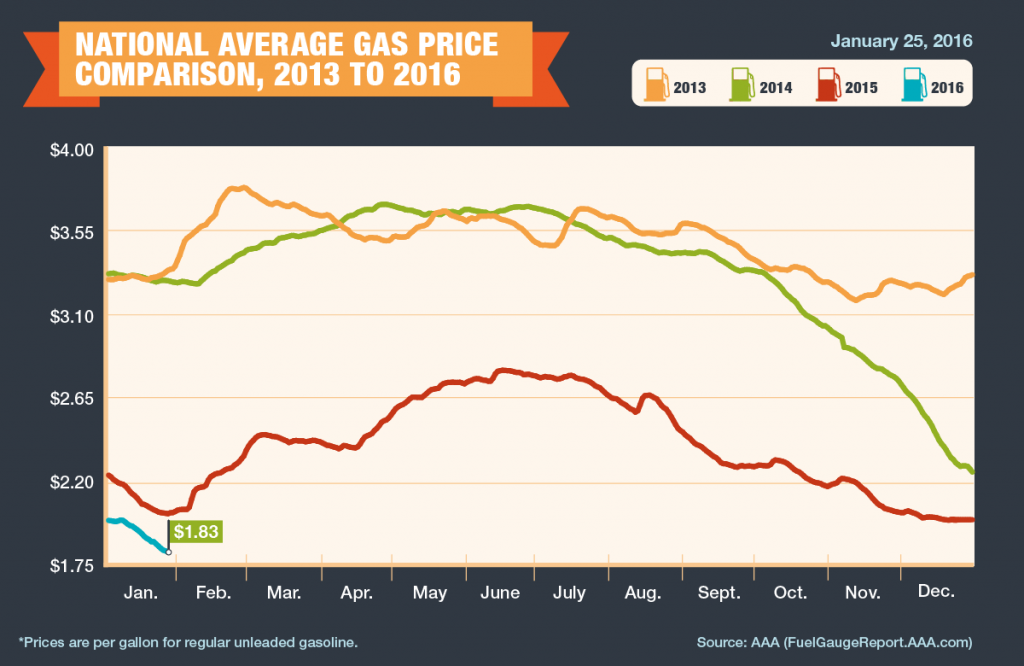

(Washington, January 25, 2016) Gas prices have spent 25 consecutive days below $2 per gallon and could head lower still as reduced seasonal demand and falling crude oil costs combine to send pump prices to the lowest mark in six years. Today’s average price of $1.83 per gallon is the cheapest price since January 2009, and retail averages have fallen for 69 of the past 80 days for a total savings of 40 cents per gallon over this span. Crude oil supply continues to outpace demand, which has helped push gas prices down by seven cents on the week, 18 cents on the month and 21 cents on the year.

A historic blizzard hit the Northeast over the weekend. The Mid-Atlantic was the hardest region hit, and a number of states in the area received more than two feet of snow. Severe weather can make it difficult for refiners to produce gasoline and can create hurdles for getting the product to market. However, storms also keep drivers off of roads, which can limit demand. Early reports indicate that PBF Energy shut down its Delaware City refinery, citing power failure due to the blizzard conditions. Averages in the region could possibly move higher in the coming days if refinery and distribution problems persist.

