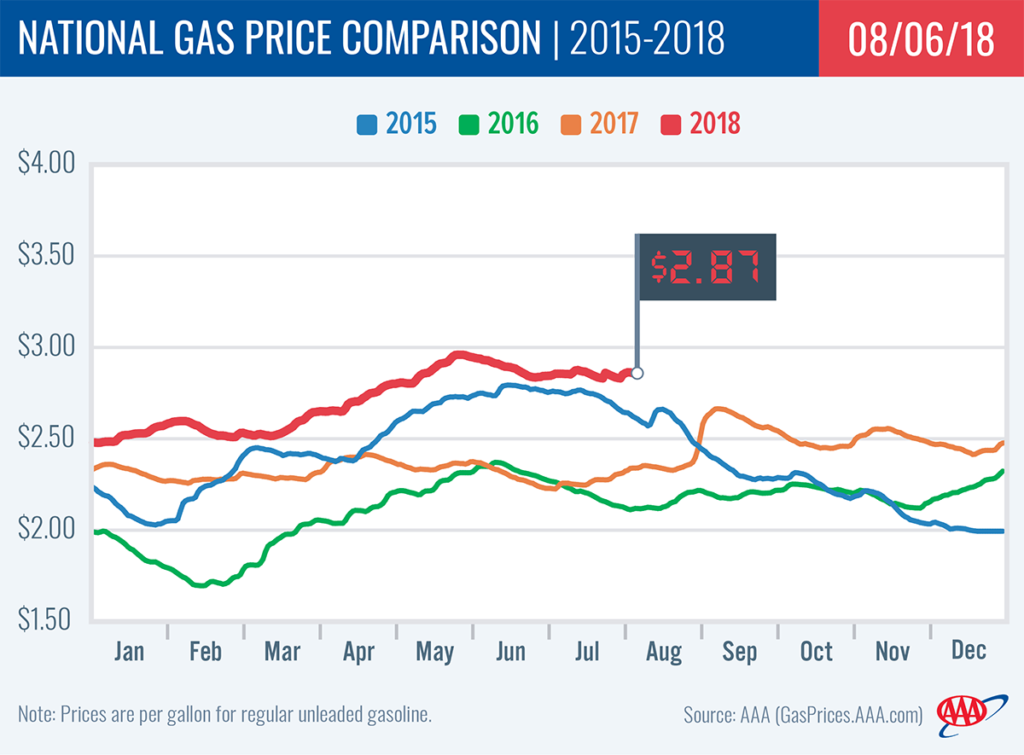

At 9.88 million b/d, gasoline demand last week was near an all-time record high according to the Energy Information Administration (EIA). More so, the latest EIA data shows gasoline inventories tightening from 240 million bbl at the end of June down to 231 million bbl at the end of July. The boost in demand and drop in inventory have driven the national gas price average to $2.87, which is the most expensive gas price seen in August since 2014.

“We are likely going to see an end of summer pump price rally as inventories continue to tighten, especially on the East Coast,” said Jeanette Casselano, AAA spokesperson. “This week’s EIA demand and inventory reports will give further indication of how much higher the national gas price average could jump before summer is over.”

While today’s gas price average is one-cent more than last week, it is the same price as one month ago, yet 52-cents more than this time last year.

