U.S. refinery utilization dropped to its lowest rate – 83% – since Sept. 2017, tightening gasoline supplies and causing nearly half of all state gas price averages to increase on the week. AAA reports these weekly trends in pump price fluctuation:

- Nearly half (22) of all states saw gas prices increase with nine state averages jumping a nickel or more

- 19 states saw gas prices decrease with the majority seeing one to two cent declines

- 10 state averages held steady

“Peak refinery maintenance season has caused volatility across the country,” said Jeanette Casselano, AAA spokesperson. “Motorists can expect fluctuations at the pump likely through the end of the month due to ongoing maintenance and tighter gasoline supply.”

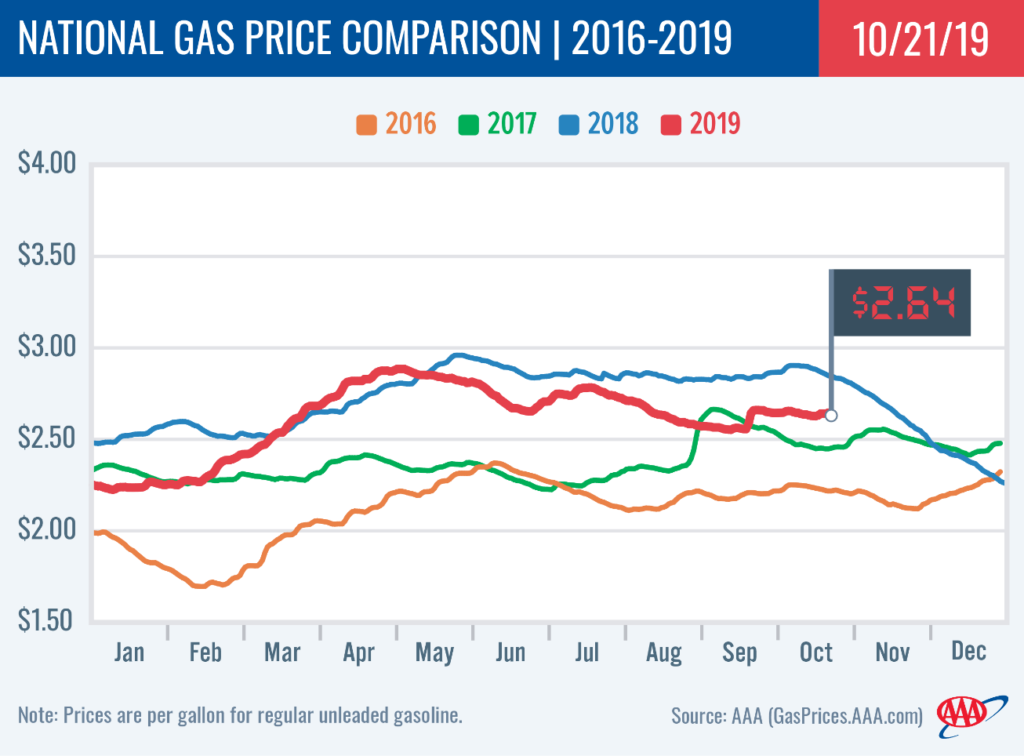

Today’s national average of $2.64 is one penny more than last week, two cents more than last month and 21-cents cheaper than last year.

