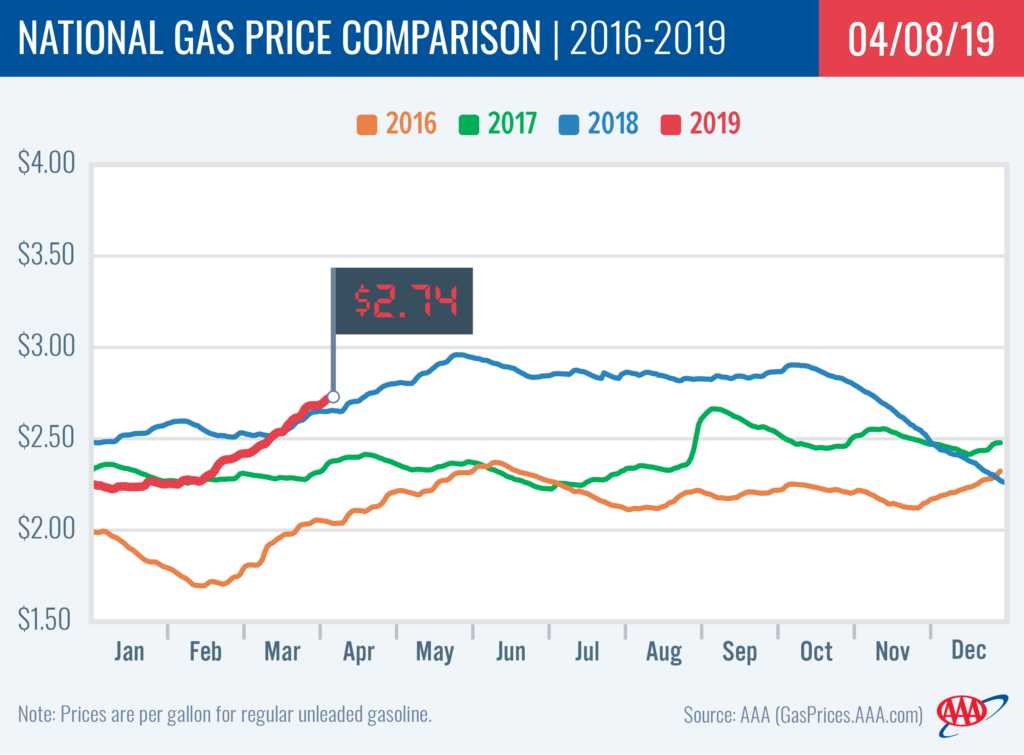

At $2.74, the national gas price average increased a nickel on the week and is eight cents more than last year at this time. And compared to one month ago, gas prices are 28 cents more expensive. As demand holds steady and inventories continue to tighten, motorists continue to see gas prices increase in every region.

“Gas prices are increasing across the country, but these changes vary by region,” said Jeanette Casselano, AAA spokesperson. “On the week, motorists in the West Coast, Rockies, Great Lakes and Central regions are seeing some of the largest weekly increases while prices mostly east of the Mississippi have made more moderate jumps.”

As overall refinery utilization stands at 86% compared to 93% last year at this time, unexpected and planned maintenance continues to be one of the leading factors in why gas prices have continued to trend more expensive.

