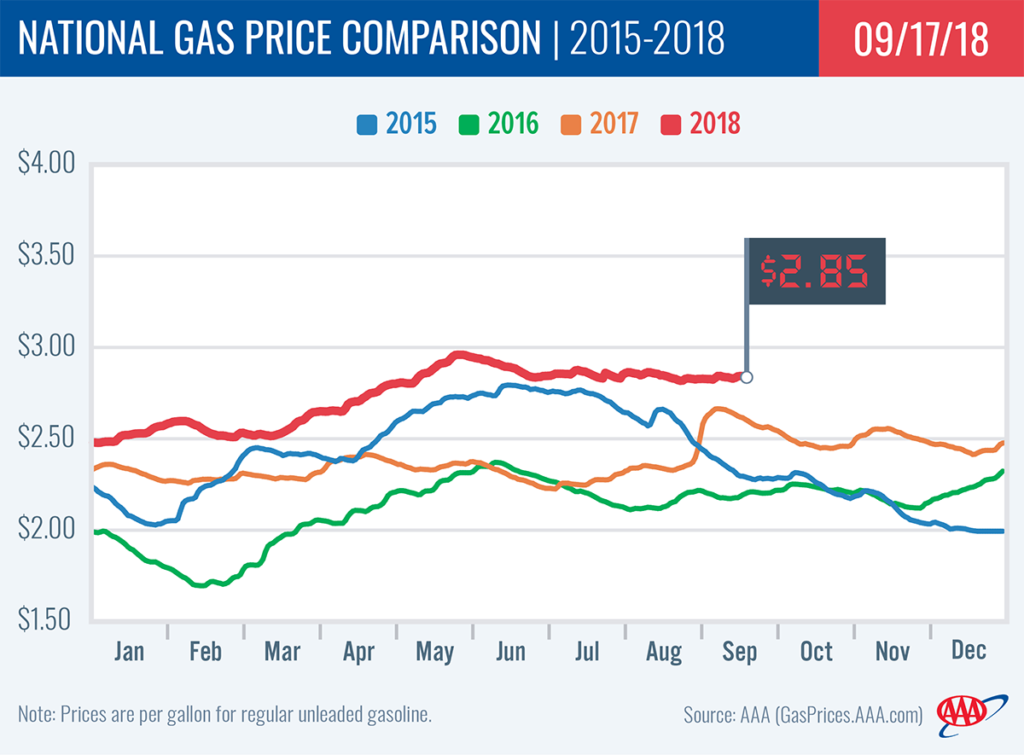

While Hurricane Florence battered the Carolinas over the weekend with life-threating storm-surge, rain and flooding, it has had little to no impact on gas prices, with the national average, holding steady at $2.85 on the week.

Gas prices have not seen much movement because unlike the Gulf Coast, which is home to dozens of refineries, the Carolinas house only pipelines and terminals. This means U.S. crude processing is not impacted and therefore neither are gas prices nationally.

Prior to Florence’s arrival, the Energy Information Administration (EIA) reported the Lower Atlantic Region’s total gasoline stocks — which includes West Virginia, Virginia, North Carolina, South Carolina, Georgia and Florida — measured at 27.9 million bbl. That is 10 percent higher than the 5-year average for this time of year.

“Gasoline stocks in the hurricane-impacted area are healthy, but delivery of gasoline will be an impediment to meeting demand in coastal areas this week,” said Jeanette Casselano, AAA spokesperson. “As power is restored, water recedes and roads open-up, we will have a better idea of how quickly fuel deliveries can be made to gas stations in the area. And while fuel availability at stations is a concern, AAA expects station outages to be short-lived.”

According to the Department of Energy, states are working closely with industry to expedite resupply shipments to impacted areas. AAA will continue to monitor hurricane recovery efforts and fuel resupply.

