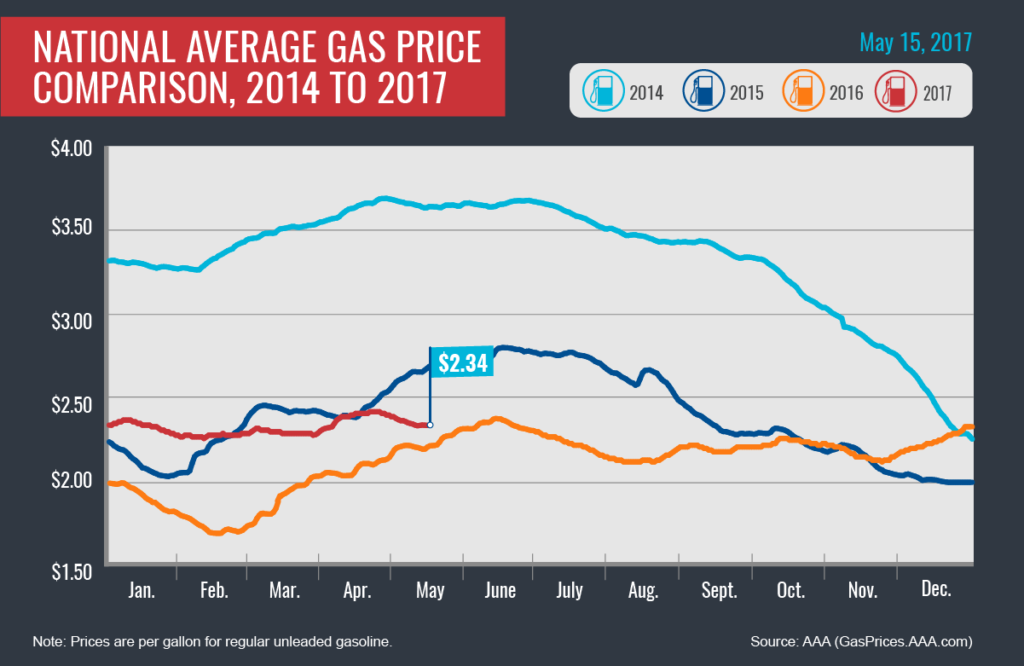

Today’s national average is $2.34/gallon. This price is a penny cheaper than one week ago, seven cents less than a month ago, but +12 cents more than a year ago. The latest Energy Information Association (EIA) report shows that gasoline demand increased by 252,000 barrels on the week. Despite the jump in demand, the continued oversupply of gasoline caused prices in most parts of the country to drop or remain steady with the exception of some states in the Great Lakes and Central regions, where prices increased by a penny or more.

In coming weeks, the onset of summer travel is likely to increase demand which might help dip into high gasoline stocks; however, it may not be enough demand to increase prices significantly.

Quick Stats

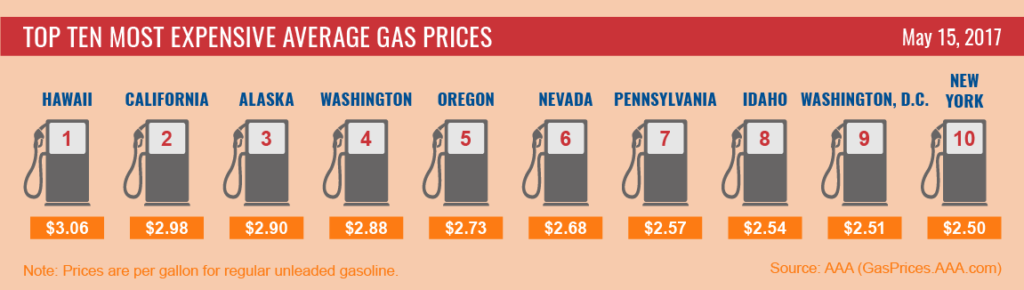

- The nation’s top ten markets with the most expensive gas: Hawaii ($3.06), California ($2.98), Alaska ($2.90), Washington ($2.88), Oregon ($2.73) and Nevada ($2.68), Pennsylvania ($2.57), Idaho ($2.54), Washington, D.C. ($2.51) and New York ($2.50).

