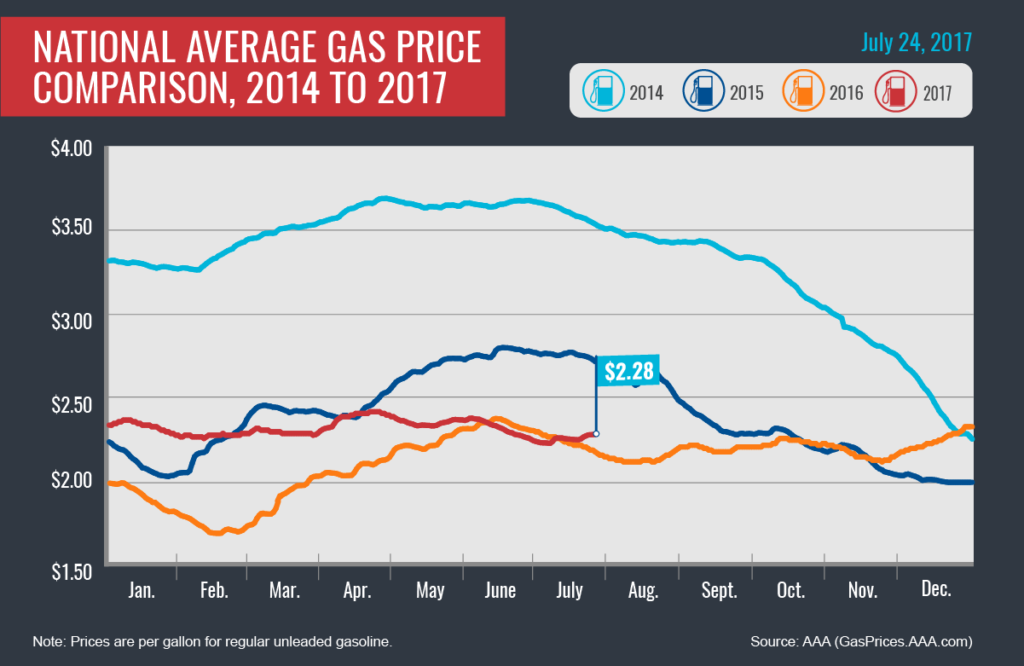

Across the country, 39 states saw prices increase on average by three cents – a major swing from last week when only nine states posted more expensive gas prices on the week. At $2.28, the national gas price is three cents more than a week ago, which is the largest seven-day increase since before Memorial Day.

“Demand has remained strong as gasoline stocks dip for a fifth consecutive week, driving up prices at the pump,” said Jeanette Casselano, AAA spokesperson. “For much of the summer, gas prices have been fairly cheap. Those days are in the rearview mirror.”

According to the Energy Information Administration (EIA), gasoline stocks took their largest dip – 4.4 million bbl – for the first time in five weeks, bringing levels down to 231 million bbl. That is a 10 million bbl deficit year-on-year and a factor in prices at the pump increasing.

Quick Stats

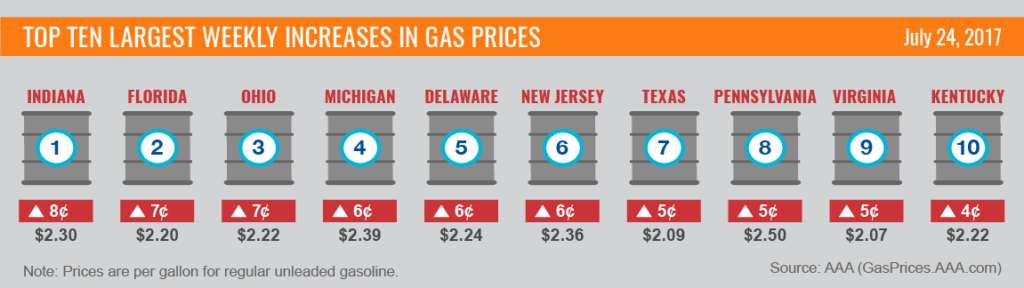

- The nation’s top ten markets with the largest weekly increases are: Indiana (+8 cents), Florida (+7 cents), Ohio (+7 cents), Michigan (+6 cents), Delaware (+6 cents), New Jersey (+6 cents), Texas (+5 cents), Pennsylvania (+5 cents), Virginia (+5 cents) and Kentucky (+4 cents).

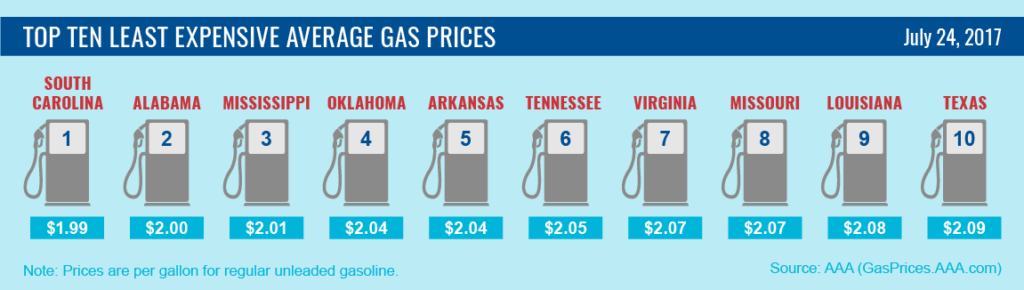

- The nation’s top ten markets with the cheapest gas are: South Carolina ($1.99), Alabama ($2.00), Mississippi ($2.01), Oklahoma ($2.04), Arkansas ($2.04), Tennessee ($2.05), Virginia ($2.07), Missouri ($2.07), Louisiana ($2.08) and Texas ($2.09).

