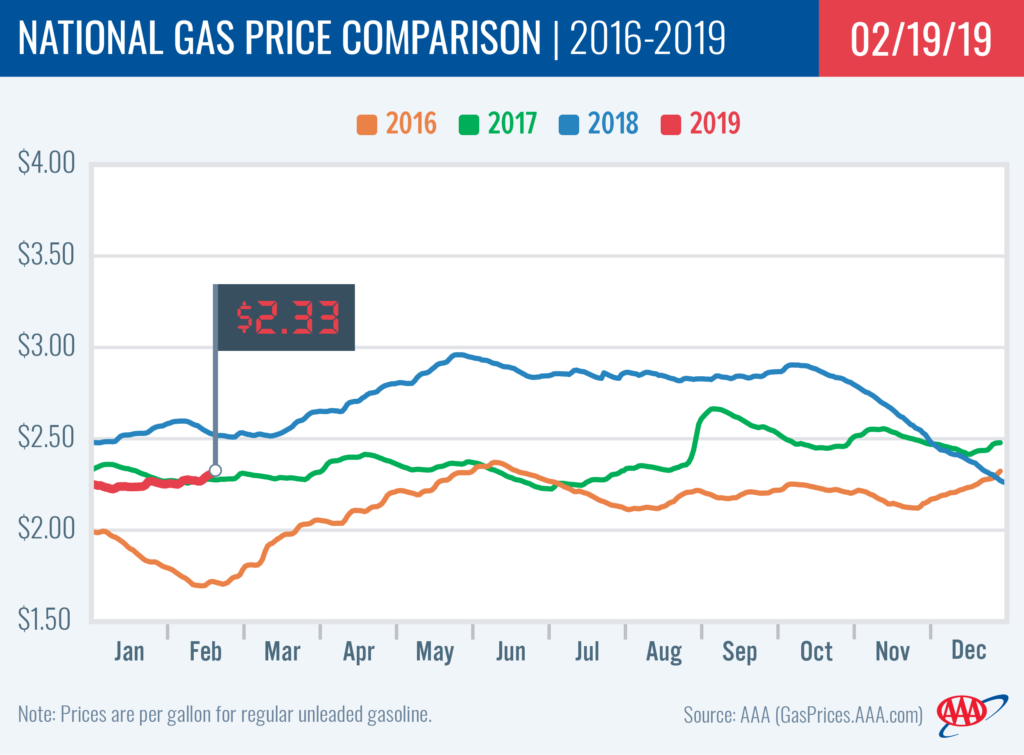

On the week, 28 states saw gas price averages increase by at least a nickel, pushing the national gas price average up six-cents to land at $2.33. That is the largest one-week increase seen at the national level this year. Today’s gas price average is nine-cents more expensive than last month, but 19-cents cheaper than a year ago.

“Motorists are seeing more expensive gas prices as a result of ongoing refinery problems coupled with crude oil prices hitting their highest level so far this year as global crude inventories tighten,” said Jeanette Casselano, AAA spokesperson. “Inventories are likely to continue to tighten and keep gas prices higher through the end of the month.”

The latest Energy Information Administration (EIA) weekly report details demand dropping for a second week, to total at 8.6 million b/d. Frigid and severe winter weather has been a driving factor for declining demand and this week’s approaching storm from the Plains to the Northeast has the potential to drop demand further. Refinery problems and increasing exports have kept inventories at minimal builds. For the week ending Feb. 8, inventories increased only 408,000 bbl to total 258.3 million bbl.

