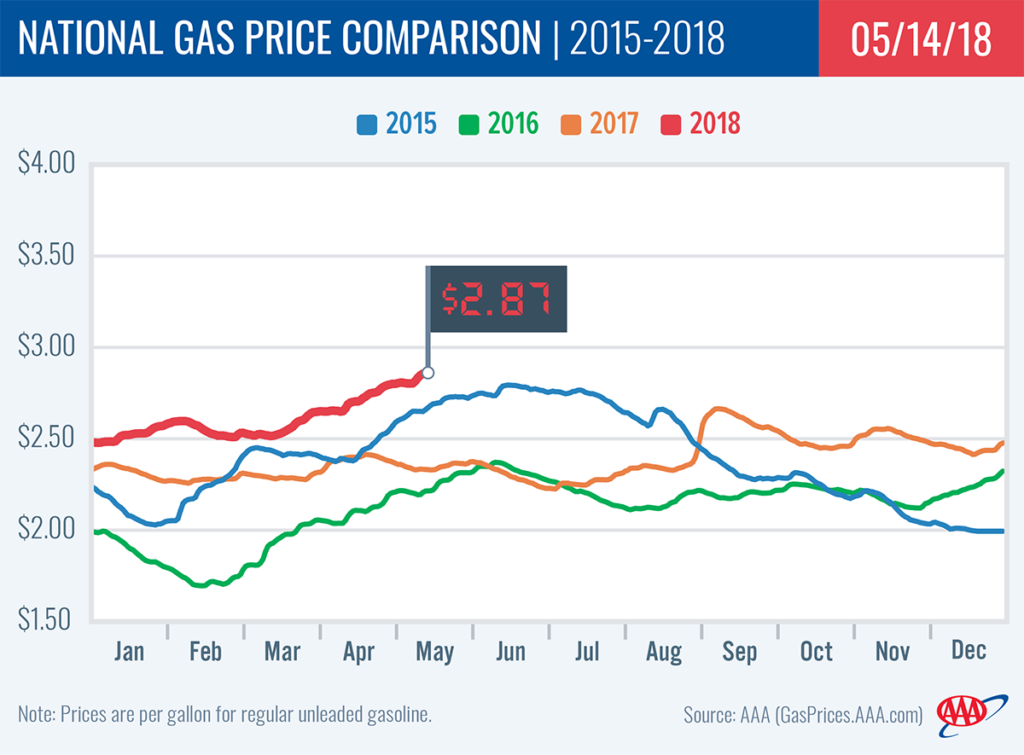

At $2.87, the national gas price average jumped six cents on the week in part due to the White House’s decision to re-impose sanctions on Iran. As a result, 36 states are seeing gas prices that are a nickel or more expensive than last Monday.

“The Administration’s move combined with the switchover to summer blend, growing global demand and shrinking supply continues to fuel pump prices as we approach the summer driving season,” said Jeanette Casselano, AAA spokesperson. “AAA predicts that the national average may reach $3/gallon this summer, especially if crude oil prices continue to increase.”

Motorists are seeing 19 percent of gas stations selling gas for $3.01 or more. Today’s gas price is 16-cents more expensive than one month ago and 53-cents more than one year ago.