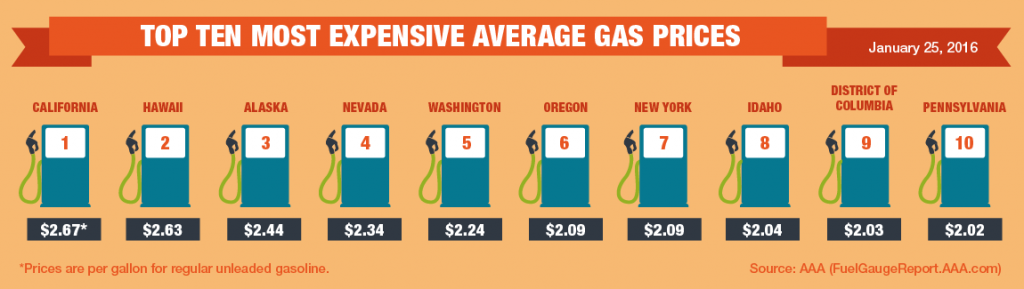

Motorists in just 11states and Washington, D.C. are paying an average above $2 per gallon. California ($2.67) continues to lead the market, however the resolution of refinery issues in the state has narrowed the difference between the Golden State and second-place Hawaii ($2.63). Regional neighbors Alaska ($2.44), Nevada ($2.34) and Washington ($2.24) round out the top five most expensive markets for retail gasoline. Consumers in Oklahoma ($1.53) and Missouri ($1.54) are paying the nation’s lowest averages at the pump, followed by the Midwestern states of Indiana ($1.55), Ohio ($1.56) and Michigan ($1.59).

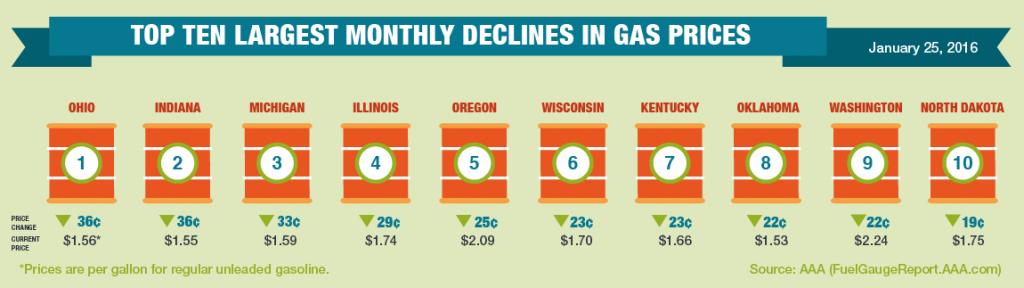

Weekly price comparisons reflect that consumers nationwide are enjoying savings in the price to refuel their vehicles. Averages are down in the majority of states (29) by a nickel or more per gallon, and prices in four states located in the Midwest: Michigan (-13 cents), Ohio (-13 cents), Indiana (-13 cents) and Illinois (-12 cents) are down double-digits. With refinery utilization rates reportedly running at upwards of 98 percent and gasoline inventories also building, drivers in the region are likely to continue to benefit from noticeable savings at the pump. Nevertheless, gas prices in the region are often unpredictable and changes in the market can happen quickly.

Consumers in nearly every state (49) are benefitting from more than a nickel per gallon in savings month-over-month. Retail averages are down double-digits in 46 states and Washington, D.C., and prices are down a quarter or more per gallon in a total of five states. Similar to week-over-week comparisons, the largest discounts are in the Midwest: Ohio (-36 cents), Indiana (-36 cents), Michigan (-33 cents) and Illinois (-29 cents). Alaska is the only state to buck this trend, and prices are up by a nickel per gallon on the month.

Pump prices remain discounted year-over-year in the majority of states (45), though the magnitude of yearly savings continues to narrow because retail averages had already fallen dramatically in January 2015. Consumers in 43 states and Washington, D.C. are saving a dime or more per gallon at the pump and prices are discounted by more than 50 cents per gallon in two states: Hawaii (-63 cents) and Indiana (-52 cents). On the other end of the spectrum, prices are higher on the year in California (+21 cents), Idaho (+17 cents), Nevada (+13 cents), Utah (+7 cents) and Washington (+7 cents).

Global oversupply and the anticipation that additional oil will soon enter the market with the lifting of sanctions on Iran, contributed to both benchmarks—Brent and West Texas Intermediate—trading last week at lows unseen since 2003. Market fundamentals remain unchanged and a “lower-for-longer” sentiment is beginning to prevail amongst speculators. Talks are now shifting to whether the market has reached its bottom and if, or when, the necessary adjustments in supply will occur in order to help bring the crude oil market more into balance.

To the surprise of many and despite this bearish sentiment, both benchmarks closed out the week with a two-day rally. This shift is likely the result of trading volatility and is not attributed to any correction in the imbalance between supply and demand. At the close of Friday’s formal trading session on the NYMEX, WTI was up nearly 9.5 percent, with a gain of $2.66 to settle at $32.19 per barrel.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.