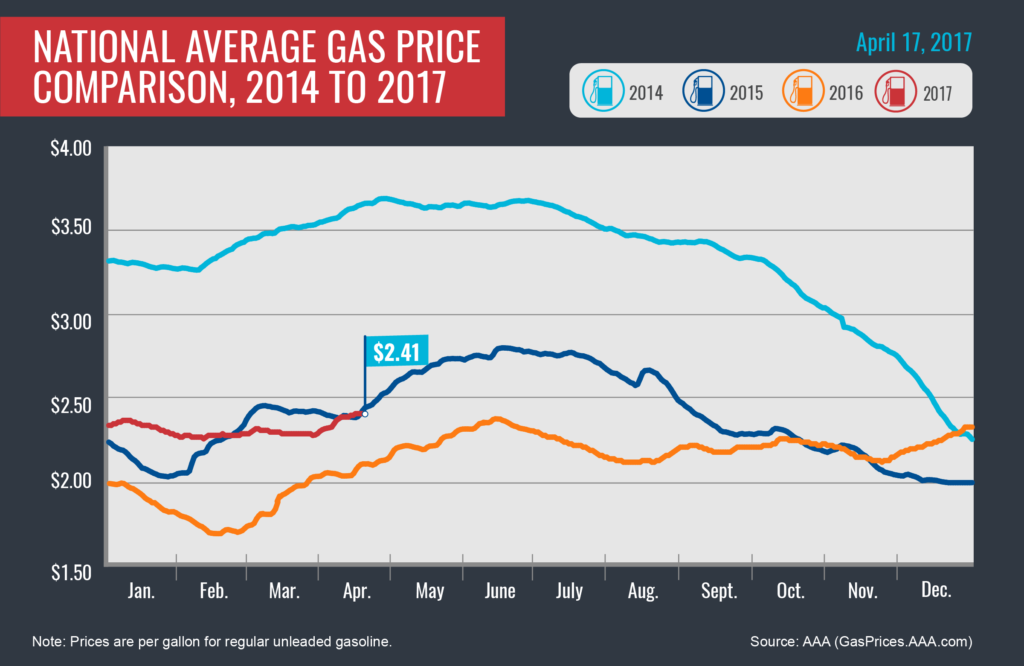

Today’s national average price for a gallon of regular unleaded gasoline is $2.41. This price is two cents more expensive than one week ago, 12 cents more than one month ago and 30 cents more than one year ago. The national average is at its highest price this year and has now increased for 20 consecutive days. Pump prices in 43 states and Washington D.C. have moved higher over the last week. This increase was most prevalent in the East Coast region where refiners wrapped up seasonal turnaround resulting in significant prices increases last week.

Quick Stats

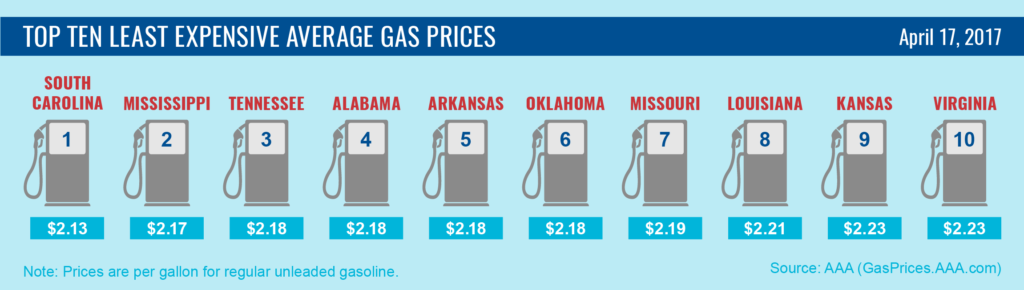

- The nation’s top ten least expensive markets are: South Carolina ($2.13), Mississippi ($2.17), Tennessee ($2.18), Alabama ($2.18), Arkansas ($2.18), Oklahoma ($2.18) Missouri ($2.19), Louisiana ($2.21), Kansas ($2.23) and Virginia ($2.23).

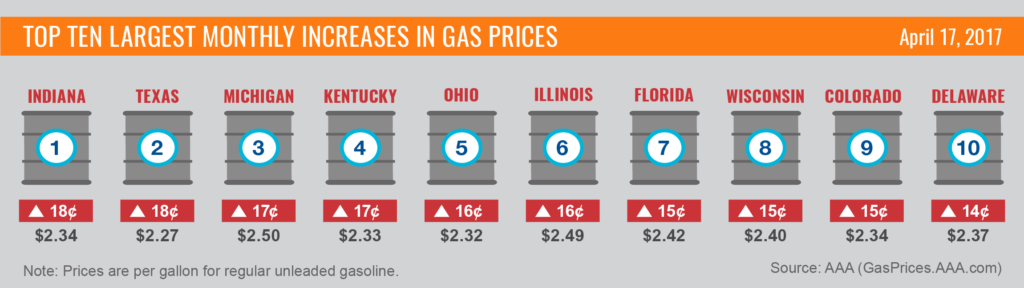

- The nation’s top ten markets with the largest monthly increases include: Indiana (+18 cents), Texas (+18 cents), Michigan (+17 cents), Kentucky (+17 cents), Ohio (+16 cents), Illinois (+16 cents), Florida (+15 cents), Wisconsin (+15 cents), Colorado (+15 cents) and Delaware (+14 cents).