Quick Stats

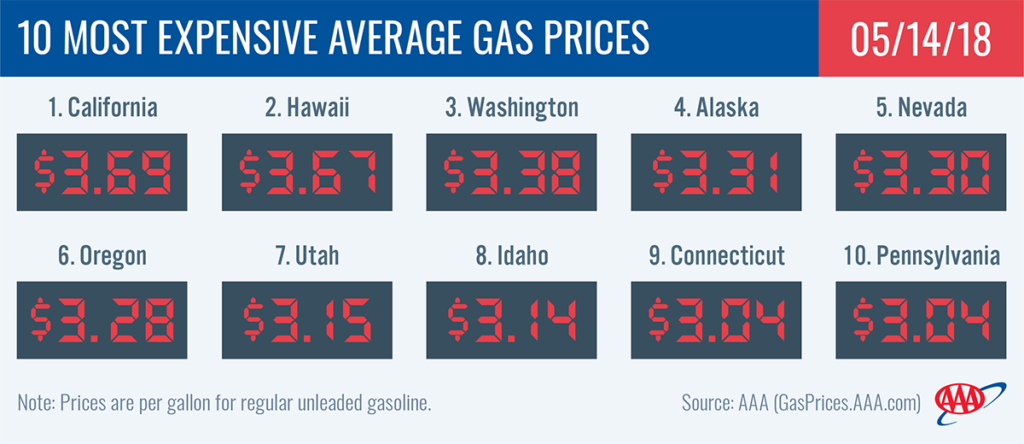

- The nation’s top 10 most expensive markets are: California ($3.69), Hawaii ($3.67), Washington ($3.38), Alaska ($3.31), Nevada ($3.30), Oregon ($3.28), Utah ($3.15), Idaho ($3.14), Connecticut ($3.04) and Pennsylvania ($3.04).

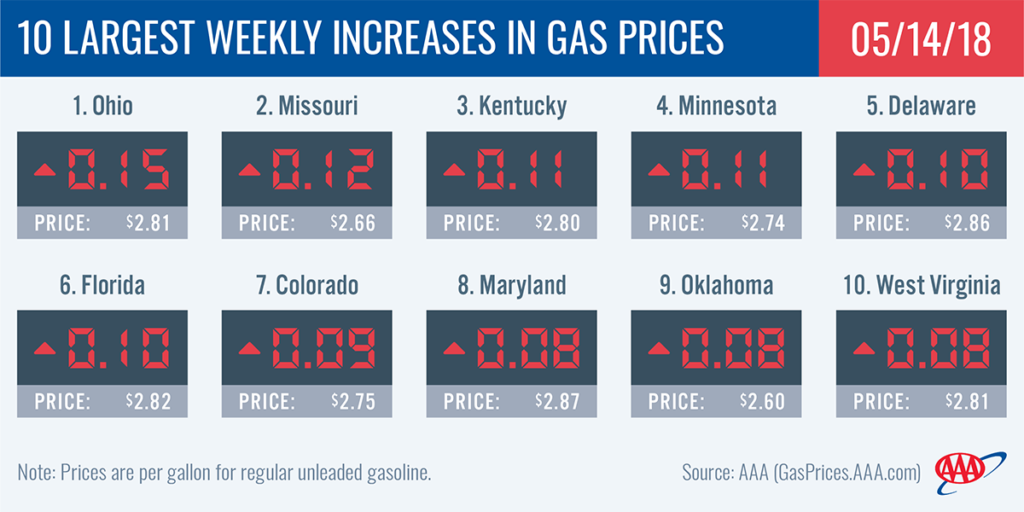

- The nation’s top 10 states with the largest weekly increases are: Ohio (+15 cents), Missouri (+12 cents), Kentucky (+11 cents), Minnesota (+11 cents), Delaware (+10 cents), Florida (+10 cents), Colorado (+9 cents), Maryland (+8 cents), Oklahoma (+8 cents) and West Virginia (+8 cents).

West Coast

Drivers in the West Coast region are paying the highest pump prices in the nation: California ($3.69), Hawaii ($3.67), Washington ($3.38), Alaska ($3.31), Nevada ($3.30), Oregon ($3.28) and Arizona ($2.94). On the week, prices in the region have all increased. California and Washington saw the biggest leap at six cents each, while Alaska (+3 cents) saw the smallest increase.

According to the Energy Information Administration’s (EIA) petroleum report for the week ending on May 4, the West Coast region saw a decline in gas stocks, falling by nearly 700,000 bbl to 29.85 million bbl. An increase in demand and a drop in imports, which fell by more than half from the previous high last week of 192,000 b/d to 67,000 b/d, helped gas stocks fall in the region. However, when compared to this time last year, current total stocks of gasoline in the region are higher by more than 200,000 bbl.