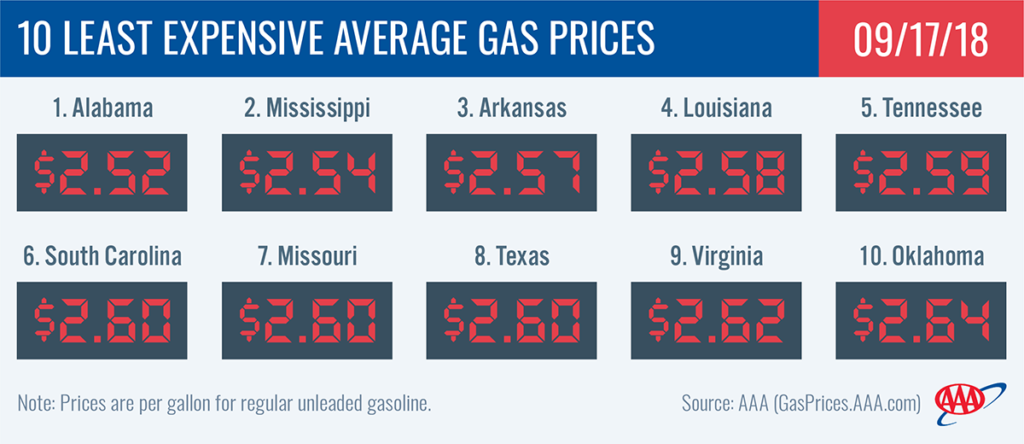

- The nation’s top 10 least expensive markets are: Alabama ($2.52), Mississippi ($2.54), Arkansas ($2.57), Louisiana ($2.58), Tennessee ($2.59), South Carolina ($2.60), Missouri ($2.60), Texas ($2.60), Virginia ($2.62) and Oklahoma ($2.64).

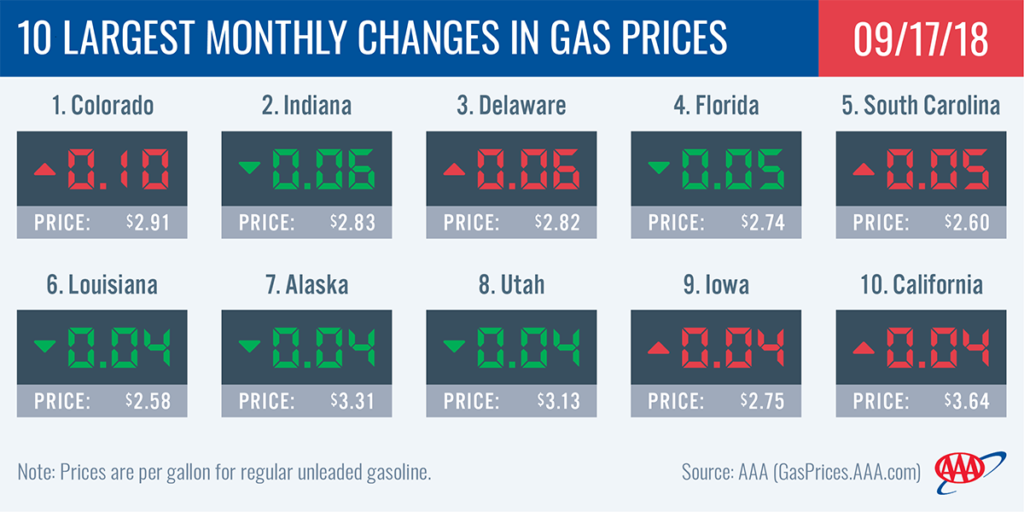

- The nation’s top 10 largest monthly changes are: Colorado (+10 cents), Indiana (-6 cents), Delaware (+6 cents), Florida (-5 cents), South Carolina (+5 cents), Louisiana (-4 cents), Alaska (-4 cents), Utah (-4 cents), Iowa (+4 cents) and California (+4 cents).

Mid-Atlantic and Northeast

Hurricane Florence drove up gas prices in North Carolina (+3 cents) and Virginia (+1 cents) this past week. All other states in the Mid-Atlantic and Northeast region saw prices decrease by a few cents or remained stable.

For motorists in coastal parts of North Carolina and Virginia, fuel availability post Hurricane Florence is a concern. As residents evacuated, panic-buying and tank-topping set-in, leaving some gas stations with low to no fuel at their pumps. The positive news is that Mid-Atlantic and Northeast regional gasoline inventories sit at a healthy 66.7 million bbl, which is not only the second highest inventory level recorded for the region this year, but a level not seen in the Mid-Atlantic and Northeast region since March 2016. This means that the region has adequate supply on-hand, and, weather-dependent, could be a resource to assist with resupply in the hurricane-impacted area, once water levels subside, roads are passable and power is restored.

