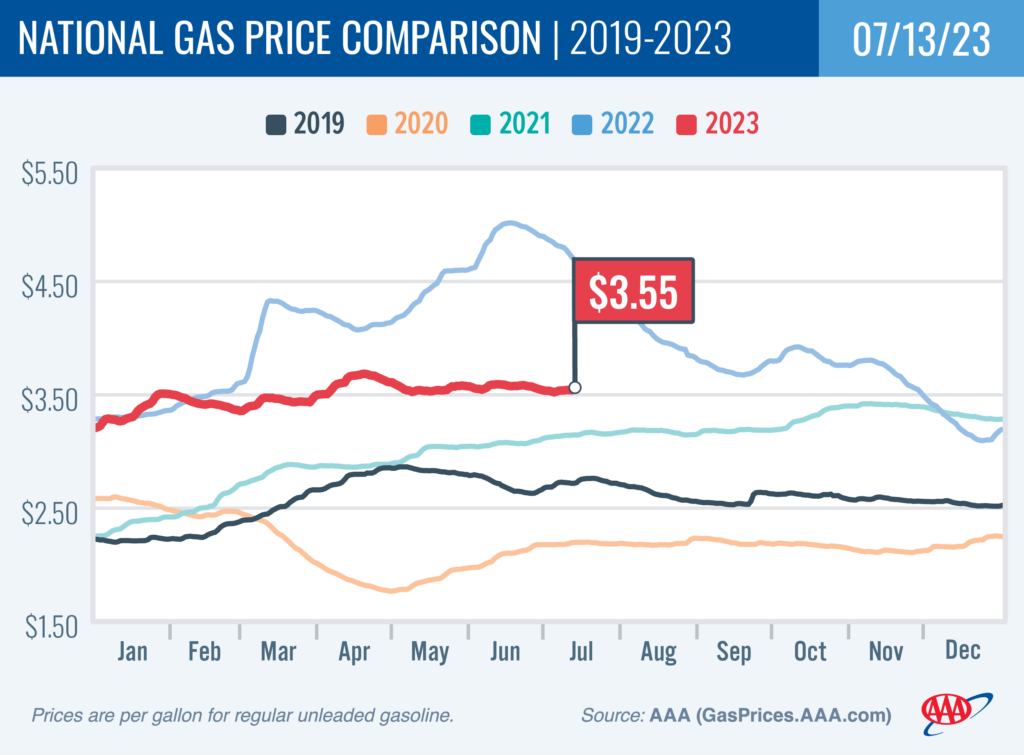

WASHINGTON, D.C. — Despite a notable cratering in gas demand in the days since the July 4th holiday, pump prices crept higher over the past week by three cents to reach $3.55. The main culprit is a higher price for oil, which moved from the upper $60s per barrel recently to the mid-$70s.

“Gas demand has fallen nearly 10 percent since the holiday, as folks have returned to their day-to-day driving routines,” said Andrew Gross, AAA spokesperson. “Typically, this would lower gas prices, but such a move is being countered for now by the increasing cost for oil, the main ingredient in gasoline.”

According to new data from the Energy Information Administration (EIA), gas demand decreased significantly from 9.6 to 8.76 million b/d last week. Meanwhile, total domestic gasoline stocks stayed flat at 219.5 million bbl. Although lower gas demand typically pushes pump prices lower, rising oil prices have lifted them. If oil prices continue to rise, pump prices will likely follow suit.

Today’s national average of $3.55 is three cents more than a month ago but $1.08 less than a year ago.

Quick Stats

- Since last Thursday, these 10 states have seen the largest changes in their averages: Florida (+11 cents), Indiana (+10 cents), Colorado (+7 cents), North Carolina (+7 cents), Georgia (+6 cents), Texas (+6 cents), California (+6 cents), Maryland (+5 cents), Utah (−5 cents), and Arizona (−5 cents).

- The nation’s top 10 least expensive markets: Mississippi ($2.99), Tennessee ($3.09), Alabama ($3.10), Louisiana ($3.11), Arkansas ($3.14), South Carolina ($3.15), Texas ($3.19), Oklahoma ($3.19), Kentucky ($3.22) and Missouri ($3.23).

Oil Market Dynamics

At the close of Wednesday’s formal trading session, WTI increased by 92 cents to settle at $75.75. Oil prices have increased this week due to rising market optimism that fewer interest rate hikes may be on the horizon. This follows the release of the U.S. Consumer Price Index (CPI) report, which saw a smaller-than-expected increase in June. Before the release of the CPI report, the market had been concerned that more interest rate increases could tip the economy into a recession. If a recession occurs, oil demand and prices will likely decline. Additionally, the EIA reported that total domestic commercial crude inventories increased by 5.9 million bbl to 458.1 million bbl.

Drivers can find current gas prices along their route using the AAA TripTik Travel planner.