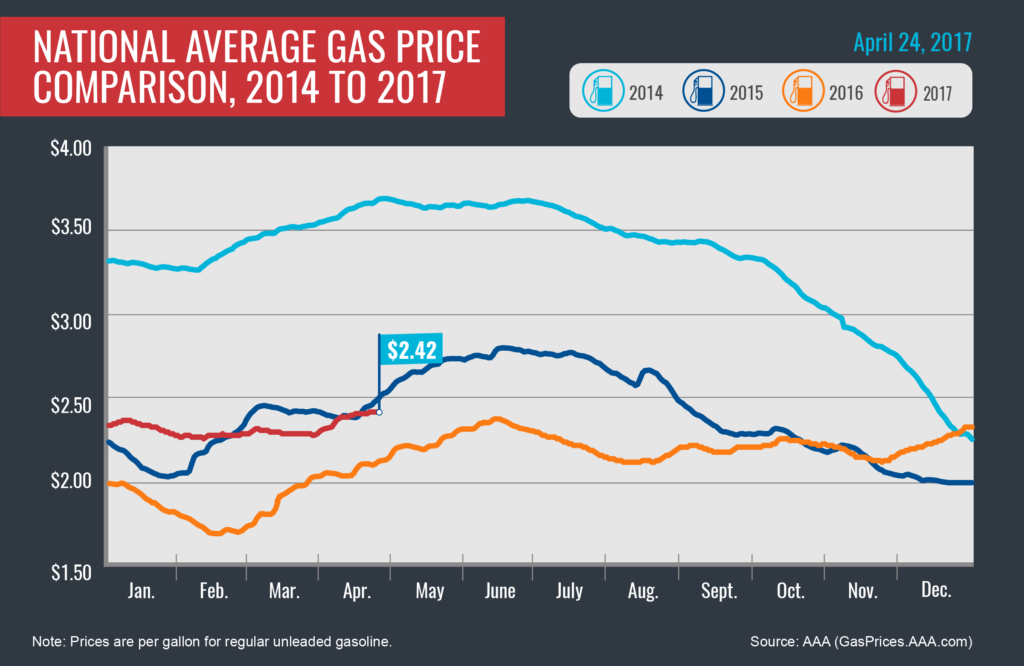

Today’s national average price for a gallon of regular unleaded gasoline is $2.42, which is an increase of 13 cents over last month and 29 cents more than this time last year. As gas prices continue to reach new heights and hit an all-time high for the year, the summer demand has not kicked in, meaning consumers can expect the price at the pump to continue to rise for coming weeks. Based on recent American Petroleum Institute reports, U.S. gasoline deliveries in March were the second highest March deliveries ever recorded, confirming the forecast that demand is on track for the summer.

Quick Stats

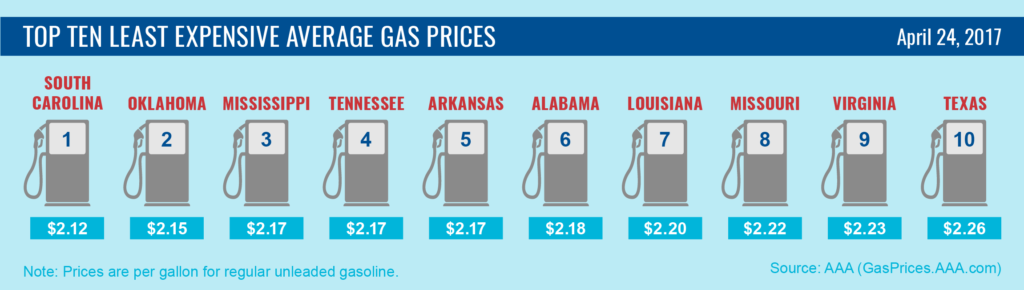

- The nation’s top ten least expensive markets are: South Carolina ($2.12), Oklahoma ($2.15), Mississippi ($2.17), Tennessee ($2.17), Arkansas ($2.17), Alabama ($2.18), Louisiana ($2.20), Missouri ($2.22), Virginia ($2.23) and Texas ($2.26)