Quick Stats

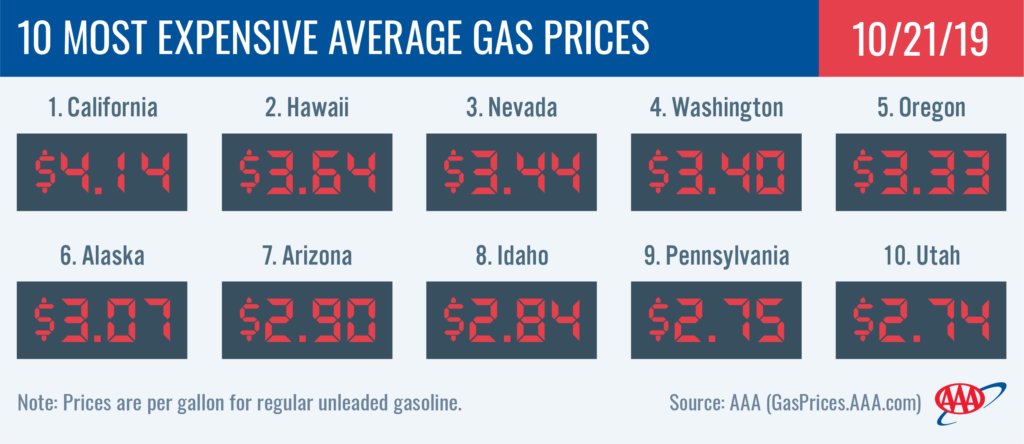

- The nation’s top 10 most expensive markets are: California ($4.14), Hawaii ($3.64), Nevada ($3.44), Washington ($3.40), Oregon ($3.33), Alaska ($3.07), Arizona ($2.90), Idaho ($2.84), Pennsylvania ($2.75) and Utah ($2.74).

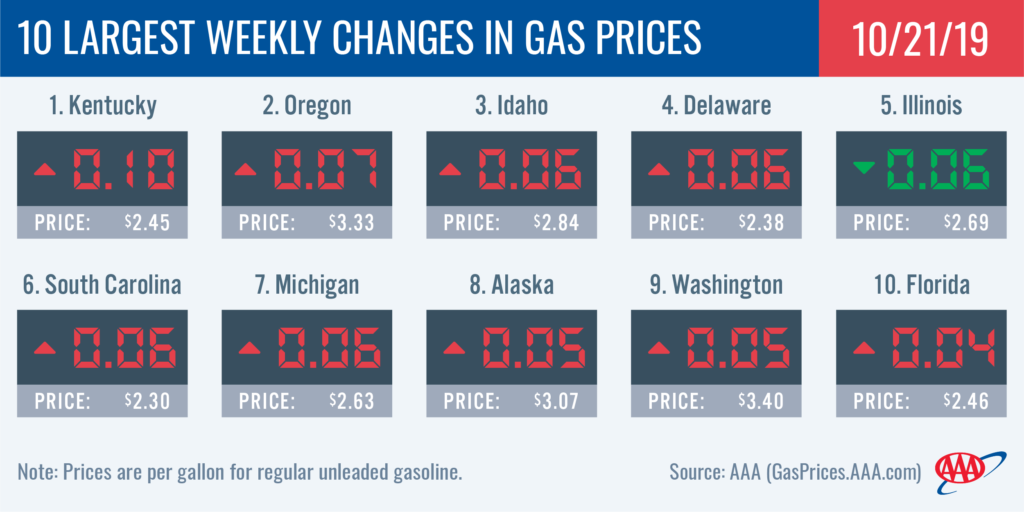

- The nation’s top 10 largest weekly changes are: Kentucky (+10 cents), Oregon (+7 cents), Idaho (+6 cents), Delaware (+6 cents), Illinois (-6 cents), South Carolina (+6 cents), Michigan (+6 cents), Alaska (+5 cents), Washington (+5 cents) and Florida (+4 cents).

West Coast

Pump prices in the West Coast region are fluctuating after a number of refineries in the region underwent planned and unplanned maintenance. Adding to the challenge, operations at Marathon Petroleum’s San Francisco Bay Area 170,000 b/d refinery halted last week as a result of the earthquake that occurred last Monday. Production has resumed at the refinery, but continuing refinery challenges have put pressure on supply, which has contributed to the increases some motorists are seeing at the pump.

California ($4.14) and Hawaii ($3.64) are the most expensive markets in the country. Nevada ($3.44), Washington ($3.40), Oregon ($3.33), Alaska ($3.07) and Arizona ($2.90) follow. Oregon (+7 cents), Alaska (+6 cents) and Washington (+5 cents) saw the largest increases, while California (-3 cent) saw the largest decrease on the week.

