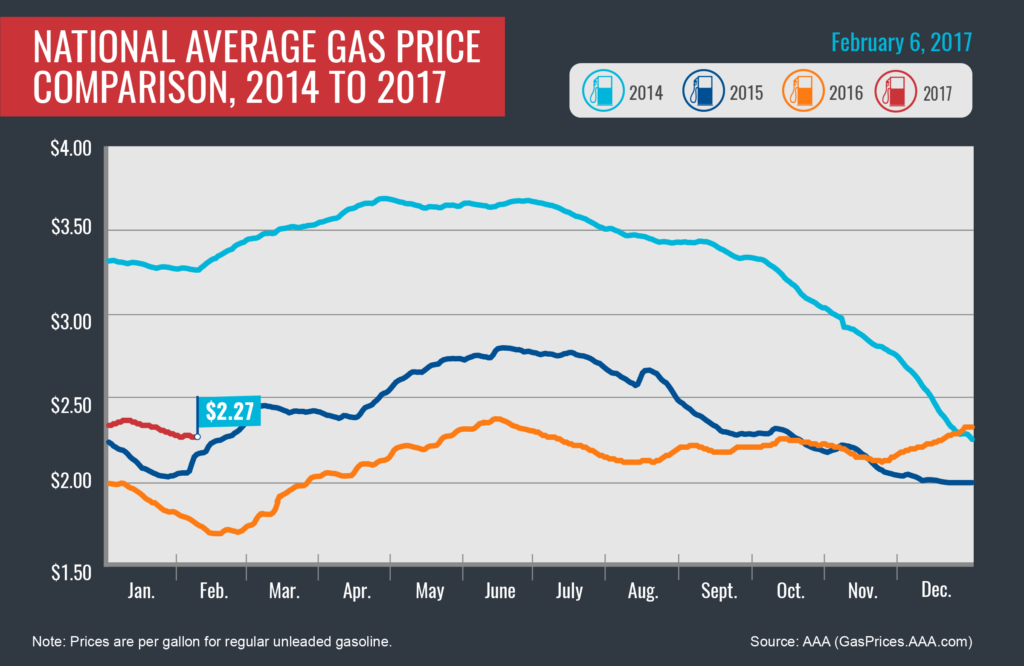

The national average price of regular unleaded gasoline remained relatively stable over the past week, settling at today’s price of $2.27 per gallon. Although today’s average remains flat compared to one week ago, drivers are paying ten cents less per gallon month-over-month, and 52 cents more per gallon year-over-year. Pump prices have been pressured higher overall due to cuts in oil production globally, but increased U.S. production and low demand has led to a leveling out of prices over the last couple of weeks. The U.S. Energy Information Administration’s (EIA) latest weekly estimates of U.S. gasoline demand show that January 2017 figures are down 6 percent from January 2016 and are at their lowest standing for the first month of the year since 2012.

Quick Stats

- The nation’s top five most expense markets are: Hawaii (3.11), California ($2.83), Washington ($2.73), Alaska ($2.72) and the District of Colombia ($2.55).

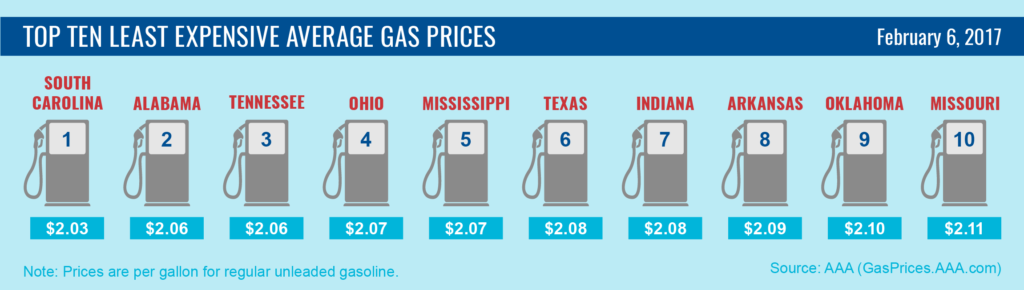

- The nation’s top five least expensive markets are: South Carolina ($2.03), Alabama ($2.06), Tennessee ($2.06), Ohio ($2.07) and Mississippi ($2.07).

