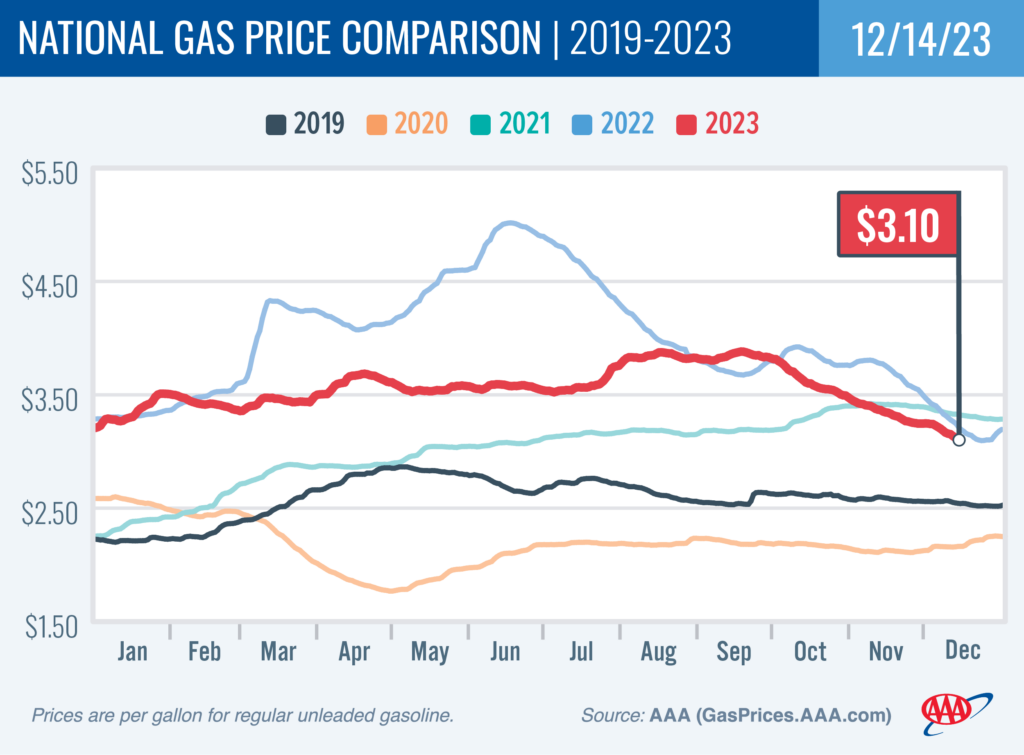

WASHINGTON, D.C. — The national average for a gallon of gas is within a penny of matching the 2022 low of $3.09 and will likely dip further in the coming days. For those keeping score at home, last year’s low came on December 23. Since last week, the national average has fallen by a dime to $3.10. The main reasons are tepid demand and a low cost for oil, which is hovering around $70 per barrel.

“AAA is forecasting that roughly 104 million Americans will drive to their holiday destinations this year, and they will be greeted with the gift of falling gas prices,” said Andrew Gross, AAA spokesperson. “With pump prices falling slowly each day, it is likely that the national average will slide below $3 per gallon by the end of the year.”

According to new data from the Energy Information Administration (EIA), gas demand increased from 8.47 to 8.86 million b/d last week. Meanwhile, total domestic gasoline stocks increased slightly to 224 million bbl. Typically, higher demand would push pump prices higher, but lower oil prices have pushed prices lower. If oil prices remain low, drivers can expect pump prices to do the same during the holiday season.

Today’s national average of $3.10 is 25 cents less than a month ago and 11 cents less than a year ago.

Quick Stats

- Since last Thursday, these 10 states have seen the largest decreases in their averages: Michigan (−17 cents), Florida (−17 cents), Indiana (−16 cents), Arizona (−14 cents), Illinois (−13 cents), Ohio (−13 cents), Montana (−12 cents), Washington, DC (−12 cents), Kentucky (−12 cents) and Texas (−11 cents).

- The nation’s top 10 least expensive markets: Michigan (−17 cents), Florida (−17 cents), Indiana (−16 cents), Arizona (−14 cents), Illinois (−13 cents), Ohio (−13 cents), Montana (−12 cents), Washington, DC (−12 cents), Kentucky (−12 cents) and Texas (−11 cents).

Oil Market Dynamics

At the close of Wednesday’s formal trading session, WTI increased by 86 cents to settle at $69.47. Oil prices increased yesterday after the US Federal Reserve announced that it plans to hold interest rates steady through the end of the year and potentially reduce rates up to three times in 2024. The market had been concerned that the economy could tip into a recession if interest rates kept increasing. Oil demand and prices would likely decline if a recession occurred. Additionally, the EIA reported that total domestic commercial crude inventories decreased by 4.3 million bbl to 440.7 million bbl last week.

Drivers can find current gas prices along their route using the AAA TripTik Travel planner.