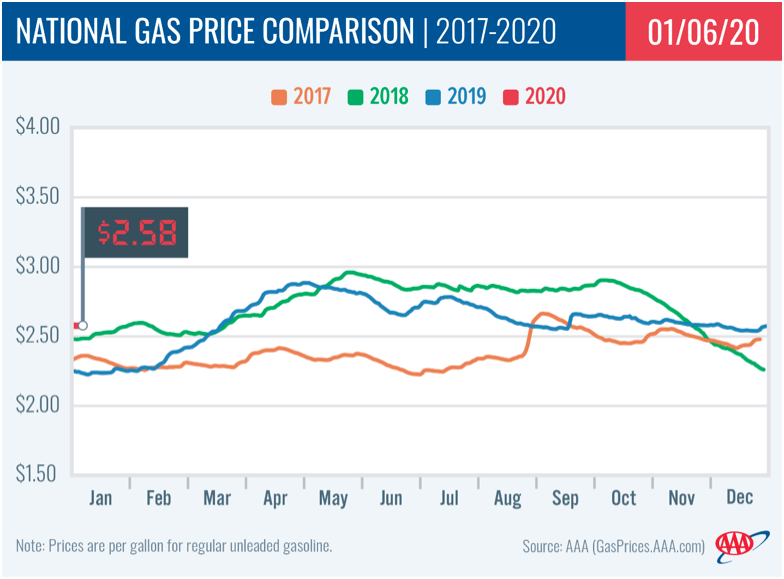

The national gas price average held steady on the week at $2.58, but that could change depending on the movement of crude oil prices due to geopolitical concerns. Following airstrikes in Baghdad last Friday, which killed Iran’s Major General Qassem Soleimani, crude oil prices increased, causing market speculation about what could happen to gas prices in the near-term.

“It’s typical to see crude oil prices push more expensive amid current events,” said Jeanette Casselano, AAA spokesperson. “What this increase means in terms of retail prices is yet be seen. It depends on how expensive crude oil prices go and the duration at which it sells at a higher price point.”

Today’s national average is $2.58, which is the same price as last Monday and last month, but 34-cents more expensive than the beginning of 2019.

Quick Stats

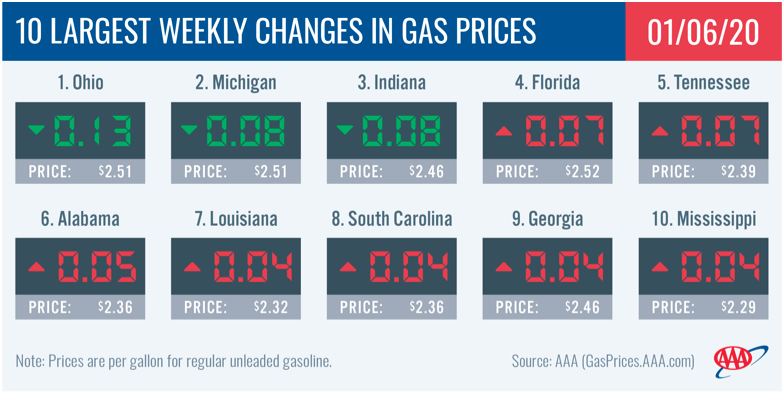

- The nation’s top largest weekly changes are: Ohio (-13 cents), Michigan (-8 cents), Indiana (-8 cents), Florida (+7 cents), Tennessee (+7 cents), Alabama (+5 cents), Louisiana (+4 cents), South Carolina (+4 cents), Georgia (+4 cents) and Mississippi (+4 cents).

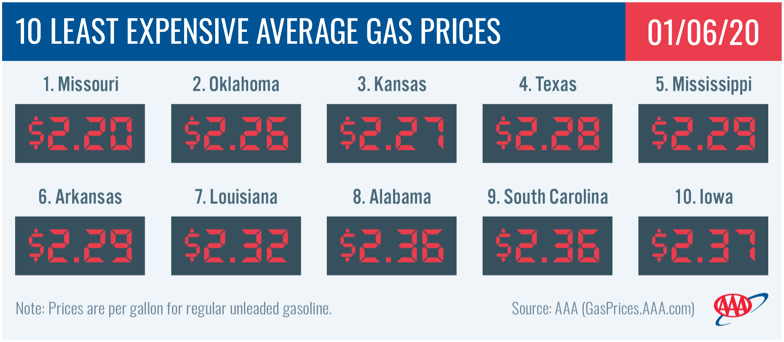

- The nation’s top 10 least expensive markets are: Missouri ($2.20), Oklahoma ($2.26), Kansas ($2.27), Texas ($2.28), Mississippi ($2.29), Arkansas ($2.29), Louisiana ($2.32), Alabama ($2.36), South Carolina ($2.36) and Iowa ($2.37).