Great Lakes and Central

Following a week of decreases, gas prices are showing signs of volatility in the Great Lakes and Central states. On the week, Ohio gas prices jumped 15-cents when last Monday (May 7) gas prices had seen an 8 cent-decrease from the previous week. The region often sees this volatile pattern with increases and decreases from week to week. Ohio’s jump is the largest of any state in the country on the week. Also seeing large price increases in the region on the week: Missouri (+12 cents), Kentucky (+11 cents), Minnesota (+11 cents), Wisconsin (+8 cents), Iowa (+8 cents), Nebraska (+8 cents), North Dakota (+8 cents), Illinois (+7 cents) and Michigan (+7 cents).

With a 328,000 bbl draw, gasoline inventories continue to dwindle in the Great Lakes and Central states. Despite more than two months of declines, however, total gasoline inventories are nearly 1 million bbl above last year’s levels measuring at 56 million bbl.

South and Southeast

Florida (+10 cents) saw the largest jump in gas price averages on the week in the region and had the sixth largest jump in the country. Also seeing noticeable spikes in the last seven days: Oklahoma (+8 cents), Texas (+6 cents), New Mexico (+5 cents) and Arkansas (+5 cents). The remaining states saw moderate jumps or no price change (Georgia).

At $2.56, Mississippi carries the least expensive gasoline in the country and the region, followed by Louisiana ($2.57), Arkansas ($2.58), South Carolina ($2.58), Alabama ($2.58) and Oklahoma ($2.59).

The South and Southeast region took the largest draw in the country with 2.7 million bbl on the week. With the draw, levels fall to 79 million bbl – the lowest inventory level the region has seen since the beginning of December 2017.

Mid-Atlantic and Northeast

Hitting the $3 mark, Connecticut ($3.04), New York ($3.00) and Washington, D.C. ($3.00) join Pennsylvania ($3.04) as some of the top 12 states with the most expensive gas prices in the country. These four states are also the only states on the east coast with gas price averages at $3 or more.

Prices are more expensive on the week across the region with Delaware (+10 cents), Maryland (+8 cents) and West Virginia (+8 cents) seeing the largest jumps on the week.

Inventories continue to grow in the region and measure at 68 million bbl. On the week, 1.8 million bbl were added to inventory. The region was the only one in the country to see inventories plus up.

Rockies

Jumping 10-cents on the week, Colorado ($2.75) lands on this week’s top 10 list of states with the largest increases. Prices continue to increase across the region: Wyoming (+6 cents), Utah (+6 cents), Montana (+5 cents) and Idaho (+3 cents). At $3.15, Utah carries the most expensive state average in the region, followed by Idaho ($3.14). Both state averages are among the 10 most expensive in the country.

Inventories drew down for a second week by 275,000 bbl. Regional inventory sits just under 7 million bbl in total and 1.5 million blow this time last year.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI dropped 66 cents to settle at $70.70. Oil prices climbed to new highs for 2018 last week, following President Trump’s decision to re-impose economic sanctions on Iran and withdraw the U.S. from the Iran Nuclear Deal. Set in 2015 under the Obama Administration, the U.S. – along with the European Union, five permanent members of the UN Security Council, and Germany – entered into the deal that lifted economic sanctions on Tehran in exchange for the country downsizing its nuclear program. Some of the pre-2015 sanctions targeted the Iranian energy sector and impeded Iran’s ability to sell oil. With those sanctions being re-imposed in the next 3-6 months, Iran’s crude exports are forecasted to decrease, contributing to already declining global crude supplies amid growing global demand. Increased fears of instability in the region may push oil prices even higher this week.

Crude prices may also increase if EIA’s weekly report shows another drop in domestic crude inventories. Last week, the report revealed that U.S. crude inventories fell by 2.2 million bbl. At 433.8 million bbl, inventories around the country are approximately 88.8 million bbl lower than were they were in May 2017. Domestic inventories have fallen steadily since OPEC and other large producers, including Russia, have reduced their combined output since the beginning of 2017. The agreement is set to expire at the end of this year, as U.S. production continues to climb. It shows no signs of slowing anytime soon, with Baker Hughes, Inc. reporting that the U.S. gained 10 oil rigs last week. The total, 844, is 132 more rigs than last year at this time.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.