The national average dropped six cents on the week, following a consistent downward trend since Memorial Day. The decline is unusual for this time of year. Pump prices usually trickle higher during the summer months due to increased demand. However, the latest Energy Information Administration (EIA) report reveals that total domestic gasoline inventories jumped a million bbl last week, helping to push pump prices lower. According to OPIS, strong production output and increased imports have helped gasoline storage levels grow consistently over the past four weeks.

“Growing gasoline inventories are contributing to relief at the pump as we head into summer,” said Jeanette Casselano, AAA Spokesperson. “Current U.S. inventories sit at nearly 235 million bbl, which is helping to feed growing demand.”

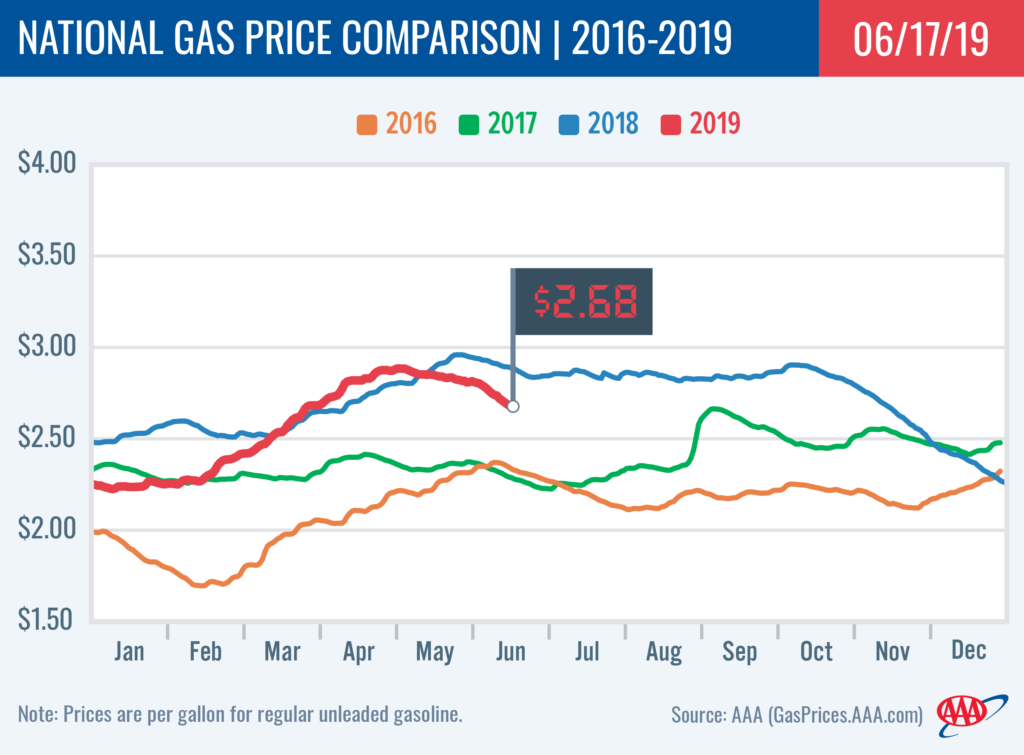

According to the latest EIA report, gasoline demand reached 9.877 million b/d last week – the 6th highest weekly count on record. Current demand levels are on par with volumes seen this same time last year (9.879 million b/d). Today’s national average is $2.68, which is six cents cheaper than last week, 17 cents less than last month and 20 cents less than the same time last year.