South and Southeast

Hurricane Florence pushed up South Carolina’s ($2.60) state gas price average by just a penny on the week. Otherwise, pump prices for the majority of the South and Southeast are getting cheaper or seeing no change. Florida saw the largest drop of 3-cents during the last seven days while a one-cent drop was seen in Texas, New Mexico and Louisiana.

Pipelines and terminals are located in South Carolina, but were unaffected by the storm. Those facilities deliver approximately 3 million b/d of refined products to the eastern U.S. Once delivery trucks are able to take to the roads, the South and Southeast pipelines and terminals will help with resupply to the coastal areas.

As Gulf Coast refineries have not been impacted by the hurricane, processing continues as normal. South and Southeast gasoline inventories built by 600,000 on the week, according the EIA’s latest report. Total inventories measure at 81.2 million bbl, which is a healthy level for this time of year.

Great Lakes and Central

As area refineries undergo maintenance, state gas price averages in the Great Lakes and Central region are as much as five-cents more expensive since last Monday: Iowa (+5 cents), Nebraska (+4 cents), Ohio (+4 cents), and South Dakota (+3 cents). Only Missouri ($2.61) and Kansas ($2.66) saw a drop in pump prices on the week.

Today, there is a 32-cent difference in the most expensive state gas prices in the region carried in Michigan at $2.93 and least expensive at $2.61 in Missouri.

As pump prices see relatively small volatility, gasoline inventories continue to hover at the 53.1 million bbl mark. However, with unplanned and planned maintenance at some Great Lakes and Central refineries, inventories could decline this fall.

Rockies

On the week, Utah (-2 cents) and Idaho (-1 cents) motorists are paying less to fill-up. In fact, gas price averages across the Rockies states are mostly moving toward a return to pre-summer pump prices. Here is a snapshot of state gas prices since Memorial Day, at their highest summer price and today’s price:

| State gas price average on May 24, 2018 (start of Memorial Day Weekend) | Highest gas price average this summer by state | State gas price average on September 17, 2018 | |

|---|---|---|---|

| Colorado | $2.89 | $2.91 | $2.91 |

| Idaho | $3.17 | $3.26 | $3.21 |

| Montana | $2.91 | $2.95 | $2.95 |

| Utah | $3.15 | $3.21 | $3.13 |

| Wyoming | $2.87 | $3.00 | $2.98 |

As demand begins to drop in the region, gasoline inventories took a small draw and continue to hover near the 6.5 million bbl mark. Gas prices will continue to trend cheaper as demand draws into the fall.

West Coast

The West Coast remains the nation’s most expensive region for retail gasoline, with six of the region’s states represented in the nation’s top 10 most expensive list. Hawaii ($3.77) is the nation’s most expensive market, followed by California ($3.64), Washington ($3.38), Alaska ($3.31), Oregon ($3.26), Nevada ($3.20) and Arizona ($2.87). Prices in the region remain relatively flat compared to last week, except for a one-cent jump in California and Arizona.

The EIA’s weekly petroleum status report showed West Coast motor gasoline stocks totaled 28.4 million bbl during the week that ended on September 7 – a gain of 100,000 bbl from the previous week. Stocks are 1.3 million bbl lower than where they were at this time last year, which could support a price spike if supplies remain low amid an increase in demand.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI increased 40 cents to settle at $68.99. Oil prices have edged higher last week following the release of the EIA’s weekly petroleum report that showed crude stocks fell by 5.3 million bbl last week. If supplies fall again in this week’s report, crude prices could climb further. Dwindling supplies have put a spotlight on shrinking global crude inventories, which could cause oil prices to push to $70-$80/bbl this fall. Continued decline in crude production from Venezuela and anticipated reduced crude exports from Iran due to U.S.-imposed sanctions that go into effect in November could place greater pressure on the market. In the near term, U.S. crude production has not been impacted by Hurricane Florence, as there were no refineries in Florence’s path.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.