for this time of year. Motorists in Colorado (+5 cents), Wyoming (+2 cents) and Montana (+2 cents) also are paying more to fill-up.

Regional refinery utilization made gains again, jumping to 87 percent, as gasoline stocks slightly built above the 7 million bbl mark, according to the latest EIA data. The region typically sees utilization lift towards the 90 percent mark as summer tourism season approaches. Compared to this time last year, gasoline stocks are only at a 260,000 bbl deficit. Gas prices are likely to continue to increase in the region in the weeks ahead.

Mid-Atlantic and Northeast

Among Mid-Atlantic and Northeast states, Delaware (-4 cents) and North Carolina (-2 cents) saw the largest declines at the pump on the week followed by Tennessee, Maryland, Washington, D.C. and West Virginia, which all saw a penny decline to their state average. Virginia ($2.64), New Jersey ($2.93) and Pennsylvania ($3.05) all saw prices hold steady.

Connecticut ($3.00) joins Pennsylvania ($3.05) at the $3/gal mark while Washington, D.C. ($2.97), New York ($2.95) and New Jersey ($2.93) trail slightly behind.

Gasoline stocks declined by about a half a million barrels in the EIA’s latest report even with regional refinery utilization jumping from 87.6 to 92.5%. The draw in stocks contributed toward the more moderate weekly retail price changes. However, an increase in stocks would be most beneficial to the region, which only sits at 59 million bbl total. There is potential for this to happen as much of the region’s refineries are almost all fully operational following unplanned and planned maintenance.

Great Lakes and Central States

Gas prices are fluctuating across the Great Lakes and Central region states with Ohio (+6 cents) and Kentucky (-3 cents) seeing the biggest jump and decline on the week. The majority of states saw prices shift by just a penny or hold steady.

Illinois ($3.01) carries the most expensive gas price average in the region. Indiana ($2.90) and Michigan ($2.89) have the second and third most expensive average, respectively, followed by Wisconsin ($2.83). Missouri ($2.59) and Kansas ($2.63) tout the cheapest prices in the region.

Amid refinery issues, the EIA reports the region saw utilization drop from 91.8 to 85.9 percent. Despite this, stocks increased marginally by 200,000 bbl to total 50.7 million bbl and the region saw only moderate fluctuation. If utilization falls further, motorists in the region can expect gas prices to increase especially as heading into summer stocks sit at a nearly 6 million deficit compared to the same time last year..

South and Southeast

The South and Southeast region is home to the most states with gas price averages lower or similar to this time last year: Alabama (-5 cents), Mississippi (-2 cent), Louisiana (-2 cent), South Carolina (-1 cent) and New Mexico (-1 cent), while Georgia’s ($2.71) average holds flat.

On the week, Florida (+6 cents) saw the largest increase while all other states saw pump prices decrease as much as two cents. At the start of the week, seven regional states hold a spot on the top 10 states with the cheapest average in the country: Alabama ($2.50), Mississippi ($2.52), Louisiana ($2.52), South Carolina ($2.53), Arkansas ($2.55), Oklahoma ($2.59) and Texas ($2.60).

Overall, regional refinery utilization remains robust as gasoline stocks added 1.7 million bbl, which the EIA records as the largest build for the week ending Apr 26. Total stocks sit at nearly 82 million bbl. Should stocks continue to build, motorists are likely to see moderate fluctuation throughout this month.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI increased slightly by 13 cents to settle at $61.94. Although prices inched up on Friday, crude saw losses last week after new concerns about U.S. oversupply emerged. EIA’s weekly petroleum report revealed that domestic crude inventories jumped significantly last week — by 10 million bbl. They now sit at 470.6 million bbl, which is nearly 35 million bbl more than the level last year at this time. Crude inventories have not been this high since September 2017, according to EIA’s data. An all-time record high for domestic crude production last week — at 12.3 million b/d — contributed to the substantial growth in U.S. crude stocks, which likely also was a reason crude oil saw losses on the NYMEX last week. Market observers will look toward EIA’s weekly report this week to see if the growth in crude stocks continues ahead of summer. In related news, Baker Hughes, Inc. reported that the U.S. gained two oil rigs last week, brining the country’s total to 807. When compared to this time in 2018, there are 27 fewer rigs now.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.