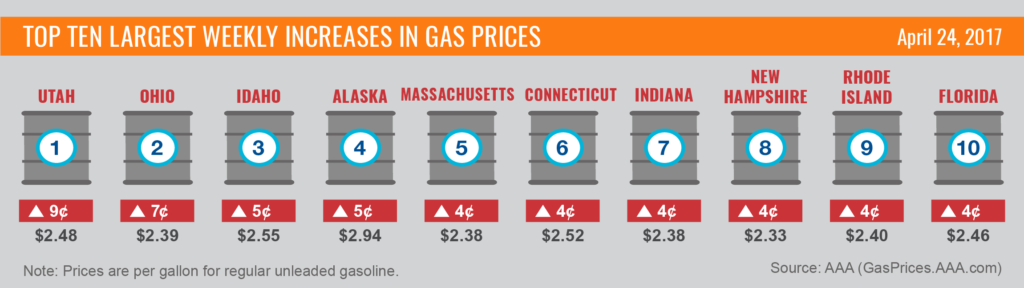

- The nation’s top ten markets with the largest weekly increases include: Utah (+9 cents), Ohio (+7 cents), Idaho (+5 cents), Alaska (+5 cents), Massachusetts (+4 cents), Connecticut (+4 cents), Indiana (+4 cents), New Hampshire (+4 cents), Rhode Island (+4 cents) and Florida (+4 cents)

West Coast

The West Coast continues to lead the country with the most expensive gas: Hawaii ($3.08), California ($3.01), Alaska ($2.94), Washington ($2.91), Oregon ($2.77) and Nevada ($2.71).

Rockies

Across the region, the Rockies saw an upward trend in gas prices. Utah (+9 cents) and Idaho (+6 cents) landed on this week’s largest price increase list. Typically, during the summer time, the region becomes short on gasoline inventory and has a tendency to see prices move up rather sharply. Drivers in other parts of the region saw relatively small increases: Montana (+2 cents), Wyoming (+2 cents) and Colorado (+1 cent).

Great Lakes and Central States

Despite declines a week ago, drivers in the Great Lakes and Central States saw prices increase with Ohio (+7 cents) and Indiana (+4 cents) landing on this week’s top 10 list for largest increases. With the 12th most expensive gas in the country, Michigan consumers are paying $2.52 at the pump, up +2 cents from last week. Elsewhere in the region, gas prices remained stable. The latest Energy Information Administration report shows that the region’s refiners raised capacity by 23,000 b/d last week, while gasoline stocks in the region dropped by 1.5 million bbl to 56 million bbl. The decline resulted in the lowest posted inventory numbers for the region in nearly three months.

South and Southeast

With area market inventories jumping by 2.5 million bbl, gas prices in the South and Southeast remained steady on the week. High gasoline inventories and low demand are causing some markets to lower prices. Prices fell by one penny from a week ago in South Carolina, Texas, North Carolina, Georgia, Arkansas and Louisiana. As we await the onset of the summer driving season, AAA predicts there are plenty of opportunities for demand to tap into the country’s excess supply and the price of gas to continue to rise.

As on trend, this region carries the country’s least expensive gas prices: South Carolina ($2.12), Oklahoma ($2.15), Mississippi ($2.17), Tennessee ($2.17), Arkansas ($2.17), Alabama ($2.18), Louisiana ($2.21) and Missouri ($2.22).

Mid-Atlantic and Northeast

This week, four states in the region landed on the top 10 list of biggest increases: Massachusetts (+4 cents), Connecticut (+4 cents), New Hampshire (+4 cents) and Rhode Island (+4 cents), while Pennsylvania ($2.64), Washington, DC ($2.55) and New York ($2.52) held their spot on the list of top 10 most expensive markets.

Consumers will likely continue to see gas prices increase as we enter the peak of summer driving season. Looking further ahead, there is early indication that the start of the Dakota Access Pipeline could impact Northeast gas prices with the potential for crude prices to rise as a result of more competition in the market looking to sell crude oil.

Oil Market Dynamics

At the close of trading last week, WTI crude oil futures fell $1.09 to settle just under $50 per barrel. One of the leading reasons for the drop was skepticism about whether the Organization of the Petroleum Exporting Countries (OPEC) and other producers would extend their pledge to cut output by 1.8 million bbl by another six months. In particular, the market is still unsure if Russia will agree to an extension deal beyond June 30, which could add dramatically to already bloated global inventories.

On Monday morning, U.S. petroleum futures were trading higher across the board, with WTI recovering after costly losses last week. This rebound follows last week’s EIA report that showed gasoline inventory building across the country, which can be attributed to higher import levels and blending activity. While spring stock-building is a normal trend to account for the peak summer demand, the counter-seasonal build is likely pressuring markets and increasing pump prices. Additionally, last week’s Baker Hughes oil rig count report showing the U.S. adding 5 rigs, bringing the total rig count to 688 — is further evidence of increased U.S. production. Traders will look closely at this week’s numbers from key indicators of supply to determine if the market will rebalance in the near term.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also be used to map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.