Quick Stats

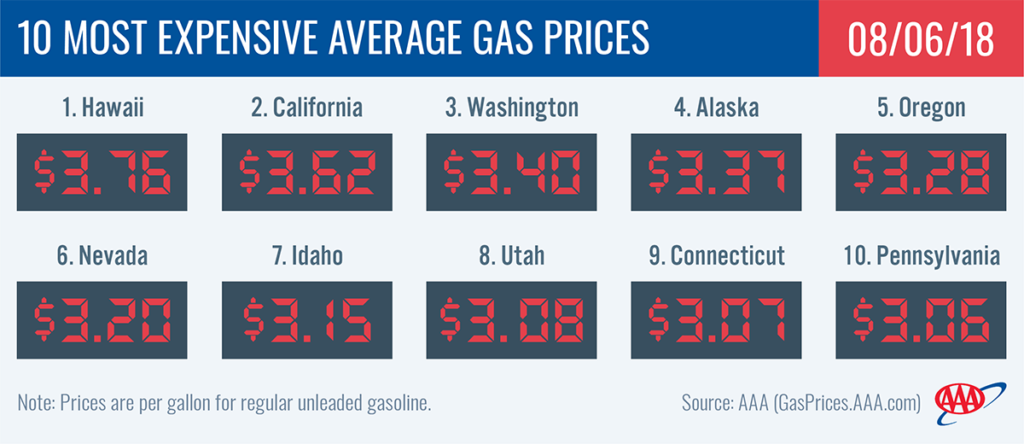

- The nation’s top 10 most expensive markets are: Hawaii($3.76), California ($3.62), Washington ($3.40), Alaska ($3.37), Oregon ($3.28), Nevada ($3.20), Idaho ($3.15), Utah ($3.08), Connecticut ($3.07) and Pennsylvania ($3.06).

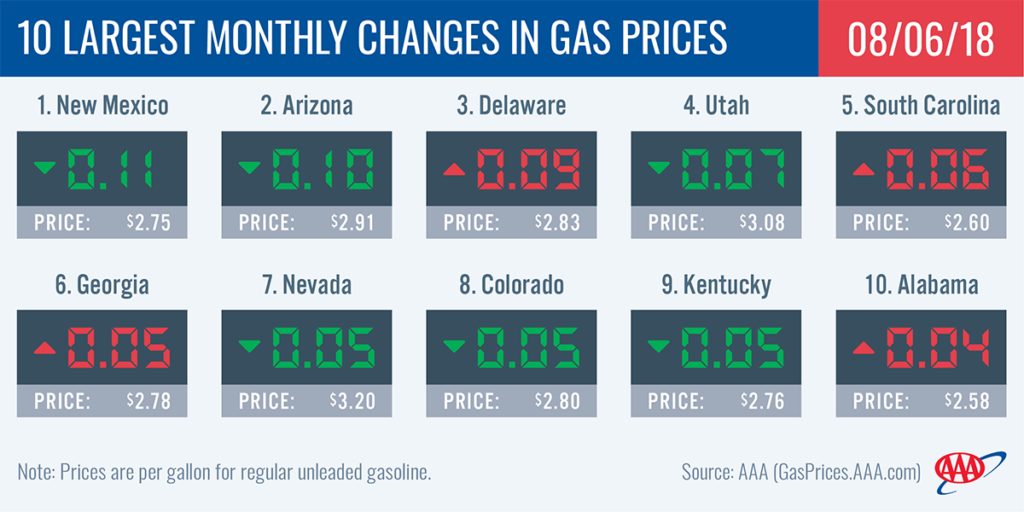

- The nation’s top 10 largest monthly changes are: New Mexico (-11 cents), Arizona (-10 cents), Delaware (+9 cents), Utah (-7 cents), South Carolina (+6 cents), Georgia (+5 cents), Nevada (-5 cents), Colorado (-5 cents), Kentucky (-5 cents) and Alabama (+4 cents).

West Coast

Motorists in states in the West Coast region are paying some of the highest pump prices in the country: Hawaii ($3.76), California ($3.62), Washington ($3.40), Alaska ($3.37), Oregon ($3.28), Nevada ($3.20) and Arizona ($2.91). When compared to last week, most gas prices in the region are down or flat. Hawaii and Arizona saw the largest drops at a penny each.

According to EIA’s petroleum status report for the week ending on July 27, inventories of gasoline in the region dropped by 400,000 bbl. They now sit at 30.2 million bbl, which is nearly 3.5 million bbl lower than total levels at this time last year. Tighter supplies leave little cushion for price shocks, which could increase prices at the pump if supply becomes more constrained.

