Gas prices see a slight uptick

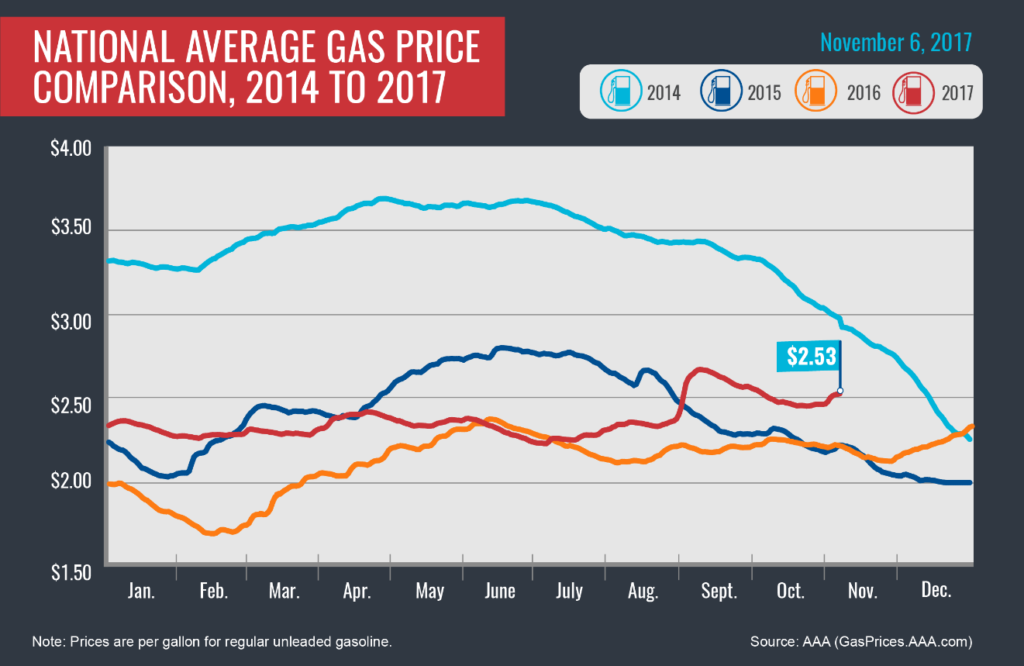

According to the Energy Information Administration (EIA), the latest gasoline demand measurement is the highest for the end of October since 2006. At $2.53, today’s gas price is six cents more than a week ago, two cents more than a month ago and 31 cents more than a year ago.

“October has seen strong demand numbers likely, in part, due to consumers taking advantage of the unseasonably warm weather rather than spending time indoors,” said Jeanette Casselano, AAA spokesperson. “As consumers fill up their tanks more frequently, we are seeing supply levels tighten and gas prices increase. However, we don’t expect this increase to be long-term.”

The national gas price average during the second half of October was relatively stable, fluctuating a penny or two until October 31. Since then, the national price has seen upward movement, primarily resulting from increased demand.

Quick Stats

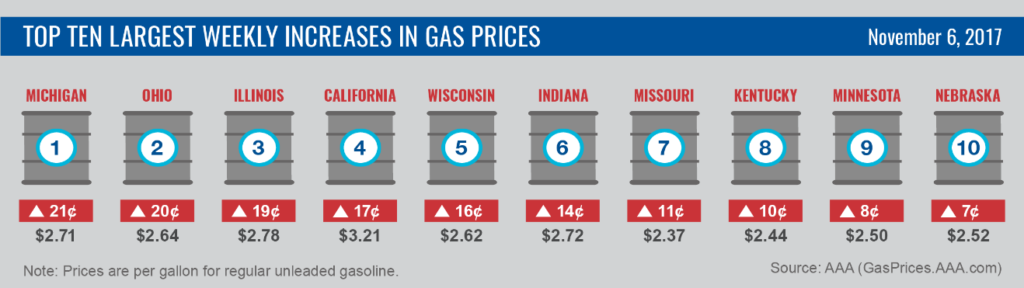

- The nation’s top ten largest weekly increases are: Michigan (+21 cents), Ohio (+20 cents), Illinois (+19 cents), California (+17 cents), Wisconsin (+16 cents), Indiana (+14 cents), Missouri (+11 cents), Kentucky (+10 cents), Minnesota (+8 cents) and Nebraska (+7 cents).

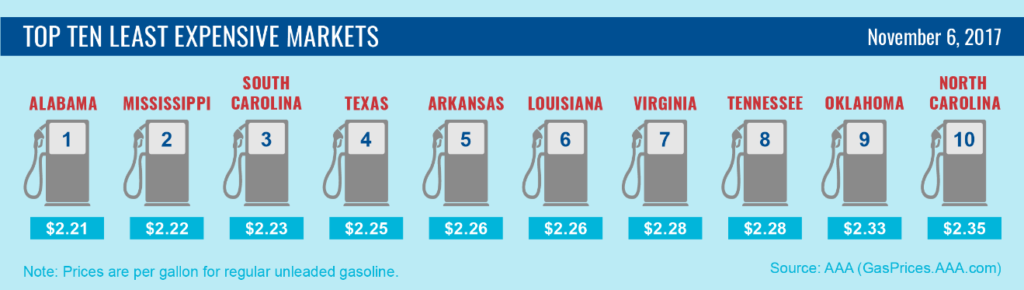

- The nation’s top ten least expensive markets are: Alabama ($2.21), Mississippi ($2.22), South Carolina ($2.23), Texas ($2.25), Arkansas ($2.26), Louisiana ($2.26), Virginia ($2.28), Tennessee ($2.28), Oklahoma ($2.33) and North Carolina ($2.35).