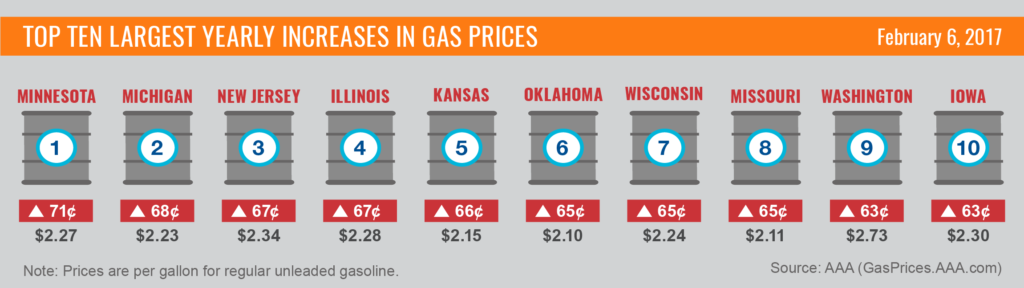

- The top five markets with the most dramatic year-over-year increases in gas prices include: Minnesota (+71 cents), Michigan (+68 cents), New Jersey (+67 cents), Illinois (+67 cents) and Kansas (+66 cents).

West Coast

Gas prices on the West Coast remain the highest in the country with six states in the region topping the list of most expensive U.S. markets: Hawaii ($3.11), California ($2.83), Washington ($2.73), Alaska ($2.72), Oregon ($2.52), and Nevada ($2.49). Prices in some parts of the region have crept higher due to planned and unplanned refinery maintenance and tight supply in Northern California.

According to the latest EIA report, West Coast refinery utilization rates dropped 4.2 percent – a five week low. OPIS reports that these drops come as planned maintenance will likely began at Tesoro’s 107,000-b/d Wilmington plant, as well as at Valero’s 149,000-b/d Benicia refinery. Phillips 66 is also planning to begin seasonal turnaround work this week at its refinery in Ferndale, Washington. The work is expected to last at least 45 days.

Rockies

Gas prices in the Rockies region have remained relatively stable over the past week with averages in most states fluctuating by two cents per gallon or less. A recent refinery project update from Phillips 66 shows that they plan to increase Canadian heavy crude processing capability at their Billings, Montana, refinery — 60,000-b/d– during the first half of the year. This, along with seasonal turnaround at other regional refineries, will likely result in increases at the pump for drivers as we head into the spring.

Great Lakes and Central States

As is often the case, volatility has characterized pump prices in the Great Lakes region over the past few weeks. Many states in the region reflected double-digit decreases three weeks ago, only to see gains over the past seven days, led by Indiana (+5 cents), Ohio (+5 cents), Michigan (+4 cents) and Kentucky (+3 cents).

The latest EIA report shows that Midwest gasoline stocks increased by nearly 3.5 million bbl to a total of almost 60 million bbl last week – the fifth consecutive weekly build and a clear sign of low regional demand.

Mid-Atlantic and Northeast

The EIA’s most recent report shows that East Coast inventories increased by 1.9 million bbl last week to 73.5 million bbl on hand – 6 million bbl more than last year. OPIS reports that it is common to see inventories build during the slow winter season, but this level of buildup has pressured market prices lower. Delaware (-4 cents), Maine (-4 cents), West Virginia (-3 cents), New Jersey (- 3 cents), Pennsylvania (-3 cents) and Virginia (-2 cents) all land on the nations list of top ten weekly decreases.

South and Southeast

Markets in the South and Southeast continue to post some of the lowest prices for retail gasoline in the nation, including South Carolina ($2.03), Alabama ($2.06), Tennessee ($2.06), Mississippi ($2.07), Texas ($2.08), Arkansas ($2.09) and Oklahoma ($2.10). The latest EIA report shows that Gulf Coast crude oil imports jumped over 750,000-b/d last week, to a total of 3.461 million b/d. The region also saw significant increases in U.S. crude oil inventory, with supplies increasing by 8.5 million bbl to 256.7 million bbl last week. OPIS reports that most other regions saw storage levels remain steady or decrease.

PBF Energy began turnaround work at its 197,000-b/d refinery in Chalmette, Louisiana last week that should wrap up by March 3. In addition, the Seaway Crude Pipeline Company LLC is back in full operation. The company released a statement Sunday saying they have restarted their crude pipeline after shutting down January 30 due to a spill near Trenton, Texas.

Oil Market Dynamics

Markets opened Monday morning with slightly higher oil prices following new U.S. sanctions imposed on Iran after its missile tests. Worries that tensions between the U.S. and Iran could impact crude oil supplies have been tempered by increasing U.S. oil production. Baker Hughes, an oil field services company, reported that U.S. energy companies added 17 oil rigs the week of February 3, bringing the total U.S. rig count to 583. The potential for more U.S. oil production has kept a ceiling on oil prices and diminished the impact of efforts by OPEC and non-OPEC countries to cut production and rebalance global oil supply. Traders will keep an eye of U.S.-Iran relations and any further gains in U.S. oil production. At the closing of Friday’s formal trading session on the NYMEX, WTI was up 29 cents to settle at $53.83 per barrel.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.