South and Southeast

Gas price averages are more expensive across the South and Southeast states with seven landing on the top 10 list for the largest weekly changes in the country. That includes: Florida (+7 cents), Tennessee (+7 cents), Alabama (+5 cents), Louisiana (+4 cents), South Carolina (+4 cents), Georgia (+4 cents) and Mississippi (+4 cents). Of all regional states, only New Mexico ($2.43), Texas ($2.28) and Oklahoma ($2.26) did not see any movement at the pump in the last seven days.

Regionally, gas prices are more expensive compared to a year ago with South Carolina (+45 cents), Alabama (+45 cents), Tennessee (+42 cents) and Georgia (+41 cents) having the largest yearly change. At the beginning of 2019, South Carolina, Alabama and Tennessee all had averages under $2/gal.

Gas prices edged more expensive despite regional gasoline stocks seeing minimal change – a draw of only 100,000 bbl. Energy Information Administration (EIA) reports stocks at 85.5 million bbl and refinery utilization up to a strong 97%. Stocks are expected to build in the coming weeks, which should cause gas prices to decrease unless crude oil prices increase.

Great Lakes and Central States

Five Great Lakes and Central States saw gas prices decrease on the week, three of which land on the top 10 list for largest weekly changes: Ohio (-13 cents), Michigan (-8 cents) and Indiana (-8 cents). Kansas and North Dakota saw prices decrease by a penny. All other states saw pump prices increase by a penny or hold steady. In the region, gas prices range from $2.20 to $2.66.

Gas prices in the region saw minimal movement thanks in part due to a substantial 1.4 million bbl build in gasoline stocks, jumping the regional total to 53.5 million bbl. Stocks have only been this high one other time since the end of March 2019, according to EIA data. With regional refinery utilization at 97%, stocks are expected to continue to build and pave the way for cheaper gas prices, but more expensive crude prices could change this forecast.

Mid-Atlantic and Northeast

The Mid-Atlantic and Northeast region has states on both the top 10 most and least expensive list this week. Motorists in Pennsylvania ($2.82), Washington, D.C. ($2.73), and New York ($2.72) are paying the most while those in Virginia ($2.38) are paying the least.

A three-cent increase was the largest jump seen in the region on the week in: Rhode Island ($2.57), Pennsylvania ($2.82), New Jersey ($2.63), Virginia ($2.38), Delaware ($2.43), New York ($2.72) and Maryland ($2.54). All other states saw slight increases, except for the average in West Virginia ($2.60), which saw no change on the week.

Regional gasoline stocks saw the largest build in the country with 1.5 million bbl. This helped to keep price increases to a minimum. At 63.8 million stocks total, the region hasn’t seen stock levels this high since the beginning of October (2019). A healthy inventory like this is poised to help drive gas prices down, so long as crude does not spike.

West Coast

Pump prices in the region continue to drop into the New Year. On the week, Nevada (-3 cents) and Alaska (-3 cents) saw the largest decreases in the region. Hawaii ($3.65) and California ($3.54) remain the most expensive markets in the country. Washington ($3.15), Nevada ($3.01), Oregon ($3.01), Alaska ($2.96) and Arizona ($2.83) follow.

Increased gasoline stocks continue to help put downward pressure on pump prices, even as demand remains robust. According to EIA’s report for the week ending on Dec. 27, total gas stocks in the region are mostly holding steady at 21.56 million bbl. The current supply level is 3.3 million bbl higher than last year’s level at this time, which will likely continue to help prices in the region decline throughout the week.

Rockies

For another week, gas prices in the Rockies region all decreased on the week: Colorado (-3 cents), Idaho (-3 cents), Utah (-2 cents), Wyoming (-2 cent) and Montana (-2 cent). Regional gas prices are also all cheaper compared to a month ago, by as much as much as a quarter. However, compared to a year ago all state averages are more expensive by 9 cents to 44 cents.

Gasoline stocks built slightly, now registering at 7.9 million bbl for the week ending Dec. 27. Per EIA data, that was the highest weekly stock level recorded in 2019 and the largest since March 2018. With this healthy level combined with strong regional refinery rates (93%), gas prices are likely to continue to be less expensive for motorists in the region.

Oil Market Dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI increased by $1.87 to settle at $63.05. Crude prices increased last week after the U.S. announced that it conducted a drone strike at an airport in Baghdad and killed Major General Qassem Soleimani – a top military leader in Iran. The incident has escalated tension in the region, raising the possibility that global crude supplies could be disrupted. As market concerns over geopolitical risk increase, crude prices have increased amid uncertainty over how long tensions may continue to rise in the region. Crude prices may rise further this week if tensions continue to mount.

In related news, EIA’s weekly report revealed that total domestic crude inventories decreased by 11.5 million bbl last week, bringing the total to 429.9 million bbl. The current level is 11.5 million bbl lower than last year’s level at this time.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.