Great Lakes and Central

Unlike most states in the country, Michigan’s gas price average dropped quite a bit on the week: eight cents. Now, Michigan ($2.92) has fallen from the most expensive Great Lakes and Central state to the second spotbehind Illinois ($2.94).

With the exception of Michigan, Kentucky (-2 cents) and Kansas (-1 cent) all state gas price averages in the Great Lakes and Central region are more expensive compared to last Monday. The largest jumps on the week were Minnesota (+3 cents), Wisconsin (+2 cents) Illinois (+2 cents) and South Dakota (+2 cents).

Gasoline inventories continue to tighten in the region following the fourth consecutive weekly draw. Total inventories register at the 51 million bbl mark. While this is the region’s lowest measurement for the year, it is on par with levels last year at this time, according to EIA data.

South and Southeast

For a second week, pump prices are on the rise in the South and Southeast. With a six-cent increase, Georgia ($2.78) has the largest jump of any state in the country while South Carolina (+3 cents) has the ninth largest. Arkansas ($2.59), Texas ($2.63) and New Mexico ($2.75) were the only states in the region to see prices hold steady on the week.

Year-over-year, gas prices are 54-cents (Georgia) to 45-cents (Louisiana) more expensive in the South and Southeast.

With a draw of 700,000 bbl, the EIA reports regional inventory is the lowest level since before Memorial Day at 78.3 million bbl. Inventories have been tightening for two weeks alongside rising gas prices. The South and Southeast have not seen levels below 78.3 million bbl during the month of July since 2015.

Mid-Atlantic and Northeast

Five Mid-Atlantic and Northeast region states land on this week’s top 10 largest jumps: Delaware (+6 cents), Tennessee (+4 cents), North Carolina (+3 cents), Maryland (+3 cents) and Pennsylvania (+2 cents). Rhode Island (-1 cent) was the only state to see a decrease at the pump while many other states’ averages held steady on the week: West Virginia ($2.86), Massachusetts ($2.90), Washington, D.C. ($3.05) and Connecticut ($3.07)

Motorists in Delaware ($2.83) are feeling the biggest pain at the pump. Compared to this time last month, gas prices are nine-cents more expensive for the state. That is the largest month-over-month gas price difference not only for the region, but also the country.

During July, total gasoline inventory levels in the region dropped from 66.4 million bbl to 64 million bbl. The latest EIA numbers report inventories were drawn down by 1.2 million bbl – the largest draw of any region for the week ending July 27. With gasoline import numbers slowing, this region could see inventory levels really tighten and gas prices amplify despite having a year-over-year surplus.

Rockies

Pump prices in the Rockies region are mostly trending higher on the week following declines last week: Idaho (+4 cents), Colorado (+1 cent) and Montana (+1 cent). Utah’s state average dropped a penny to $3.08 while Wyoming held at $2.94.

With a draw of 82,000 bbl, inventory levels sit right at 7 million bbl. A draw this week would mean levels would dip below this mark for the first time in six weeks and encourage more expensive pump prices.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI dropped 47 cents to settle at $68.49. Oil prices made some gains last week, but are ending at a loss after EIA reported that total oil inventories across the country grew by 5.6 million bbl last week. The build in crude stocks was supported by crude exports falling to 1.31 million b/d.

Crude price losses may not extend into this week as global supply concerns re-emerge. One concern is that based on recent reports, Saudi Arabia’s crude output unexpectedly fell 200,000 b/d to 10.3 million b/d last month. Saudi Arabia is the largest producer in OPEC, so a drop in its production means that the planned increase in crude production that the cartel and its partners announced in June may be moving slower than expected. Additionally, an announcement on U.S.-imposed sanctions against Iran is expected early this week, which could heighten geopolitical concerns in the crude market.

In related news, according to Baker Hughes, Inc., the U.S. lost two oil rigs last week, bringing the total to 859. Currently, there are 94 more active rigs this year than last year at this time.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.