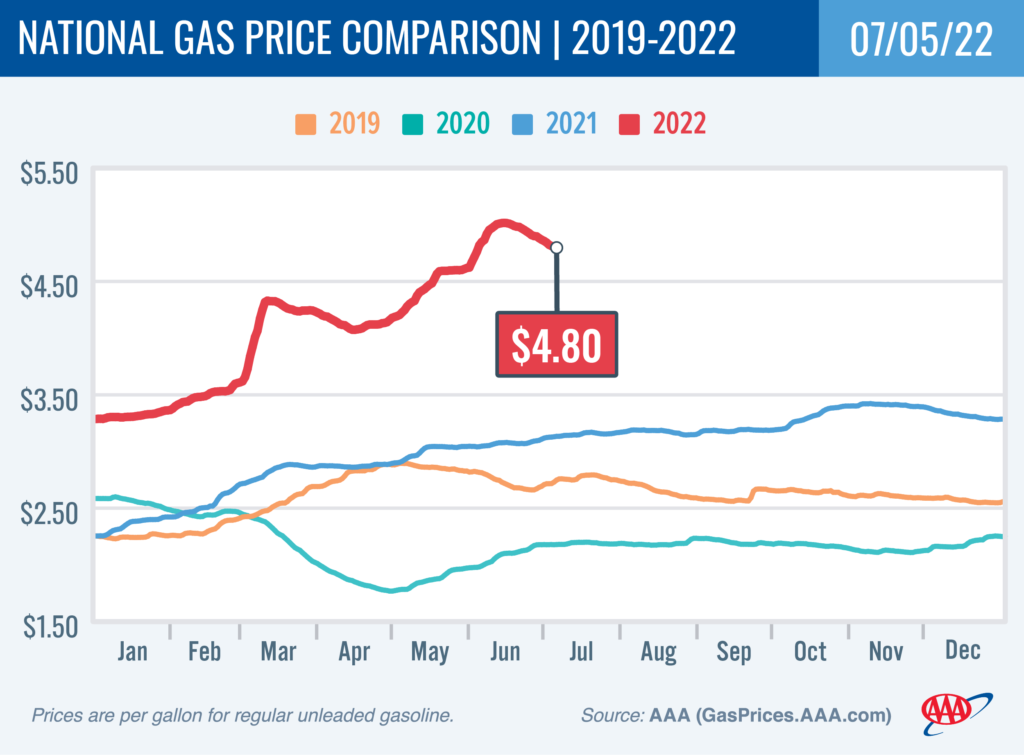

WASHINGTON, D.C. — The national average for a gallon of gasoline fell to $4.80, down eight cents over the past week. The primary reason for the decline is lower demand at the pump as fewer people fueled up over the past two weeks. The lull, however, could end with the arrival of the summer driving season.

“Domestic gasoline demand dipped recently, which took some of the pressure off of pump prices. About 80% of stations are now selling regular for under $5 a gallon,” said Andrew Gross, AAA spokesperson. “But July is typically the heaviest month for demand as more Americans hit the road, so this trend of easing prices could be short-lived.”

According to the latest Energy Information Administration (EIA) data, gas demand currently sits at 8.93 million b/d, which is lower than last year’s rate of 9.11 million b/d at the end of June. On the other hand, total domestic gasoline stocks increased by 2.6 million bbl to 221.6 million bbl. These supply/demand dynamics, along with decreasing oil prices, have pushed pump prices lower. If these trends continue, drivers will likely continue to see relief at the pump.

Today’s national average of $4.80 is four cents less than a month ago and $1.67 more than a year ago.

Quick Stats

The nation’s top 10 largest weekly decreases: Texas (−13 cents), Delaware (−13 cents), Arizona (−12 cents), Illinois (−12 cents), Indiana (−12 cents), Ohio (−12 cents), South Carolina (−11 cents), Florida (−11 cents), Virginia (−11 cents) and Maryland (−10 cents).

The nation’s top 10 least expensive markets: South Carolina ($4.29), Georgia ($4.30), Mississippi ($4.31), Louisiana ($4.35), Arkansas ($4.35), Texas ($4.39), Alabama ($4.39), Tennessee ($4.41), North Carolina ($4.43) and Oklahoma ($4.50).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI increased by $2.67 to settle at $108.43. The price of crude increased at the end of last week due to market optimism that demand will remain robust throughout the summer. However, crude prices faced strong resistance amid broad market concern regarding the potential for economic growth to slow or stall due to rising interest rates and inflation, which could send prices lower this week if market concerns persist. A lower-than-expected economic growth rate could cause crude demand to decline, leading prices to follow suit. Additionally, EIA reported that total domestic crude stocks decreased by 2.7 million bbl to 415.6 million bbl last week, which is nearly 37 million bbl lower than at the end of June 2021.

Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.