Quick Stats

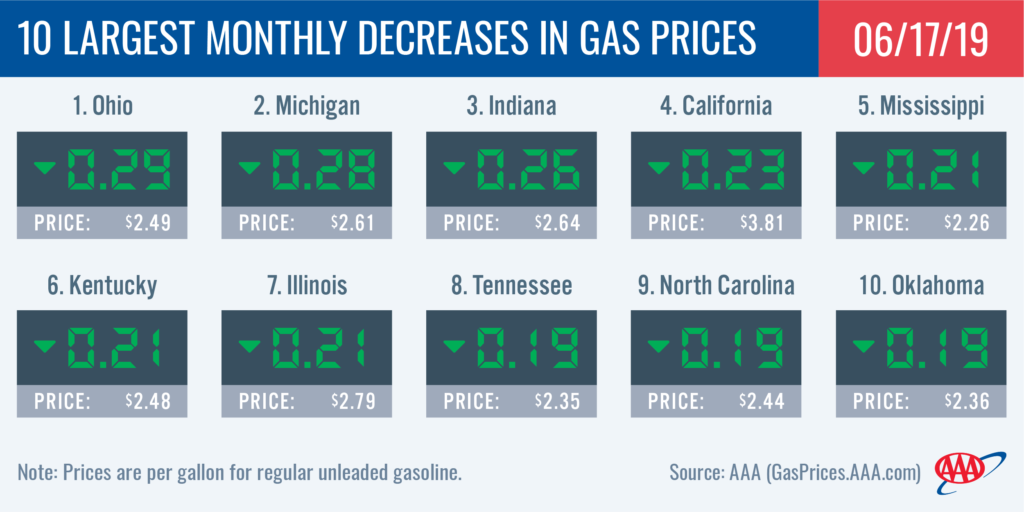

The nation’s top 10 largest monthly decreases are: Ohio (-29 cents), Michigan (-28 cents), Indiana (-26 cents), California (-23 cents), Mississippi (-21 cents), Kentucky (-21 cents), Illinois (-21 cents), Tennessee (-19 cents), North Carolina (-19 cents) and Oklahoma (-19 cents).

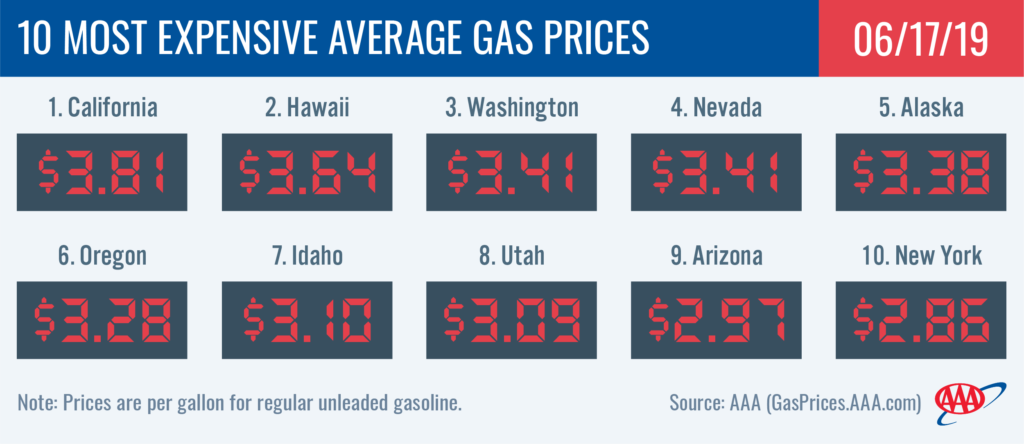

The nation’s top 10 most expensive markets are: California ($3.81), Hawaii ($3.64), Washington ($3.41), Nevada ($3.41), Alaska ($3.38), Oregon ($3.28), Idaho ($3.10), Utah ($3.09), Arizona ($2.97) and New York ($2.86).

Great Lakes and Central States

Gas prices dropped by 4 cents or more across most of the region, with Michigan (-12 cents), Illinois (-9 cents), Oklahoma (-9 cents) and Ohio (-7 cents) landing on the list of top 10 largest weekly declines.

Compared to last month, all motorists in the Great Lakes and Central states are seeing a cost savings at the pump. The states seeing the largest drops are: Ohio (-29 cents), Michigan (-28 cents), Indiana (-26 cents), Kentucky (-21 cents), Illinois (-20 cents), Tennessee (-19 cents) and Oklahoma (-19 cents).

