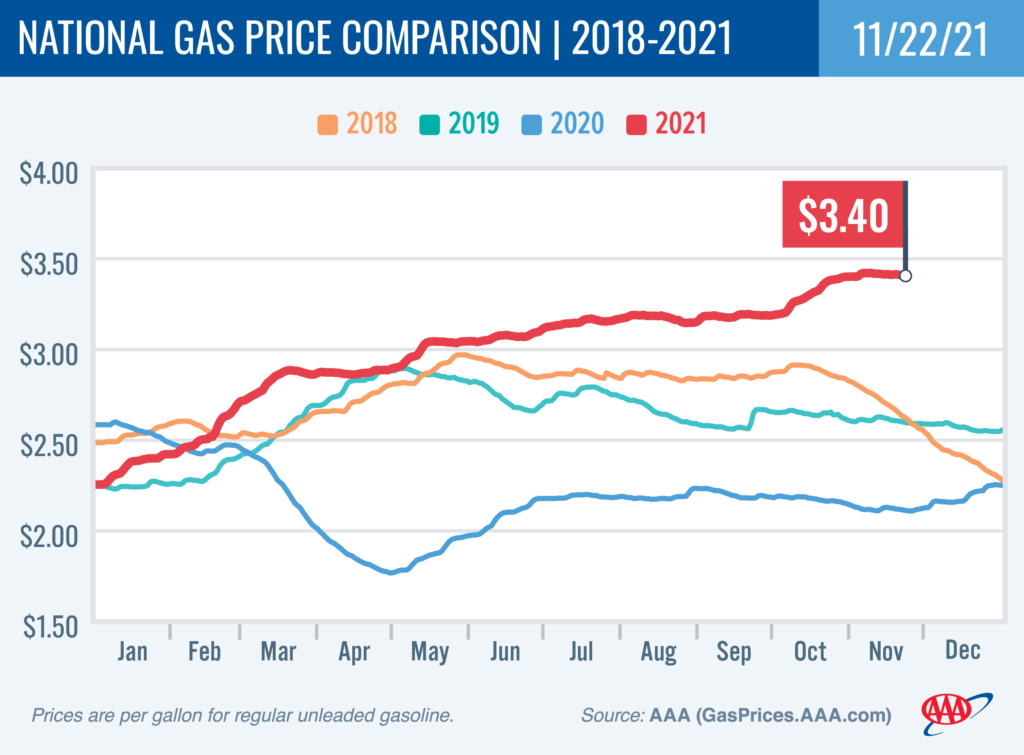

WASHINGTON, D.C. — After stubbornly staying above $80 a barrel since Labor Day, the price of crude oil tumbled this week into the mid-$70s. Fears of slowing economic activity in the U.S. and Europe due to a resurgence of COVID-19, along with reports that the Biden Administration is calling for a simultaneous release of stockpiled oil by large oil-consuming nations, including the U.S., China, Japan and South Korea, is putting downward pressure on crude prices. The national average price for a gallon of gas is $3.40, down a penny since last week.

“The price of crude oil accounts for about 50%–60% of what consumers pay at the pump, so a lower oil price should translate into better gasoline prices for drivers,” said Andrew Gross, AAA spokesperson. “But until global oil production ramps back up to pre-pandemic levels, this recent dip in the price of crude may only be temporary.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 700,000 bbl to 212 million bbl last week. Gasoline demand also dropped slightly from 9.26 million b/d to 9.24 million b/d. The decrease in demand, alongside stocks, has helped to steady pump prices. However, gasoline prices will likely remain elevated as long as oil prices are near or above $75 per barrel.

Today’s national average of $3.40 is 3 cents more than a month ago and $1.29 more than a year ago, and 81 cents more than in 2019.

Quick Stats

The nation’s top 10 largest weekly changes: Florida (+9 cents), Arizona (+7 cents), Washington, D.C. (−5 cents), Michigan (−5 cents), Texas (−5 cents), Indiana (−5 cents), Ohio (−4 cents), Kansas (−4 cents), Oklahoma (−3 cents) and Kentucky (−3 cents).

The nation’s top 10 most expensive markets: California ($4.70), Hawaii ($4.34), Nevada ($3.98), Washington ($3.88), Oregon ($3.78), Arizona ($3.73), Alaska ($3.72), Utah ($3.69), Idaho ($3.68) and Pennsylvania ($3.59).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by $2.91 to settle at $76.10. Crude prices declined at the end of last week as the dollar grew in strength and market concerns about crude demand increased over growing COVID infection rates in Europe and the U.S. If social restrictions are re-imposed to curb COVID transmission, crude demand will likely decline and prices will likely follow. Additionally, crude prices decreased last week despite EIA’s weekly report showing that total domestic crude supply decreased by 2.1 million bbl to 433 million bbl. When compared to the end of November 2020, current total domestic crude supply is nearly 12 percent lower than last year.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.