Quick Stats

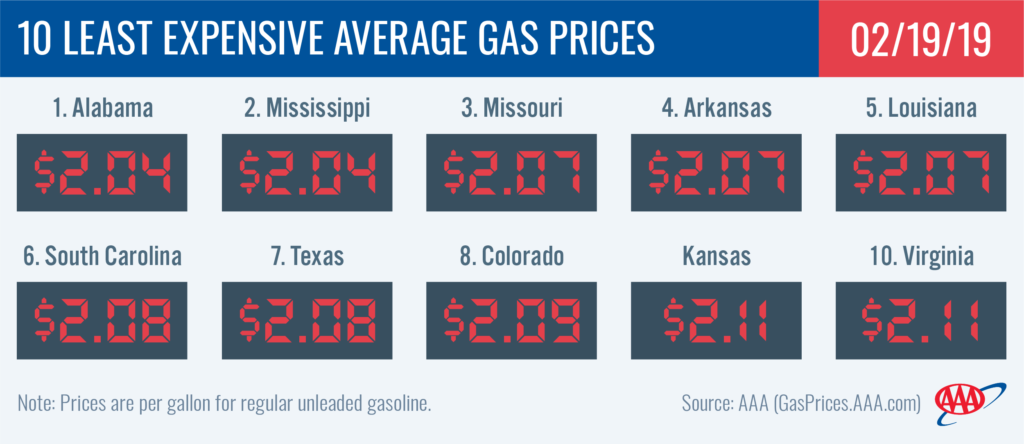

- The nation’s top 10 least expensive markets are: Alabama ($2.04), Mississippi ($2.04), Missouri ($2.07), Arkansas ($2.07), Louisiana ($2.07), South Carolina ($2.08), Texas ($2.09), Colorado ($2.09), Kansas ($2.11) and Virginia ($2.11).

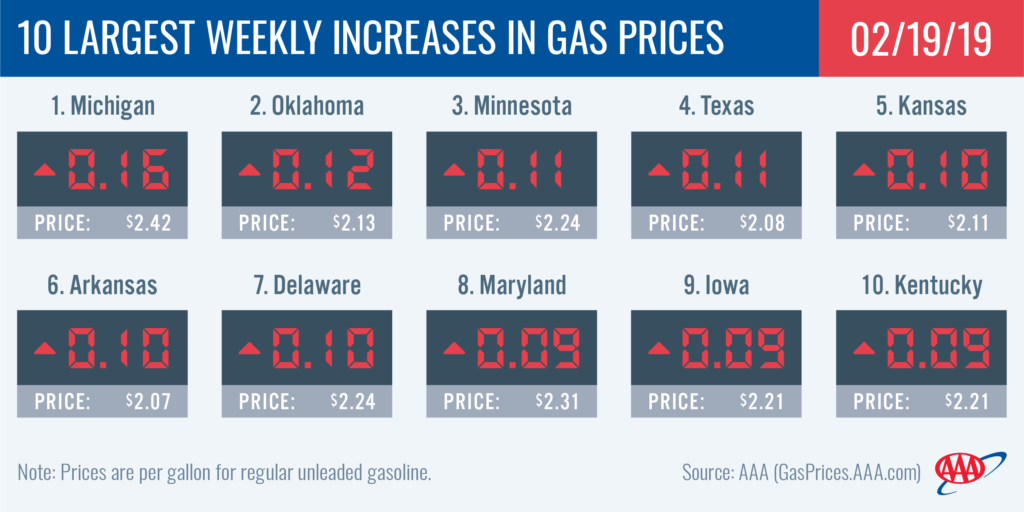

- The nation’s top 10 largest weekly increases are: Michigan (+16 cents), Oklahoma (+12 cents), Minnesota (+11 cents), Texas (+11 cents), Kansas (+10 cents), Arkansas (+10 cents), Delaware (+10 cents), Maryland (+9 cents), Iowa (+9 cents) and Kentucky (+9 cents).

Great Lakes and Central

Gas prices are 4 to 16 cents more expensive on the week across the Great Lakes and Central states mostly due to ongoing refinery maintenance and inventories tightening. Eleven states in the region have averages that are a nickel or more expensive since last week: Michigan (+16 cents), Minnesota (+11 cents), Kansas (+10 cents), Iowa (+9 cents), Kentucky (+9 cents), Nebraska (+8 cents), Missouri (+8 cents), Wisconsin (+7 cents), Ohio (+6 cents), Indiana (+5 cents) and Illinois (+5 cents).

While gas prices are less expensive than a year ago, they are more expensive than last month for most Great Lakes and Central states. In fact, four states land on the top five chart for all states in the country with the largest month-over-month difference: Michigan (+35 cents), Ohio (+25 cents), Wisconsin (+22 cents) and Indiana (+20 cents).