Quick stats

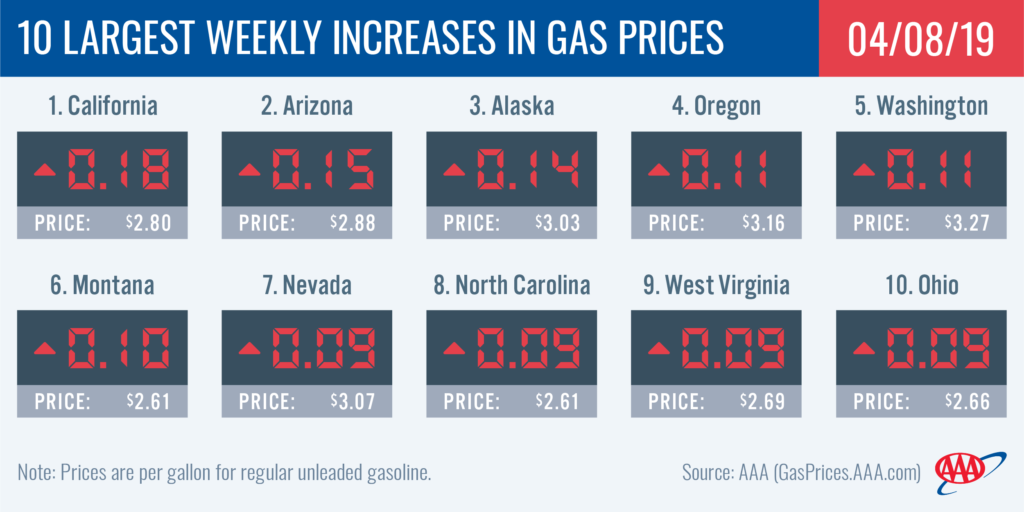

- The nation’s top 10 largest weekly increases are: California (+18 cents), Arizona (+15 cents), Alaska (+14 cents), Oregon (+11 cents), Washington (+11 cents), Montana (+10 cents), Nevada (+9 cents), North Carolina (+9 cents), West Virginia (+9 cents) and Ohio (+9 cents).

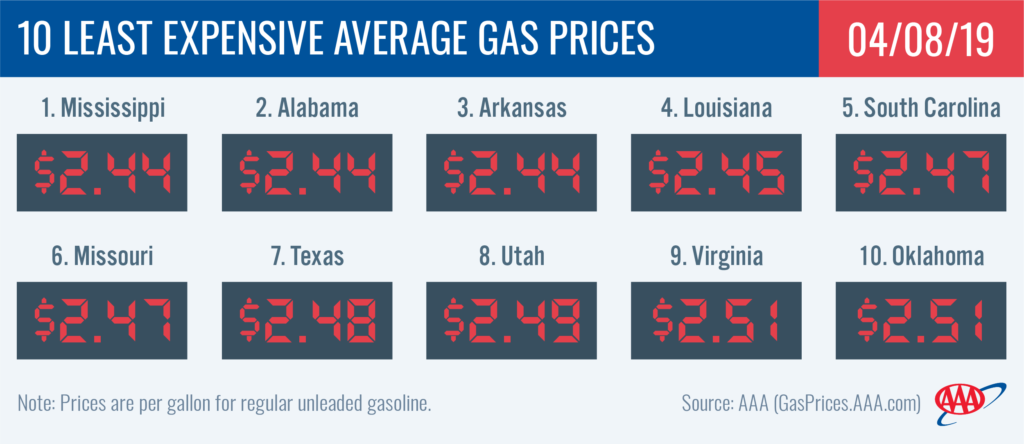

- The nation’s top 10 least expensive markets are: Mississippi ($2.44), Alabama ($2.44), Arkansas ($2.44), Louisiana ($2.45), South Carolina ($2.47), Missouri ($2.47), Texas ($2.48), Utah ($2.49), Virginia ($2.51) and Oklahoma ($2.51).

West Coast

Pump prices in the West Coast region are the highest in the nation, with all of the region’s states landing on the nation’s top 10 most expensive list. California ($3.80) and Hawaii ($3.51) are the most expensive markets. Washington ($3.27), Oregon ($3.16), Nevada ($3.07), Alaska ($3.03) and Arizona ($2.88) follow. All prices in the region have increased on the week, with California (+18 cents) and Arizona (+15 cents) seeing the largest increases in the region and country.

The Energy Information Administration’s (EIA) recent weekly report, for the week ending on March 29, showed that West Coast gasoline stocks fell slightly by 70,000 bbl from the previous week and now sit at 30.96 million bbl. Ongoing planned and unplanned refinery maintenance throughout the region, including at Valero’s 149,000-b/d refinery in Benicia, CA, have reduced stock levels in the region amid reports of HollyFrontier’s 100,000-b/d Navajo Refinery in New Mexico contributing to gasoline shortages in Arizona. Stocks are approximately 1.5 million bbl lower than this time last year and could fall further this week depending on refinery maintenance turnaround.