On the week, regional gasoline inventories built by 200,000 bbl to register at 48.3 million bbl. Refinery production has also been strong in the region, with operating rates increasing 4% on the week to reach a total of 88%.

Mid-Atlantic and Northeast

While prices have dropped on the week, some states are still paying high prices at the pump. New York ($2.86), Connecticut ($2.85), Pennsylvania (2.84) and Washington D.C. ($2.80) all land on the top 15 list of most expensive prices in the country. Within the region, gas prices range from $2.86 in New York to $2.43 in Virginia.

Last week, east coast gasoline inventories dropped 1.6 million bbl. United Refining also shut down its 70,000-b/d refinery in Warren, Pennsylvania, for unplanned maintenance. United reports that operations should return to normal within a week, however the downtime could impact supply in parts of southwestern New York and northwestern Pennsylvania.

Rockies

Prices have fallen across the region between 2 to 5 cents on the week. Despite the declines, Idaho ($3.10) and Utah (3.09) both land on the top 10 list of most expensive states in the country. At $2.78, Colorado carries the cheapest average in the region.

The latest EIA report shows that gasoline inventories in the region increased 5% to 7.6 million bbl. The increase can likely be attributed to strong production. The refinery utilization rate in the region hit 100% last week.

South and Southeast

Prices in the region continued to move down on the week. Drivers in the Southeast saw some of the largest regional discounts, with Florida (-9 cents), South Carolina (-8 cents) and North Carolina (-7 cents) all landing on the top 10 list of largest weekly declines. Texas (-31 cents), Mississippi (-31 cents), Louisiana (-31 cents), Georgia (-28 cents), Alabama (-28 cents) and Arkansas (-28 cents) all land on the list of top 10 largest yearly declines.

According to the latest EIA report, gasoline inventories in the gulf coast grew 1.7 million-bbl on the week.

West Coast

Motorists in the West Coast region are paying the highest pump prices in the nation, with all seven states landing on the top 10 most expensive list today. California ($3.81) and Hawaii ($3.64) are the most expensive markets. Washington ($3.41), Nevada ($3.41), Alaska ($3.38), Oregon ($3.28) and Arizona ($2.97) follow. Pump prices in the region have mostly decreased on the week, with Arizona (-6 cents) seeing the largest drop.

The EIA’s recent report for the week ending on June 7 showed that West Coast gasoline stocks increased slightly by 90,000 bbl from the previous week and sit at 30.8 million bbl. The current level is 700,000 bbl less than last year’s level at this time, which could cause prices to spike if there is a supply disruption or gas demand surges in the region this week.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI increased by 23 cents to settle at $52.51. Crude prices increased late last week as a result of an attack on two tankers in the Gulf of Oman. This attack heightened market fears that rising tensions could continue in the Middle East and negatively impact crude oil availability. Approximately 20% of global crude supplies flow through the waterway. The Trump Administration attributed the attack to Iran, however, the country denies the accusation. If tensions between the U.S. and Iran escalate, the market will likely continue pushing global crude prices higher.

Before market fears increased, the price of crude hit its lowest point in six months last week. The drop in crude oil prices was supported by EIA revealing that total domestic crude inventories grew again by 2.2 million bbl and now sit at 485.5 million bbl. The current level is 53 million bbl higher than last year’s level at this time. An oversupply of crude has increased concerns that the market has a glut of oil – even as U.S.-imposed sanctions on Iran and Venezuela have worked to reduce global supply. Moreover, the Organization of the Petroleum Exporting Countries (OPEC) reduced their global oil demand outlook for the remainder of 2019 to 1.14 million b/d – down 70,000 barrels b/d from OPEC’s previous demand forecast due to reduced global trade as a result of tensions between the U.S., China, and Mexico. At its upcoming meeting on June 25-26, the cartel and its partners are expected to extend the current agreement to cut production by 1.2 million barrels per day through the end of 2019. Reduced global supply, amid robust demand, could increase crude prices in the latter half of the year.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.