West Coast

Moving into the week, the West Coast continues to lead the U.S. among most expensive markets. Six of the top ten most expensive markets in the country are found in this region: California ($3.21), Hawaii ($3.17), Alaska ($3.09), Washington ($2.94), Oregon ($2.79) and Nevada ($2.73). Most prices in the region have seen growth over the past week, with California (+17 cents) and Alaska (+5 cents) seeing the largest increases of markets in the region. Drivers in California are likely to see pump prices increase due to new gasoline taxes that were imposed on November 1. The tax rate for gasoline increased 12cts/gal, from 29.7cts/gal to 41.7cts/gal.

In the EIA’s latest report, total gasoline stocks are below 28 million bbl, reaching a seven-week low at 27.6 million bbl. Additionally, EIA’s report showed that the refinery utilization rate of crude fell to 81.4 percent from 81.9 percent last week, which means less gasoline is being produced. With demand remaining high and supplies tightening in the region, prices are also being pushed up by these supply and demand factors.

Great Lakes and Central

Compared to a year ago, more than a dozen Great Lakes and Central states are paying at least 25 cents more a gallon to fill up their tanks. Topping the year-over-year increases list: Indiana (+60 cents), Illinois (+59 cents), Michigan (+54 cents), Ohio (+52 cents), Wisconsin (+51 cents), Minnesota (+44 cents), Missouri (+43 cents) and Kansas (+40 cents).

On the week and similar to last week, the region continues to see gas prices increase more than any other region in the country. This week, Illinois ($2.78), Indiana ($2.72), Michigan ($2.71) and Ohio ($2.64), all land on the top 15 states with the most expensive gas in the country.

The price volatility is attributed to the continued regional trend of gasoline inventory declines. With 45.5 million bbl, the region has seen levels drop for six straight weeks.

Mid-Atlantic and Northeast

Gas prices continue to be volatile in the Mid-Atlantic and Northeast regions with motorists either paying more or seeing stability at the pump. Not one state saw a decrease. A handful of states saw sizeable increases to gas prices on the week: Pennsylvania (+6 cents), Delaware (+6 cents), New Jersey (+5 cents), Maine (+5 cents) and Maryland (+5 cents). However, Massachusetts, Connecticut and Rhode Island saw no change to prices at the pump.

With a 2.9 million bbl decrease in inventory, the region saw the biggest drop of any in the country. With nearly 54 million bbl, inventory is nearing some of the lowest levels of the year. As supplies tighten, it brings a nearly 7 million bbl deficit compared to this time last year.

South and Southeast

Most South and Southeast motorists are paying more at the pump for a gallon of unleaded gasoline on the week: Louisiana (+4 cents), Arkansas (+4 cents), Mississippi (+3 cents), Oklahoma (+2 cents), Texas (+2 cent), South Carolina (+2 cents) and Alabama (+2 cent). Only the state of Georgia (-1 cent) saw gas prices decrease and Florida remained stable over the course of the last seven days. Despite the increases, the region carries some of the cheapest gas prices in the country with Alabama ($2.21) topping the country’s list of least inexpensive gas.

Compared to one month ago, many states in the region have seen double-digit declines in gas prices: Georgia (-20 cents), Florida (-16 cents), Alabama (-15 cents), South Carolina (-13 cents), Texas (-13 cents) and Mississippi (-11 cents).

The region is the only one in the country on the week to see a build in gasoline inventory. EIA reports an increase of 1.15 million bbl. Sitting at 78.8 million bbl, the total inventory is on par with levels this time last year.

Rockies

Gas prices in the Rockies region are showing some volatility from state to state. On the week, Colorado (+5 cents) saw the biggest increase while Utah (-3 cents) saw the largest dip in gas prices. Idaho declined (-2 cents), while Wyoming and Montana remain stable. Despite the small change in price, Idaho ($2.66) carries the most expensive gas of all five states in the region.

Oil market dynamics

Last week, WTI hit a new 2017 high at $54.54 and the market will likely build on those gains this week. At the close of Friday’s formal trading session on the NYMEX, WTI settled up $1.10/bbl at $55.64/bbl. The latest EIA report showed major inventory draws and increased exports, both of which have helped push oil prices higher. Crude oil inventories slid by 2.4 million bbl, while crude oil exports reached a new record of 2.133 million b/d. All of this news has given market observers renewed confidence in seeing oil prices pushing higher as supplies appear to grow tighter and demand remains strong, fueled by oil demand growth in key export markets.

Last week, Baker Hughes, Inc. reported that the U.S. oil rig count dropped by eight rigs, bringing the total to 729. The news follows reports that at OPEC’s next meeting in Vienna on Nov. 30, OPEC and allied non-OPEC producers will review the agreement to reduce production through March of next year. Some reports have stated that the group may extend the agreement through the end of 2018, which if true, will likely help boost oil prices through the end of the year.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.