Rockies

Pump prices have made a more noticeable uptick throughout the Rockies region on the week: Montana (+10 cents), Utah (+8 cents), Idaho (+7 cents), Colorado (+5 cents) and Wyoming (+4 cents). Even with these increases, Utah ($2.49) continues to hold a spot on the top 10 list of lowest state averages.

Compared to previous winters, the region saw mostly cheap gas price averages among adequate stock levels However, since the end of February stocks have decreased from 7.7 million bbl to 7 million bbl, per EIA. This squeeze will likely continue to contribute to jumps at the pump. Currently, the region sits at a 900,000 bbl year-over-year deficit. If stocks do not build, motorists filling up in the region can expect an expensive spring and summer with prices potentially hitting the $3/gal mark again.

Mid-Atlantic and Northeast

The majority of states in the Mid-Atlantic and Northeast region continue to see moderate weekly prices jumps. On the week, 9 of the 14 states had just one to three cents increases. However, a few state averages did jump more than a nickel this past week: North Carolina (+9 cents), West Virginia (+9 cents) and Pennsylvania (+7 cents).

Gas prices in the region range from $2.50 to $2.88. Among the Mid-Atlantic and Northeast states, three carry gas prices that are a quarter or less from hitting the $3/mark and rank among the top 15 states with the largest averages today: Pennsylvania ($2.88), Washington, D.C. ($2.86) and New York ($2.76). At $2.74, Connecticut is trending this way too.

Gasoline stocks drew just under 1 million bbl, according to EIA’s latest report. Levels measure at 63.5 million bbl, which is a 6 million bbl year-over-year surplus. That stock number has the potential to grow considering regional refinery utilization has been steadily rising since the beginning of March, jumping from 67.7% to 79%. However, should spring and summer demand rapidly increase, stock levels would chip away at the surplus and would likely cause more expensive pump prices.

Great Lakes and Central States

On the week, Ohio (+9 cents), Indiana (+7 cents) and South Dakota (+6 cents) saw the largest increase in the Great Lakes and Central states at more than a nickel. Meanwhile on the week, Missouri ($2.47) saw prices hold steady while Illinois ($2.87) ranks among the top 10 states with the highest averages in the country.

Compared to last month, gas prices are now nearly a quarter or more expensive for all states across the region. Illinois (+34 cents), Kentucky (+33 cents), Ohio (+32 cents), Wisconsin (+31 cents) and Indiana (+30 cents) carry among the top 10 largest monthly difference in gas prices of all states.

The latest EIA report shows stocks have steadily declined since mid-February in the region. With the latest 1 million bbl draw, stock levels have dropped to a new low for the year at 53.8 million bbl. Furthermore, EIA reports regional refinery utilization for the week ending March 29 is down three percentage points from the week prior. This could cause stocks to decrease even further in next week’s report and has the potential to cause jumps at the pump in coming weeks.

South and Southeast

All states in the region, with the exception of New Mexico (-4 cents), have more expensive gas prices compared to a year ago: Oklahoma (+10 cents), Florida (+9 cents), Arkansas (+6 cents) and Texas (+5 cents) carry the largest yearly differences.

At the start of the work week, gas price averages in the South and Southeast range from $2.70 in Florida to $2.44 in Mississippi. Oklahoma ($2.51) had the largest increase in the region at six cents while Florida (-3 cents) was the only state in the country to see prices decrease.

The South and Southeast region was the only one to see gasoline stocks build on the week with the addition of 605,000 bbl. The increase pushes total stock levels just above the 81 million bbl mark. Stocks will likely

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI increased 98 cents to settle at $63.08. Oil prices climbed last week following strong U.S. economic data that reduced fears of a drop in global crude demand later this year. Moreover, escalating military actions in Libya – a major global crude producer and exporter – supported crude price increases amid concerns that crude exports from the country could be affected by the tension. Oil prices could climb even further this week as OPEC’s 1.2 million b/d production reduction agreement remains in place through June and the U.S. tightens its crude export sanctions against Iran and Venezuela.

In related news, EIA data revealed that total domestic crude inventories grew by 7.2 million bbl to 449.5 million bbl. Additionally, Baker Hughes Inc. reported that the U.S. gained 15 oilrigs last week, bringing the total to 831. When compared to last year at this time, there are 23 more rigs this year.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.