The Energy Information Administration (EIA) report for the week ending Oct. 11, showed that total West Coast gasoline stocks took a slight draw from 26.25 million bbl to 26.23 million bbl. The current level is approximately 1.42 million bbl lower than this same time last year. Tighter supplies will continue to keep prices high this week, but as refineries resume normal gasoline production levels and imports enter the region, pump prices are expected to continue stabilizing.

Great Lakes and Central States

The Great Lakes and Central states are seeing wide fluctuations in weekly pump price changes. Kentucky (+10 cents) saw the largest increase in the region and country, while Illinois (-6 cents) saw the largest decrease in the region and country. However, the majority of states in the region are only paying one to two cents more or less to fill-up, with a few states seeing stability on the week.

For the last four weeks, both gasoline stocks and regional refinery utilization have steadily decreased, contributing to the fluctuation in pump prices. EIA’s latest data for the week ending Oct. 11, measures total regional stocks at 50.5 million bbls and measures utilization at 86%, as compared to 53 million bbls and 100% utilization as of Sept. 6.

Maintenance has been reported at more than a dozen regional refineries since early September, including Phillips 66’s Wood River refinery (344,500 bbl) in Roxanna, Ill. With ongoing maintenance, motorists can expect volatility to continue through the end of the month.

South and Southeast

On the week, South Carolina (+6 cents), Florida (+5 cents) and Texas (+2 cents) saw increases while all other states saw prices hold steady or decrease as much as four cents. State gas prices in the South and Southeast range from $2.25 – $2.46.

Compared to gas prices last month and last year at this time in the region, all states today have cheaper averages. On the month, averages are as much as a dime cheaper, while the real cost savings is compared to a year ago – Louisiana has the largest yearly difference of 36 cents cheaper.

While gasoline stocks drew by a substantial 1.3 million bbls in EIA’s latest report, stocks sit at a healthy 79 million bbl amid the lowest refinery utilization rate of the year (84.5%). Motorists are likely to see some fluctuation in gas prices in the week ahead, especially as refineries in the region undergo maintenance. This includes two refineries in Texas: Motiva’s 639,700 b/d in Port Arthur and Valero’s 300,000 b/d in Corpus Christi.

Mid-Atlantic and Northeast

While gas prices fluctuated on the week in the Mid-Atlantic and Northeast states, volatility is low. Delaware (+6 cents) and North Carolina (+4 cents) saw large jumps, but nine states in the region only increased or decreased by one to two pennies. Four averages held steady including New Hampshire ($2.45), Maine ($2.53), Connecticut ($2.66) and Washington, D.C. ($2.67).

The region carries the second highest level of gasoline stocks at 62.9 million bbl. The latest EIA data shows stocks drew 544,000 bbl and the region saw a 1% dip in refinery utilization, down to 59%. The relatively marginal week-over-week changes helped to keep fluctuations minimal. While there is refinery maintenance in the region, the largest impact continues to stem from the Philadelphia Energy Solutions refinery fire and shut down earlier this year.

Rockies

With a six-cent increase, Idaho saw the largest weekly increase in the region and ranks among the top 10 states with the biggest increase. Colorado (+1 cents) was the only other state among those in the Rockies to see an increase. Averages in Utah ($2.74), Montana ($2.70) and Wyoming ($2.68) decreased one penny since last Monday.

At 81.6%, regional refinery utilization fell on the week and is among the lowest in the country. It’s not surprising that stocks also decreased to total 7.3 million bbl in EIA’s latest data report. Industry data indicates that two refineries are set to undergo fall maintenance, which could further drive down utilization and potentially cause spikes in gas prices. The two refineries are both located in Wyoming: the HollyFrontier 52,000 b/d in Cheyenne and the Par Pacific 181,500 b/d in New Castle.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI decreased 15 cents to settle at $53.78. Crude prices mostly fell last week after EIA’s report revealed that total domestic crude inventories grew significantly – by 9.3 million bbl – to total 434 million bbl. Increased domestic production, which hit 12.6 million b/d last week, has helped to push crude stocks up. When compared to last year’s rate at this time, crude production is up by 1.7 million b/d this year. Additionally, trade tensions between China and the U.S. continue to worry the market, putting downward pressure on prices. If trade tensions continue, prices could take another step back this week.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.