West Coast

The country’s six most expensive gas prices continue to reside on the West Coast (Hawaii $3.06), California ($3.01), Washington ($2.90), Alaska ($2.90), Oregon ($2.75) and Nevada ($2.69). Compared to this time last year, four West Coast states are experiencing some of the country’s biggest year-over-year price jumps: Washington (+58 cents), Alaska (+57 cents), Oregon (+54 cents) and Hawaii (+45 cents).

This region could see prices hit $3/gal this month due to maintenance at variety of refineries in the area, including Torrance’s refinery in Southern California and Shell’s Martinez California Refinery. Shell’s maintenance, which is scheduled for late April/early May, could tighten San Francisco Bay area refined products markets. In the Pacific Northwest, refined products supplies are expected to tighten as Tesoro’s 125,000-b/d refinery in Anacortes, WA, carries out an eight-week maintenance program; however, the company is expected to meet its obligations in the Oregon and Washington region by delivering product via barge.

Rockies

Gas prices in this region moved higher on the week: Colorado (+5 cents), Idaho (+4 cent) and Wyoming (+3 cents). Drivers in Colorado continue to see price increases resulting from planned and unplanned maintenance at Phillips 66’s 154,000 b/d Borger refinery in the Texas Panhandle. The refiner supplies gasoline to Colorado and parts of the Gulf Coast and Central States via pipeline.

Great Lakes and Central States

Drivers in some parts of the Great Lakes region experienced weekly declines at the pump: Michigan (-7 cents), Indiana (-7 cents), Ohio (-6 cents) and Illinois (-2 cents). Drivers in some Central states saw slight increases on the week: Nebraska (+2 cents), North Dakota (+2 cents) and Minnesota (+2 cents). Volatility in the region along with early turnaround by regional refineries resulted in significant monthly increases in: Indiana (+18 cents), Michigan (+17 cents), Kentucky (+17 cents), Ohio (+16 cents), Illinois (+16 cents) and Wisconsin (+15 cents).

The latest Energy Information Administration (EIA) report shows that Midwest refiners raised capacity by 23,000 b/d last week, while gasoline stocks in the region dropped by 1.5 million bbl to 56 million bbl. The decline resulted in the lowest posted inventory numbers for the region in nearly three months.

South and Southeast

South Carolina ($2.13), Mississippi ($2.17), Tennessee ($2.18), Alabama ($2.18), Arkansas ($2.18), and Louisiana ($2.21) are posting some of the cheapest prices for gasoline in the country despite recent increases in each state’s respective average price. As we enter into the high-drive season of summer, the demand for gas will increase, dipping into crude oil storage across the country and leading to increases at the pump through September. The latest EIA report shows regional refining capacity increased 102,000 b/d in the Gulf Coast last week while gasoline inventories dropped by 1.8 million bbl.

Mid-Atlantic and Northeast

Pennsylvania ($2.64), Washington, DC ($2.55), New York ($2.52) and Connecticut ($2.48) all land on the list of top 15 most expensive markets. The region made the final switch to summer-blend gasoline last week, causing states in the region to top the list of largest weekly increases: Delaware (+9 cents), Vermont (+6 cents), Maryland (+6 cents), North Carolina (+5 cents), Rhode Island (+5 cents), Maine (+5 cents) and Pennsylvania (+5 cents). Compared to this same time last year, New Jersey (+43 cents), Delaware (+36 cents), and Pennsylvania (+35 cents) are seeing significant increases at the pump. This trend is likely the result of the region’s move toward less substantial gasoline imports.

Oil Market Dynamics

Last week, crude oil futures held onto the week’s gains closing out above $53 per barrel. Competitive prices were led by reports that OPEC and non-OPEC compliance is above 90 percent and the countries are considering extending production cuts beyond June, the original end date for the agreement reached last November. Participating OPEC countries plan to meet on May 25 to discuss how an extension of their agreement could further rebalance global oil supply and inventory levels.

Markets opened Monday morning with less confidence, countered somewhat by growing U.S. production. The U.S. Energy Information Administration (EIA) reported a larger-than-expected decline in oil stockpiles last week showing growth in U.S. oil output. National crude oil output reached a one-year high of an estimated 9.1 million b/d in March this year. Last week’s Baker Hughes oil rig count report — which showed the U.S. adding 11 rigs last week, bringing the total rig count to 683 — is further evidence of increased U.S. production. Traders will continue to watch the impact that increased U.S. production has on OPEC’s efforts to rebalance the market. At the close of last week’s formal trading session on the NYMEX, WTI was up seven cents to settle at $53.18 per barrel.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also be used to map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.