West Coast

Gas prices in five West Coast states dropped on the week: Arizona (-2 cents), Hawaii (-1 cent), Nevada (-1 cent), Alaska (-1 cent) and Washington (-1 cent), while prices in both Oregon and California saw no change. The region continues to lead the country with the most expensive gas prices with a regional average price of $2.72.

After notching the biggest one-week draw in nearly two and a half years, West Coast gasoline stocks are at their lowest level in seven months. Stocks tumbled 1.7 million bbl, bringing the region’s supply level to nearly 27 million bbl, according to the EIA.

The tumble in stocks paired with potentially lower West Coast refinery runs, due to ongoing maintenance this week, means the regional decline in gas prices could be short lived and gas prices have the potenital to increase in the coming days.

Rockies

In the Rockies, gas prices were volatile on the week with three states seeing increases: Colorado (+3 cents), Wyoming (+1 cent) and Montana (+1 cent), and two states seeing decreases: Utah (-2 cents) and Idaho (-1 cent). Utah and Idaho were two of only eight states in the country to see gas prices decline on the week and both continue to hold their rank on the top ten most expensive gas list.

After four weeks of stock draws, the Rockies added 100,000 bbl to regional levels. The increase, albeit it small, was likely a factor in the region’s gas price volatility.

Great Lakes and Central States

Gas prices are more expensive on the week in all Great Lakes and Central States, except for Kansas where prices remained flat. Four states land on the weekly biggest increase list: Indiana (+8 cents), Ohio (+7 cents), Michigan (+6 cents) and Kentucky (+4 cents).

Gasoline stocks in the region increased by 1.3 million bbl, bringing regional levels to nearly 55 million bbl. While levels are above the year-ago figure by a more than 1 million bbl, they are down considerably from the 2017 high of 60 million bbl reported in February, according to the EIA.

South and Southeast

The South and Southeast saw gas prices increase on the week with Florida (+7 cents) and Texas (+5 cent) seeing the biggest jumps across the region. Even with prices going up, the region carries the country’s cheapest gas prices: South Carolina ($1.99), Alabama ($2.00), Mississippi ($2.01), Oklahoma ($2.04), Arkansas ($2.04), Tennessee ($2.05), Louisiana ($2.08) and Texas ($2.09).

Despite a 2 million bbl draw in stocks on the week, the South and Southeast house the largest gasoline stockpile of any region in the country with nearly 79 million bbl.

Mid-Atlantic and Northeast

All states in the Mid-Atlantic and Northeast region saw prices increase on the week, but seven states saw significant jumps: Delaware (+6 cents), New Jersey (+6 cents), Pennsylvania (+5 cents), Virginia (+5 cents), Maine (+4 cents), North Carolina (+4 cents) and New Hampshire (+4 cents). On average, gas prices increased by three cents in the region on the week.

The increase in price is in-line with the nearly 2 million bbl draw in gasoline stock in the region on the week. Stockpiles dropped to 62 million, which is an eight million bbl deficit year-on-year, according to the EIA.

Oil Market Dynamics

The price per barrel of crude oil kicked off the week climbing above $46 for West Texas Intermediate. The positive climb, compared to Friday’s close of $45.77, follows the OPEC announcement this morning that Nigeria will join its production reduction agreement to cut oil output by a combined 1.8 million b/d from January 2017 until the end of March 2018. With today’s announcement at the 4th OPEC & Non-OPEC Ministerial Monitoring Committee in St. Petersburg, Russia about Nigeria – along with other countries in the agreement pledging stricter adherence to the cuts – OPEC’s efforts to rebalance the market may have found a new foothold. However, outliers, including rising exports from OPEC and Libya’s growth in production, could stall OPEC’s efforts. In fact, at today’s meeting Saudi Arabia agreed to cut its exports by 600,000 b/d, suggesting that OPEC has its eyes on the role of exports in thwarting its efforts to increase the global price per barrel of oil.

Growth in U.S. oil production still plays a critical role in suppressing the price of crude per barrel. For example, the latest EIA report for the week ending on July 14 showed that although crude oil inventories declined by 4.4 million bbl, when being compared with the five-year average, the surplus still stands at well over 75 million bbl. The total number of U.S. oil rigs stands at 764, which is one less than last week according to Baker Hughes, Inc., and is up 393 from last year.

On both the inventory and rig count fronts, the weekly decreases only show incremental downward movement, while the overall numbers still remain very high when compared to historical data. Unless these numbers take a more pronounced nosedive, they will still depress crude prices. In the meantime, as the numbers get closer to this season’s steady, strong demand for refined products, such as gasoline, drivers are likely to see prices continue to move up.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also be used to map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.