Regional inventories drew down by 3.2 million bbl, according to EIA latest reports, to total at 58.6 million bbl. This is the second lowest inventory level of the year. Regional refinery utilization is also down nearly 9 percent. The large draw and drop in utilization are pushing gas prices higher.

South and Southeast

Three South and Southeast have seen gas prices increase by at least a dime on the week and also land on the top 10 list with this week’s largest increases in the country: Oklahoma (+12 cents), Texas (+11 cents) and Arkansas (+10 cents). Despite pump jumps for all states in the region, states in the South and Southeast tout the cheapest average in the country: Alabama ($2.04), Mississippi ($2.04), Arkansas ($2.07), Louisiana ($2.07), South Carolina ($2.08) and Texas ($2.08).

EIA reports that regional inventories built by a substantial 5.7 million bbl for the week ending Feb. 5, registering total inventories once again above the 90 million bbl mark. Year-over-year, inventories sit at a 7 million bbl surplus. The large inventory may help motorists only see modest pump price jumps through the end of the month as much of the region’s refineries enter maintenance season.

Mid-Atlantic and Northeast

With a penny decrease, Massachusetts ($2.38) was the only state in the region to see gas prices drop on the week while Vermont ($2.38) and Washington, D.C. ($2.52) averages held steady. For all other states, gas prices are as much as a dime more expensive on the week. Delaware (+10 cents) and Maryland (+9 cents) saw the largest jumps.

Inventories measure at 69.5 million bbl following a draw of 1.775 million bbl, according to the EIA. The latest regional refinery utilization dropped five percent down to 69.7 percent, the lowest of any region in the country. With reduced utilization, the region may see stocks tighten in coming weeks which may drive up gas prices.

Rockies

Utah (-5 cents), Wyoming (-2 cents), and Idaho (-1 cents) are among the fewer than 10 states where gas price averages decreased on the week. After weeks at nearly $2/gal, Colorado’s average jumped seven-cents to $2.09. Idaho has the most expensive average in the region at $2.29.

With a build of 151,000 bbl, inventory measures at 7.5 million bbl. This is the largest inventory level for the Rockies region in 52-weeks and should help to keep gas price fluctuation modest for the rest of the month.

West Coast

Motorists in the West Coast region are paying some of the highest pump prices in the nation, with most of the region’s states landing on the nation’s top 10 most expensive list. At $3.27, California is the most expensive market. Hawaii ($3.26), Washington ($2.86), Nevada ($2.84), Alaska ($2.82) and Oregon ($2.74) follow. Arizona ($2.42) is the only state in the region that dropped from the 10 most expensive markets list this week. Prices in the region have mostly declined on the week, with Arizona (-2 cents) seeing the largest drop.

EIA’s recent weekly report showed that West Coast gasoline stocks decreased for a second week. They fell by approximately 500,000 bbl to 32.1 million bbl. Stocks are approximately 2.3 million bbl lower than at this time last year, which could cause prices to spike if there is a supply challenge in the region this week.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI increased $1.18 to settle at $55.59 – the highest price point of the year. Crude prices continued their ascent last week, due to growing belief that global supply is tightening. OPEC’s 1.2 million b/d production cut agreement, which is in effect for the first six months of 2019, has helped to rebalance the market. Also, an increasing reduction in crude exports from Venezuela due to U.S.-imposed sanctions has contributed to market observers believing the market will grow tighter in the coming weeks.

These concerns will likely bolster crude prices even more this week, and market observers will look to this week’s EIA report to see if there are additional indicators of market tightening. As crude prices increase, American motorists can expect pump prices to follow suit, since approximately 50 percent of the cost consumers pay at the pump is due to the cost per barrel of crude oil.

Additionally, EIA reported that total domestic crude inventories grew by 3.6 million bbl to 450.8 million bbl last week. High crude production in the U.S., which held steady at a staggering 11.9 million b/d last week, contributed to the growth in crude stocks around the country and is expected to help meet global crude demand as supply challenges loom.

In related news, Baker Hughes Inc. reported that the U.S. added three oilrigs last week, bringing the total to 857. When compared to last year at this time, there are 59 more rigs this year.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.