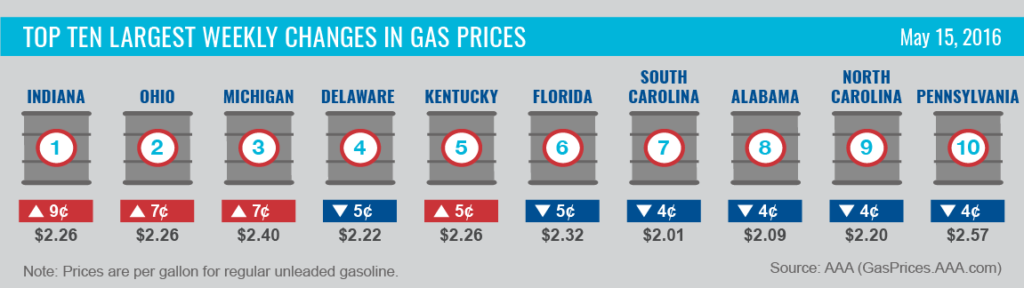

- The nation’s top ten markets with the biggest changes in the last week include: Indiana (+9 cents), Ohio (+7 cents), Michigan (+7 cents), Delaware (-5 cents), Kentucky (+5 cents), Florida (-5 cents), South Carolina (-4 cents), Alabama (-4 cents), North Carolina (-4 cents) and Pennsylvania (-4 cents).

West Coast

Hawaii ($3.06), California ($2.98), Alaska ($2.90), Washington ($2.88), Oregon ($2.73) and Nevada ($2.68) lead the nation with the highest gas prices. Demand in the region continues to dip into seasonally high inventories, but not enough to deplete the unseasonably high gasoline stocks. Despite dropping 388,000 bbl last week, gasoline stocks are sitting close to a high of 30 million bbl.

Down time at the Valero Benicia refinery coupled with potential month-end work at Tesoro’s 166,000-b/d Martinez, Calif., refinery are creating supply concerns in the region. A drop in supply could potentially move prices higher in the coming weeks.

Rockies

In the Rockies, Utah’s gas prices fell two cents since last week, while Montana and Colorado saw just a penny decline. Wyoming and Idaho remained flat. With gas prices ringing in at $2.54, Idaho lands on this week’s top ten cities with the most expensive gas prices. According to the latest EIA report, the region’s gasoline stocks are at 7 million bbl- the lowest in the entire country.

Great Lakes and Central States

Despite high gasoline stocks in the regions, five states saw price increases on the week: Indiana (+9 cents), Ohio (+7 cents), Michigan (+7 cents), Illinois (+2 cents) and Minnesota (+1 cent). The region is carrying 55 million bbl in gasoline stocks- 2 million bbl more than this same time last year.

South and Southeast

Every state in the South and Southeast saw prices decline on the week, with the exception of Kentucky (+5 cents). Consumers can find the cheapest gas in the country in this region, with eight states landing on the top 10 weekly list of least expensive markets: South Carolina ($2.01), Oklahoma ($2.07), Alabama ($2.09), Mississippi ($2.09), Tennessee ($2.09), Arkansas ($2.10), Louisiana ($2.12) and Missouri ($2.12).

The Gulf Coast saw a small dip in gasoline stocks last week and is the only region where current gasoline stocks (79.2 million) are below levels posted during this same time last year (83.1 million).

Mid-Atlantic and Northeast

Mid-Atlantic and Northeast states continued to see prices at the pump decline, notably Delaware (-5 cents), North Carolina (-4 cents) and Pennsylvania (-4 cents). Even with the price drop, Pennsylvania held its spot on the country’s top 10 list of most expensive markets along with Washington, D.C. ($2.51) and New York ($2.50). Ranked as the 11th most expensive state this week, Connecticut is just as pricey at $2.50.

With a 2.6 million bbl increase, the Mid-Atlantic and Northeast were the only regions in the country to see a jump in gasoline stocks, according to EIA data. This jump likely contributed to declines on the week.

Oil Market Dynamics

On Monday morning, U.S. petroleum futures were just below $50 per barrel. Prices rallied after officials from Russia and Saudi Arabia announced that they plan to extend production cuts into March 2018. This news comes after OPEC released its May report, which warns that the global oil market will not rebalance by the end of the year unless there is a collective effort from all oil producers to increase market stability.

OPEC is expected to draft a formalized production cut extension during its meeting in Vienna, Austria, on May 25. However, there is skepticism that any extended cuts will offset growing U.S. production. Last week, U.S. drillers added an additional nine oilrigs, bringing the total U.S rig count to 712 and marking 17 weeks of growth. The expected result of OPEC’s actions is far from certain. Until it is, drivers may continue to benefit at the pump – even during the typically more expensive summer driving season.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also be used to map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.